Advertisement

Advertisement

Czech central bank signals rates to stay elevated, welcomes strong crown

By:

By Robert Muller and Jan Lopatka PRAGUE (Reuters) - The Czech National Bank (CNB) left interest rates unchanged at a more than two-decade high on Thursday, saying rate stability for longer was the best course for an economy that has tipped into a mild recession amid persistent double-digit inflation.

By Robert Muller and Jan Lopatka

PRAGUE (Reuters) – The Czech National Bank (CNB) left interest rates unchanged at a more than two-decade high on Thursday, saying rate stability for longer was the best course for an economy that has tipped into a mild recession amid persistent double-digit inflation.

The bank’s board voted 5-2 to hold the key two-week repo rate at 7.00%, where it has sat since last June following a year-long hiking cycle totalling 675 basis points.

Since Governor Ales Michl took the helm in July last year, the central bank has prioritised rate stability rather than further hikes, even as its outlook and some observers like the International Monetary Fund have said more tightening would help tame price growth faster.

Markets have taken bets of further tightening off the table and actually see rate cuts starting later in 2023, with a total of 150 basis points in easing seen in the next 12 months.

Michl said on Thursday, though, that he expected rates to stay higher than the market is currently pricing in.

He also backed having a strong crown, which is around 14-year highs and is helping contain inflation, even if it could start hitting exporters.

“A majority of the bank board preferred to keep key interest rates unchanged for longer,” he told a news conference.

“Inflation is our biggest problem, not exports,” he added. “A strong crown is a cornerstone for us to lower inflation.”

The bank’s updated outlook, released on Thursday, was again consistent with a rise in interest rates.

But the bank said a scenario of leaving rates flat for longer would also lead to inflation hitting its 2% target in the first half of next year.

“As a result of the current wait-and-see policy, the bank board missed an ideal time for another rate hike, and also for getting an earlier return to the inflation target,” Komercni Banka said on Thursday.

Inflation stood at 15.8% in December. The bank expects it to jump to 17.6% in January due to new energy price contracts and companies’ repricing, before starting its long decline.

Stability shift

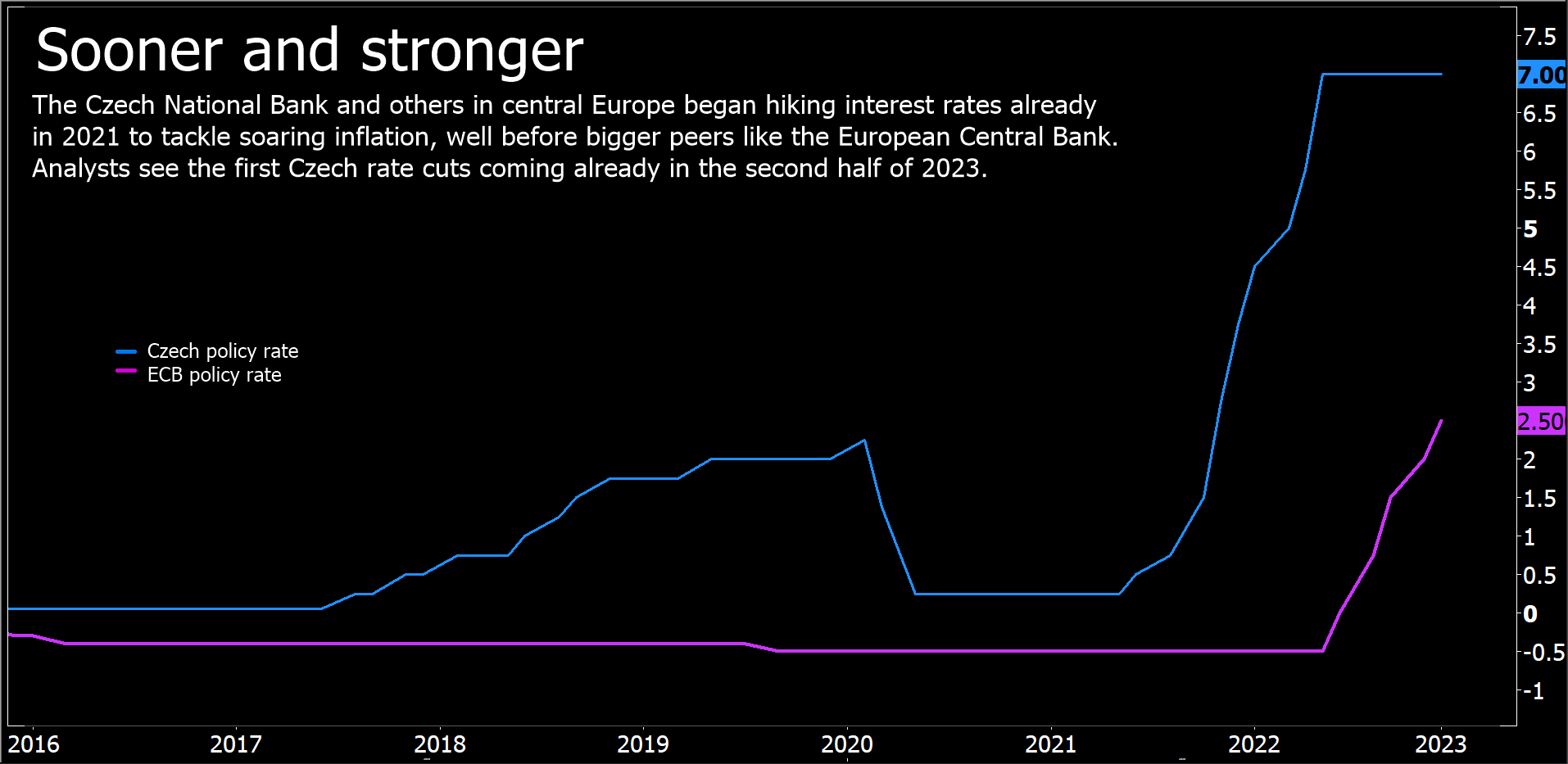

The shift by the Czech central bank and others in central Europe to rate stability follows sharp hiking cycles started in 2021, before bigger global banks began tightening. Analysts see chances central Europe can also start cutting rates sooner.

Price growth is taking a toll on households’ purchasing power and the economy fell into a technical recession to end 2022.

The bank’s new outlook saw a milder contraction of 0.3% in 2023 than a previous forecast, and higher inflation at an average of over 10%. But it expects the rate to ease into single digits in the second half of the year.

(Reporting by Robert Muller and Jan Lopatka; Writing by Jason Hovet; Editing by Alex Richardson and Sharon Singleton)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Latest news and analysis

Advertisement