Litecoin Prepares for 35% Rally by December as Bitcoin Nears $100K

Litecoin eyes a 35% rally by December 2024 as it breaks above the 200-week EMA and hits record hash rate levels, signaling bullish momentum ahead.Litecoin (LTC) is positioning itself for a potential 35% rally by December 2024, led by strong technical indicators, increasing network security, and broader bullish momentum in the cryptocurrency market.

Litecoin Eyes Retesting April 2022 High

The weekly LTC/USD chart shows Litecoin trading within an ascending channel, with the lower trendline consistently acting as a strong accumulation zone.

Currently, LTC is targeting the channel’s upper boundary at the April 2022 high of $122.35, which would mark a 35% gain from its current price of around $90. The level further coincides with Litecoin’s 0.236 Fibonacci retracement line.

This bullish outlook is supported by rising trading volumes and a breakout above key moving averages, signaling renewed investor interest.

Litecoin Breaks 200-Week EMA: Fractal Hints at Massive Upside Potential

Litecoin has broken above its 200-week exponential moving average (EMA) for the first time since Bitcoin’s halving in April 2024. The move comes after months of sideways consolidation within a defined range, marked in red in the chart below.

Interestingly, the breakout resembles Litecoin’s price action following the 2020 Bitcoin halving, when the cryptocurrency surged by over 565% after breaching its consolidation structure and 200-week EMA.

This fractal shows that Litecoin will likely undergo a similar explosive rally. This sentiment aligns with growing optimism in the crypto market, fueled by Bitcoin’s potential climb toward $100,000 and improving regulatory sentiment under the incoming Donald Trump administration.

That said, the LTC price can rise 35% by the end of 2024, which may follow up with further price rallies in 2025.

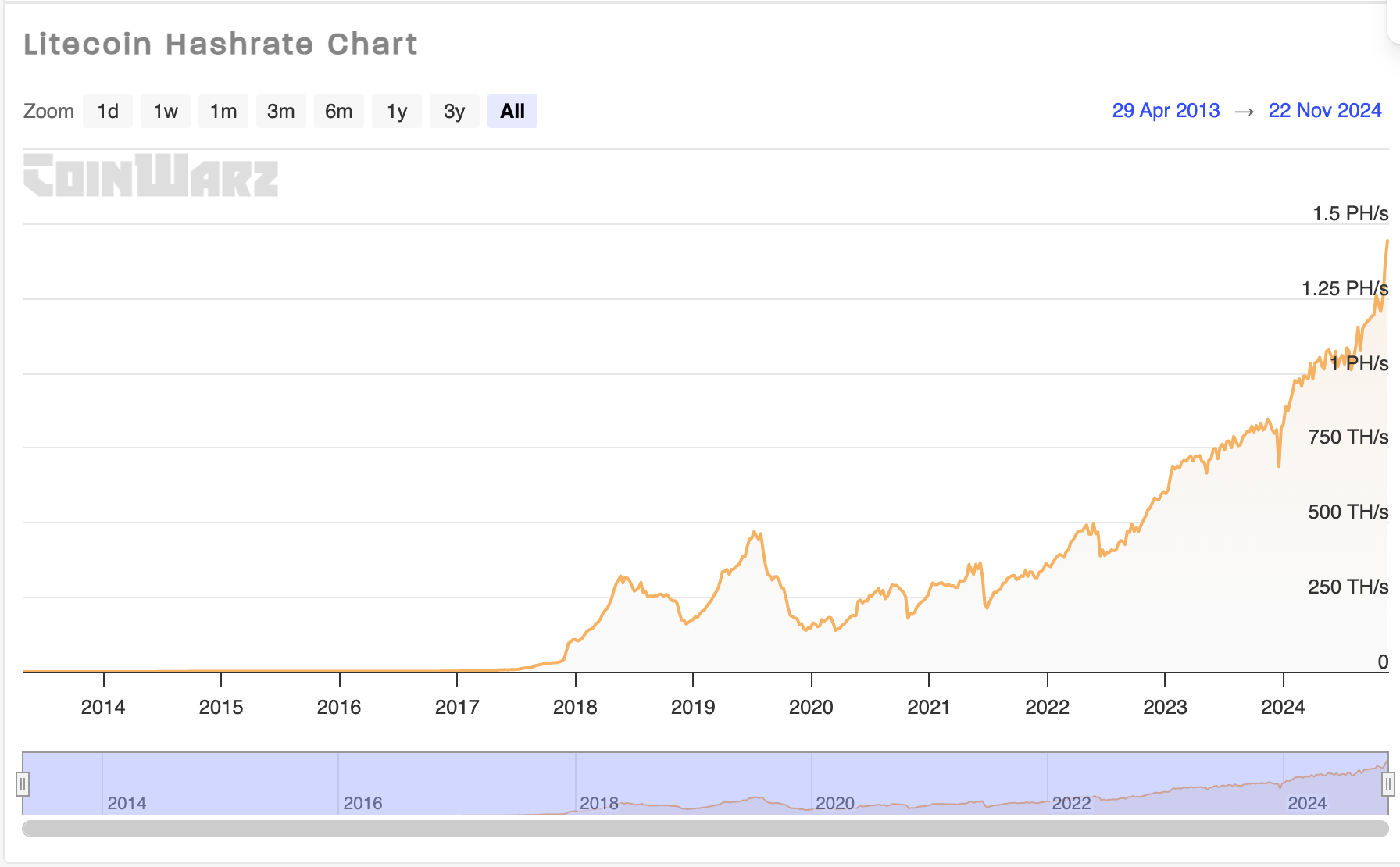

A higher hash rate indicates increased miner participation and network security, as more computational power is used to validate transactions and secure the blockchain.

Historically, spikes in hash rates have often preceded price rallies.

For example, during Litecoin’s 2021 bull run, the hash rate rose from 300 terahashes per second (TH/s) in January to over 365 TH/s by May, coinciding with LTC’s price surge from $100 to nearly $400.

Litecoin’s year-to-date performance further supports the correlation between hash rate and price. From its low of $50 earlier this year, LTC has already gained nearly 90%, with the record hash rate suggesting continued upward momentum.