Advertisement

Advertisement

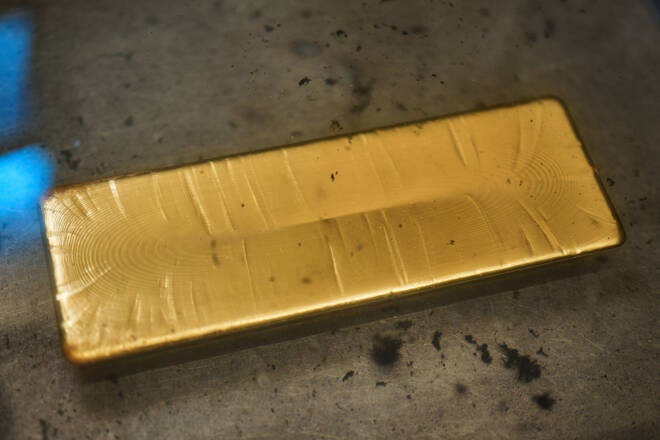

Gold, Silver, Platinum – Silver Soars As Dollar Pulls Back

By:

Lower Treasury yields provided additional support to silver markets.

Key Insights

- Gold tests resistance at $1965 as traders bet on a more dovish Fed.

- Silver rallied above the $24 level.

- Platinum is losing ground amid recession worries.

Gold

Gold gains ground as Treasury yields decline after the release of the disappointing Initial Jobless Claims report. Traders bet on a more dovish Fed, which is bullish for gold.

If gold settles above $1965, it will head towards the next resistance level at $1980. A move above $1980 will push gold towards the $2000 level.

R1:$1965 – R2:$1980 – R3:$2000

S1:$1950 – S2:$1930 – S3:$1915

Silver

Silver rallied as gold/silver ratio moved closer to the psychologically important 80 level. U.S. dollar’s pullback also served as an important bullish catalyst for silver.

The nearest resistance for silver is located at $24.60. If silver climbs above this level, it will head towards the next resistance at $24.85.

R1:$24.60 – R2:$24.85 – R3:$25.10

S1:$24.10 – S2:$23.80 – S3:$23.50

Platinum

Platinum remains under pressure amid recession worries. Lower Treasury yields did not provide any support to platinum markets.

If platinum settles below $1015, it will move towards the $1000 level. A successful test of this level will open the way to the test of the next support at $980.

R1:$1040 – R2:$1065 – R3:$1085

S1:$1015 – S2:$1000 – S3:$980

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Vladimir Zernovauthor

Vladimir is an independent trader, with over 18 years of experience in the financial markets. His expertise spans a wide range of instruments like stocks, futures, forex, indices, and commodities, forecasting both long-term and short-term market movements.

Advertisement