Advertisement

Advertisement

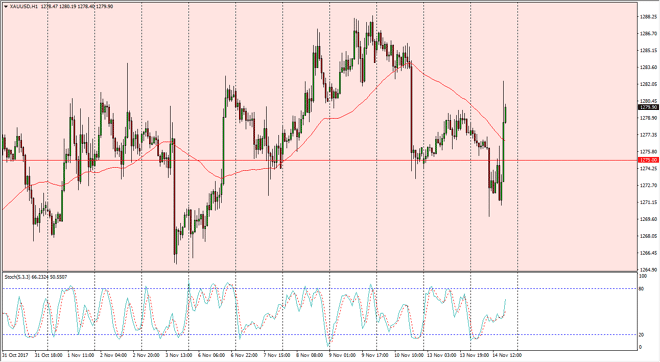

Gold Price Forecast November 15, 2017, Technical Analysis

Updated: Nov 15, 2017, 05:31 GMT+00:00

Gold markets initially fell during the Wednesday trading session, falling towards the $1270 level underneath. The market looks likely to find plenty of

Gold markets initially fell during the Wednesday trading session, falling towards the $1270 level underneath. The market looks likely to find plenty of reason to go back and forth, as the US dollar has been very noisy in general. By bouncing the way it has, it looks like we go towards the $1290 level above, which is major resistance that extends to the $1300 handle. Enough time, I believe that the buyers will continue to be interested in this market on dips, as there are a lot of uncertainties when it comes to the U.S. Congress being able to pass tax reform. This has weighed upon the US dollar, and with the EUR/USD pair breaking above the 1.17 level again, it’s likely that this market will continue to punish the US dollar.

If we were to break above the $1300 level, then I think we are free to go much higher, but currently we are in a longer-term consolidation area that extends from the $1200 level underneath to the $1300 level above. So although this looks like a very bullish market, I think that the upside more than likely is going to be somewhat limited as a simple continuation of what we have seen for some time. Gold is volatile, and that of course means that the market will be something that you have to keep an eye on if you plan on trading, least with any size. Longer-term outlook for gold is relatively strong, but that’s more of an investment and a “buy-and-hold” physical trade. The markets continue to be noisy, and of course sensitive the news flow. Because of this, keep your position size small unless you are holding physical. The CFD markets are also a reasonable way to play this market as it can keep your losses to a minimum if the market moves against you suddenly.

Gold Outlook Video 15.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement