Bitcoin (BTC) Price Prediction 2025

The high volatility and price fluctuations for most cryptos like bitcoin keep investors on the edge of their seats. Some BTC price predictions, however, are rather optimistic.Key Insights:

- The top cryptocurrency, BTC, started trading in the $46,000 zone this year.

- Quite a few optimistic predictions have been made for bitcoin.

- For now, however, with BTC’s price moving in a close range, short-term prospects for gains look weak.

Bitcoin’s price movement over the years has been nothing short of a rollercoaster ride full of surprises. From the bull run of 2017 to the great crypto crash of 2020 to the recent price drawdown, the cryptocurrency market has been largely unpredictable and driven by volatility.

In 2009, when bitcoin was first launched, the financial ecosystem wasn’t prepared for the dynamic and substantial change that cryptocurrencies would bring to the global economy.

Now, after almost 13 years, the cryptocurrency industry has diversified the monetary landscape globally. In fact, the adoption of cryptos has indicated that the inception of a decentralized model could be the future of investment and trading.

Thirteen years ago, BTC started the cryptocurrency revolution paving the way for digital assets and stirring mass interest among financial investors worldwide. However, the speculative nature and high volatility of cryptocurrencies and digital assets have made investors reluctant about the asset class and price predictions.

Nonetheless, crypto price predictions have gained a lot of steam over the last few years and still continue to be broadly popular among long-term investors. In fact, price prediction models in the crypto space have become more streamlined and transparent.

So, here are some of the top bitcoin price predictions from 2022 to 2025:

Bitcoin’s Price Drawdown

The top cryptocurrency started this year trading in the $46,000 zone. At the time of writing, BTC traded at $31,657, noting 3.90% daily and 9.27% weekly gains. Due to the larger financial market sell-off in January, BTC’s price fell down to $33,184.

While BTC price began to rebound in the first half of February, the top coin quickly lost value again at the end of the month after Russia’s invasion of Ukraine led to another marketwide sell-off.

Bitcoin’s price dropped from above $40,000 in mid-February to below $34,500 by February end, marking the top coin’s downtrend. At press time, BTC was down by over 30% year-to-date.

BTC Price Forecast 2022-2025

Different analytics websites curate varying results for BTC’s price prediction. However, one thing is certain – nothing is certain in the crypto-verse.

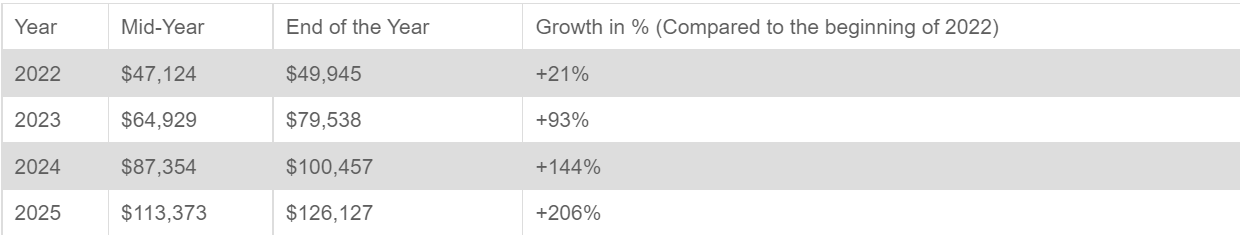

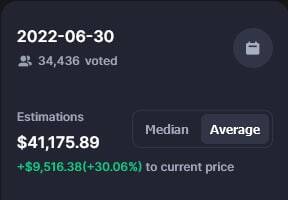

According to the Coin Price Forecast website, the forecasted Bitcoin price at the end of 2022 is $49,065, noting a year-to-year change of +5%. The website predicts one BTC to value $53,164 in the first half of 2023 and $65,126 by 2023 end.

For 2024 and 2025 the website predicts BTC to reach $100,457 and $126,127.

A Coin Market report from 2021 expected the average prediction of BTC to be worth $249,578 by 2025. However, after the recent fall from BTC’s all-time high price, the new price recovery could take longer.

The recent price drawdown led to many websites redoing their year-end predictions. Recently, according to Finder’s panel of fintech specialists, the price of BTC is expected to jump to $65,185 by the end of 2022.

In April, the Finder panel gave predictions of $65,185 by the end of 2022, which is 15% lower than the previous prediction of $76,360 made in January before the recent pullback.

By 2025, the panel predicts that BTC would be worth $179,280, a 7% drop from the January forecast of $192,800.

That said, while price predications carefully assess an asset’s prospects, nothing can be said for sure, especially in a sector as volatile as the cryptocurrency market.