Advertisement

Advertisement

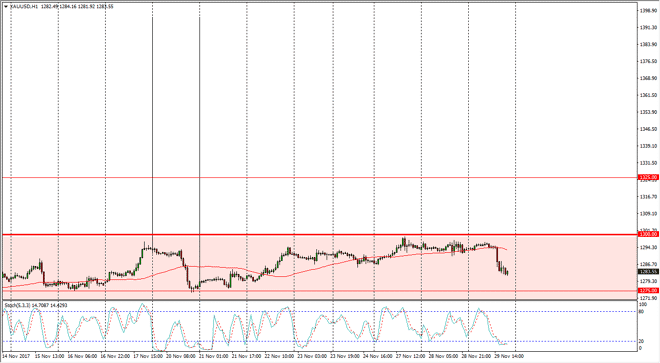

Gold Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:05 GMT+00:00

Gold markets went sideways initially during the trading session on Wednesday, as the $1300 level continues to be a massive resistance barrier. However,

Gold markets went sideways initially during the trading session on Wednesday, as the $1300 level continues to be a massive resistance barrier. However, the market looks likely to continue to see volatile moves, meaning that the market will probably bounce relatively soon. In fact, I see the $1275 level as support, and on the hourly chart we are already in the oversold condition, with the stochastic oscillator crossing over. I think that the market is probably going to continue to work its way towards the $1300 level, and any type of major geopolitical issue, and yes – I’m looking at you North Korea, could send the gold markets higher. In the meantime, one of the other major factors will be the U.S. Congress and whether he can pass a tax bill. We have seen some progress in that direction, and that should help the US dollar.

If we were to break above the $1300 level, the market then goes looking towards the $1325 level above, which should be resistance. I think that a breakdown below the $1275 level tells of the exact opposite, and other words that the US dollar is strengthening and it’s likely that we could go down to the $1250 level next. Volatility continues to be a major issue, but eventually we should find some type of clarity when it comes to direction. Right now, we don’t have it, so keep your position size small, and your stop losses either above or below the major areas that I have mentioned. I believe that the market is very technically driven now, meaning that every $25 we should see a reaction. There is a longer-term proclivity to the upside, so I believe that longer-term traders are probably more of the buy-and-hold flavor, perhaps holding precious metals.

Gold Price Forecast Video 30.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement