Advertisement

Advertisement

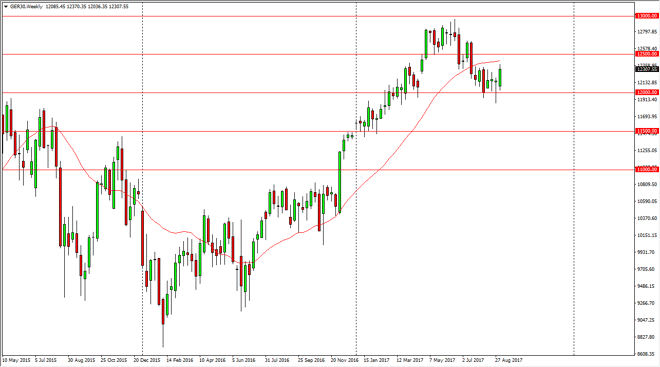

DAX forecast for the week of September 11, 2017, Technical Analysis

Updated: Sep 9, 2017, 05:40 GMT+00:00

The DAX broke higher during the week, after initially dipping down towards the €12,000 level. By breaking the top of the hammer from the previous week,

The DAX broke higher during the week, after initially dipping down towards the €12,000 level. By breaking the top of the hammer from the previous week, this is a bullish sign and it looks as if were going to go looking for the €12,500 level above. That is an area that should be resistive, but in the overall look of the market, I believe we will be able to overcome that barrier. The DAX has been in an uptrend for some time, and should continue to be based upon the improving economic conditions in Europe, which of course is heavily influenced by Germany itself. I believe that buying dips continues to be the way forward, although we may get a bit of volatility in the short term, the longer-term uptrend is very much intact.

DAX Video 11.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement