Advertisement

Advertisement

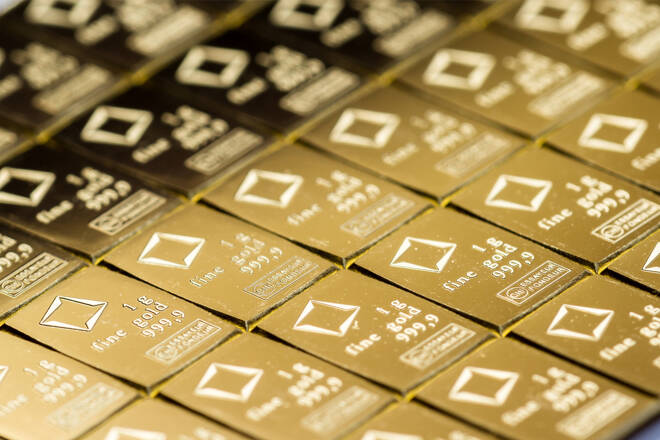

Gold, Silver, Platinum – Precious Metals Retreat As Traders Take Profits

By:

Weak dollar and lower Treasury yields did not provide enough support to precious metals in today's trading session.

Key Insights

- Gold settled below the support level at $1915.

- Silver faced resistance near $24.50 and pulled back towards the $24.00 level.

- Platinum gained strong downside momentum after it managed to get below the 20 EMA.

Gold

Gold pulled back below the $1915 level despite weaker dollar and lower Treasury yields. Traders continued to take profits after the strong rally. RSI remains in the overbought territory, so gold will need material positive catalysts to move above the recent highs at $1929.

Silver

Silver pulled back towards $24.00 after the unsuccessful attempt to settle above the $24.50 level. From a big picture point of view, silver must get above the strong resistance area in the $24.00 – $24.50 range to have a chance to gain sustainable upside momentum.

Platinum

Platinum settled below the 20 EMA and gained strong downside momentum. RSI remains in the moderate territory, so there is plenty of room to gain additional momentum in case the right catalysts emerge. The nearest material support level for platinum is located at the 50 EMA at $1025. A move below this level will open the way to the test of the $1000 level.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Vladimir Zernovauthor

Vladimir is an independent trader, with over 18 years of experience in the financial markets. His expertise spans a wide range of instruments like stocks, futures, forex, indices, and commodities, forecasting both long-term and short-term market movements.

Advertisement