Advertisement

Advertisement

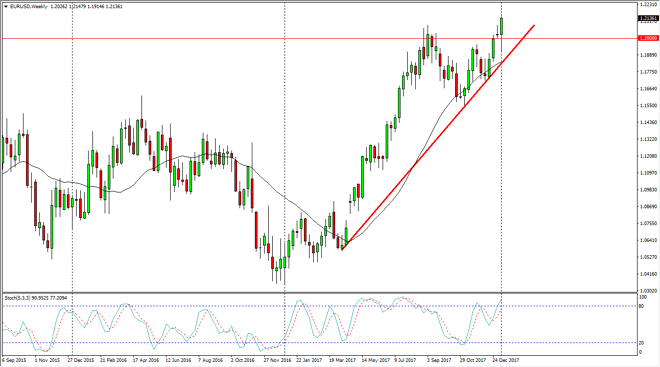

EUR/USD forecast for the week of January 15, 2018, Technical Analysis

Updated: Jan 13, 2018, 03:02 GMT+00:00

The EUR/USD pair has rallied significantly during the week, finally breaking above the 1.21 handle. This is a market that looks as if it is ready to continue going higher, and therefore I think that longer-term traders are starting to put money to work yet again.

The EUR/USD pair initially dipped during the week, but as you can see turned around to form a very bullish candle. By breaking above the 1.21 level on Friday, it suggests that the market is going to continue to go much higher. I believe that the next target is the 1.25 handle, and I think that short-term pullbacks are buying opportunities. The market will more than likely find plenty of support at the 1.20 level now, and most certainly at the trendline that we have just bounced from over the last several weeks. In general, I believe that the US dollar continues to struggle, and it makes sense that the market participants continue to work against it. This is the ultimate “anti-dollar” play, as it is the largest part of the US Dollar Index.

With this candle, it looks as if we are going to continue the explosive moved to the upside based upon the bullish flag, and therefore I look at the potential target of 1.32 as a longer-term move just waiting to happen. I don’t have any interest in trying to short this market, least not until we break below the uptrend line. If we do, then I think we could consider it, but not until then. I anticipate seeing volatility, but those should be thought of as buying opportunities, as it will offer value. It looks as if the inflationary Outlook for the European Union is picking up.

EUR/USD Video 15.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement