Advertisement

Advertisement

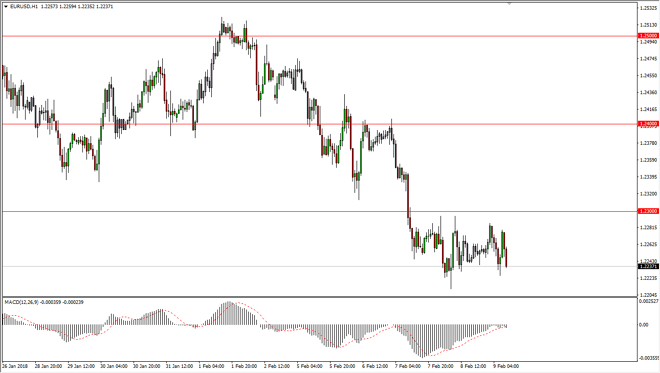

EUR/USD Price Forecast February 12, 2018, Technical Analysis

Updated: Feb 10, 2018, 05:55 GMT+00:00

The EUR/USD pair has been very choppy during the trading session on Friday, as we continue to consolidate just below the 1.23 level. This market continues to be very noisy, and as a result I think it’s difficult to hang onto a trade for a significant amount of time. Longer-term though, I think there is plenty support just below.

The EUR/USD pair went back and forth during the trading session on Friday, so it looks as if we are still trying to figure out which way to go. Longer-term, I believe in the uptrend, but I also recognize that there is plenty of support underneath, and eventually I think that the market will find buyers, if not at the 1.22 handle, most certainly at the 1.21 level as it was the scene of a massive breakout. On the weekly chart, there is a nice uptrend line that has been keeping this market to the upside, and therefore it’s not until we break down below that uptrend line that I would be interested in trying to short this market.

Alternately, if we can break above the 1.23 level, I think that we would probably go to the 1.24 handle, and then eventually the resistive 1.25 level above, which has been a major resistance barrier. The 1.25 level is of course a large, round, psychologically significant number, so it makes sense that we struggle to get above there. This pullback could be an opportunity to build up enough momentum to finally break above that level. Longer-term, when I look at the bullish flag on the weekly chart it measures for a move to the 1.32 handle, so technically speaking, this pair should have go much higher. Ultimately, I don’t have any interest in shorting in the near term.

EUR/USD Video 12.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement