Advertisement

Advertisement

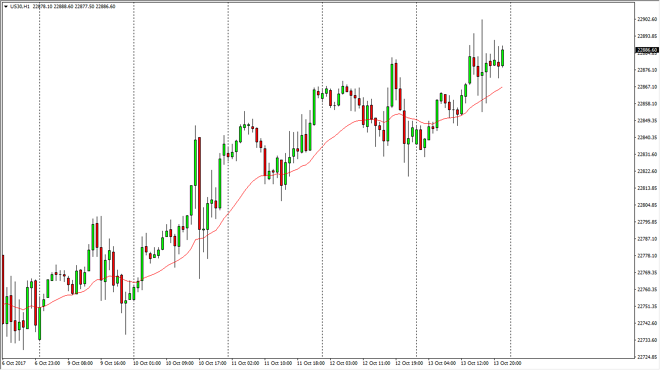

Dow Jones 30 and NASDAQ 100 Price Forecast October 16, 2017, Technical Analysis

Updated: Oct 15, 2017, 08:28 GMT+00:00

Dow Jones 30 The Dow Jones 30 initially rally during the day on Friday and then hugged the 24-hour exponential moving average. It looks as if we are

Dow Jones 30

The Dow Jones 30 initially rally during the day on Friday and then hugged the 24-hour exponential moving average. It looks as if we are trying to break above the 22,900 level, and then eventually will go looking to the 23,000 level which is my next target. I believe that pullbacks continue to offer buying opportunities and that the 22,800-level underneath should be massively supportive. I think that the market continues to chop around, but quite frankly we have earnings season coming into play now, so I think that we will continue to have good enough results to push the market to the upside. In fact, I don’t have a scenario in which a willing to sell the Dow Jones 30, as it is leading the way in a very nice and steady manner for the rest of the American indices.

Dow Jones 30 and NASDAQ Index Video 16.10.17

NASDAQ 100

The NASDAQ 100 exploded during the day, reaching to fresh new highs at the 6100 level. Technology certainly has done quite well over the last several days, after breaking above the vital 6000 handle. Now that we’ve done this, the measured move from the ascending trial that we broke out of suggested we were going to the 6200 level, and I don’t see the reason why it won’t happen. I recognize her will be a little bit of resistance at the 6100 level, so I suspect that a pullback coming soon might be reason enough to start going long. Again, earnings season should help the NASDAQ 100 as well, and at this point in time, I don’t see the reason to start shorting. In fact, I think the bottom of the market has moved from the 6000 level to the 6050 level now.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement