Advertisement

Advertisement

What Rollover Swap Rate and Spreads to Use for Forex MT4 Backtest?

Updated: Mar 5, 2019, 16:14 GMT+00:00

Intro

Backtesting is an important step in forex trading strategy evaluation. Because backtesting is historical, the backtesting program will have to make

Backtesting is an important step in forex trading strategy evaluation. Because backtesting is historical, the backtesting program will have to make assumptions regarding two key components of forex trading profitability: the spread and swap rate.

What Spreads to Use for MT4 Backtest?

Let’s look at spreads, which is the difference between bid and ask prices when you trade currencies, and also the amount you pay the broker on each trade for settling the trade for you. On the Metatrader platform, you can input the spread which you would like to use for the backtest, see blue arrow below.

What Spread Should We Use for the Backtest?

When forex markets are open, selecting “current” would use the current spreads, and strategy tester applies this same spread to the period of testing. Your forex broker may also provide you with the typical average spreads for each pair for the previous month. Using the monthly average spread will even out spread volatility. Here is an example from Forex.com’s website:

What are Rollover or Swap Rates?

This is the interest which accrues for holding an open forex trading position. On MT4, this is known as the swap, and it is commonly termed the rollover in the finance industry. While forex markets operate 24 hours daily, spot trades are settled in 2 business days. This creates the needs to “roll over” accounts. If you would like to extend your position without settling at the end of each trade day, you can close your position by 5pm EST on the settlement day, and reopen the following trading day. This will incur spreads when you re-open a new position.

Currencies are quoted in pairs. The first currency is referred to as the base currency and the second is referred to as the counter currency. A trader borrows money to purchase another currency. Interest is paid on the borrowed currency and earned on the purchased currency. The difference is the roll over interest, which can be a profit or loss depending on which pairs you trade.

What Rollover Rate to Use on MT4 Backtest?

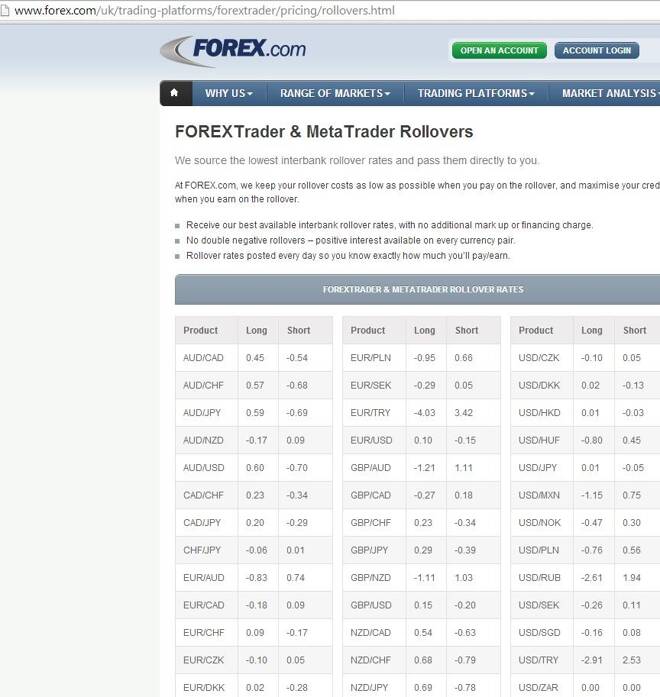

As rollover rates contribute to a traders profit and loss, it is more accurate to consider this amount when backtesting, especially when the strategy holds on to positions for over 2 days. The MT4 strategy tester does not allow us to input values for rollover rates, so you can consider other backtesting software such as Tick Story. To get updated rollover rates, you can check your brokers website, here is an example from Forex.com:

While it may be more accurate to use recent rollover rates, it may not have a significant impact. If your trading strategy has both long and short positions, the net rollover interest should breakeven over time

About the Author

Advertisement