Advertisement

Advertisement

Fed Hiked Its Interest Rate by 0.75 Percentage Points – Is It Time to Buy Gold?

Updated: Jun 16, 2022, 14:50 GMT+00:00

This rate increase is the biggest rate hike since 1994!

To fight soaring inflation in the United States, currently at its highest level in 40 years above 8%, the American Federal Reserve (Fed) increased its key interest rates by 0.75 percentage points yesterday to a range of 1.5%-1.75%. This rate increase is the biggest rate hike since 1994!

At the beginning of the US monetary policy normalization process, markets were expecting the Fed to keep approving a 0.5-percentage-point hike. However, analysts and economists believed the quick rise in prices has left the Fed behind the curve, requiring a strong response to demonstrate its willingness to lower inflation to its 2% target over the long term.

Depending on incoming economic data, statistics, and projections, the pace of the upcoming rate increases might be of similar magnitude, especially in July. Still, the size of this rate hike is considered “an unusually large one” by Powell, and markets shouldn’t expect further moves to be that large.

“From the perspective of today, either a 50 basis point or a 75 basis point increase seems most likely at our next meeting,” Powell explained during the press conference following the Fed’s monetary policy decision. “Clearly, today’s 75 basis point increase is an unusually large one, and I do not expect moves of this size to be common,” he added.

The Fed’s target rate should conclude the year at 3.4 percent, according to the Fed’s “dot plot”, an increase of 1.5 percentage points from the March projections.

Financial conditions tightening are weighing on the US and global growth prospects. Is it time to buy Gold?

Markets are increasingly worried about the consequences of the Fed’s rate hike’s path on economic growth projects, supporting the idea of an upcoming recession, as financial conditions tighten in the United States.

The Fed’s economic forecasts were downgraded during this meeting, with the economy now expected to slow to a below-trend 1.7 percent pace of growth in 2022, with unemployment increasing to 3.7 percent by the end of the year.

It’s important to remember that with a higher unemployment rate comes lower salaries and lower spending, which tends to weigh on growth, as consumption represents more than 60% of the US GDP. Not to mention that inflation is reducing consumer purchasing power, which also includes spending, saving, as well as investing habits.

Gold, or a tool to protect your portfolio

Investors should therefore think about ways to protect their investments and portfolios from uncertainty and market volatility. One way is to invest in Gold.

When investors are looking to safeguard their assets against slowing economic growth, growing uncertainty, and increased volatility, they’re indeed often buying gold, which drives up demand and prices.

Gold has other advantages as it is also often considered as a hedge against inflation that preserves wealth over time, as the precious metal doesn’t deteriorate or lose value over time due to age. It is, therefore, a great tool to better protect and diversify investment portfolios.

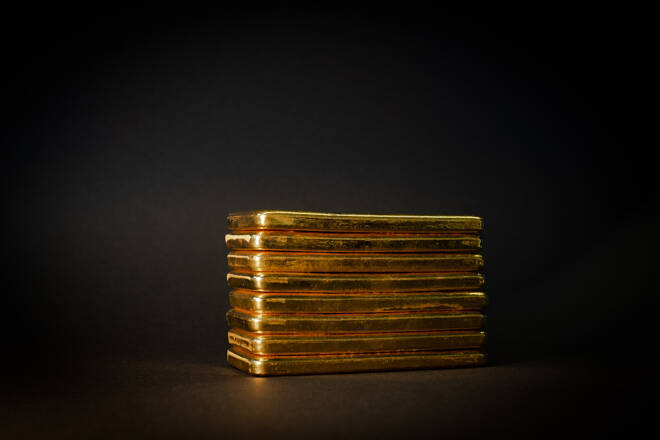

Moreover, it is possible to invest in Gold in different ways and through different financial products. You can buy physical Gold like bars, coins, or jewelry, but you can also get digital Gold. If you don’t want to own the underlying asset, you can also use financial derivatives such as CFD or Contracts For Difference, but you can also invest in various ETF on Gold.

Gold movements after rate hike

After losing almost 4% in only two days, partly due to a firmer US Dollar, Gold prices increased 1.41% with yesterday’s rate hike decision, and are still up at the time of writing at around $1,831. Some analysts believe that the Fed will be unable to fight inflation, which should push Gold prices higher towards the $2,000 mark due to higher stagflation risk. Not to mention that there are still significant geopolitical tensions.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Carolane De Palmascontributor

Carolane's work spans a broad range of topics, from macroeconomic trends and trading strategies in FX and cryptocurrencies to sector-specific insights and commentary on trending markets. Her analyses have been featured by brokers and financial media outlets across Europe. Carolane currently serves as a Market Analyst at ActivTrades.

Advertisement