Advertisement

Advertisement

Crude Oil Price Forecast December 21, 2017, Technical Analysis

Updated: Dec 21, 2017, 05:59 GMT+00:00

Crude oil markets rally during the day on Wednesday, as we continue to see strength in the energy markets, and of course the US dollar had taken a bit of a hit.

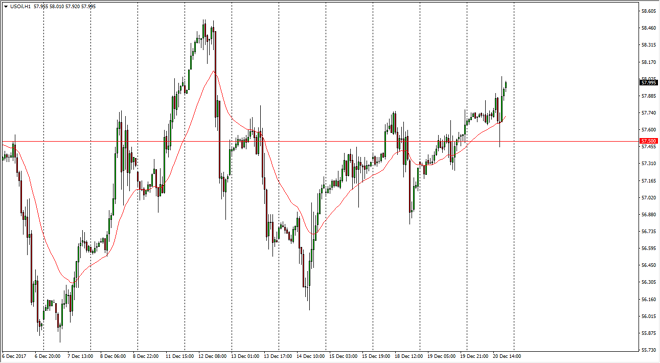

WTI Crude Oil

The WTI Crude Oil market initially went sideways during the trading session on Tuesday, pulled back to reach towards the $57.50 level, and then rallied to the upside, reaching towards the $58 handle. If we can break above the $58 level significantly, I think the market then goes to the $58.50 level, and then eventually the $59 level after that. I expect we will see a lot of volatility due to the lack of liquidity, but in general looks as if the buyers are trying to make a bit of a statement. I think that you need to be quick to take your profits in this market, as there will be a lot of noise in this market, but I think that the market will be difficult to hang onto a trade in, so keep that in mind. Volatility continues to be the biggest factor.

Crude Oil Price Forecast Video 21.12.17

Brent

The Brent market initially tried to rally during the day on Wednesday, but then broke down to turn around and find support underneath. By doing so, the market rallied a bit and reached towards the $64.40 level. After that, the market looks very likely to reach towards the $65 handle above which of course has much more structural importance. I think that the markets might be bullish towards the next couple of sessions, but the liquidity is going to be an issue, so a lot of this may be a low-volume. Because of that, be quick to take your profits in a market that has been very noisy and quick to change attitudes.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement