Advertisement

Advertisement

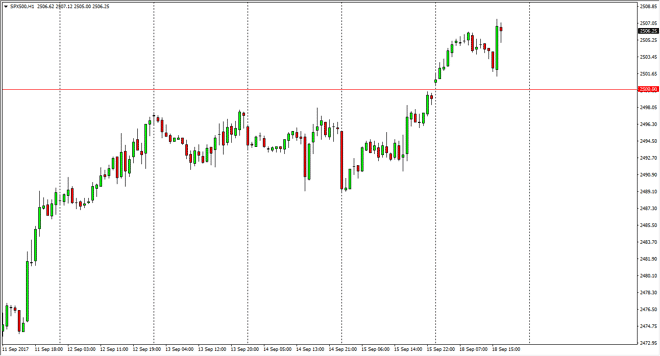

S&P 500 Price Forecast September 19, 2017, Technical Analysis

Updated: Sep 19, 2017, 07:15 GMT+00:00

The S&P 500 gapped higher at the open on Monday and then pulled back closer to the 2500 level just before New York opened. We then exploded to the

The S&P 500 gapped higher at the open on Monday and then pulled back closer to the 2500 level just before New York opened. We then exploded to the upside, and have seen buyers jump back into this market after a short-term dip. The S&P 500 looks likely to continue going higher now that we have cleared the 2500 level, which is a psychological victory for the buyers. Because of this, I believe the dips continue to offer buying opportunities, and that the 2500 level should act as a bit of a “floor” in this market. Ultimately, I believe that the market continues to find plenty of bullish pressure from underneath, as the markets are certainly going to continue to follow the other indices in America, as well as the rest of the world. Stock markets are on fire, and that, of course, is going to extend over here in the S&P 500.

Currently, I believe that the target is probably 2525, as it is a nice psychologically significant number. I think that if we can stay above 2500, selling is all but impossible. We have been working for some time to break out above this level, and now that we have I think the buyers are going to jump in hand over fist.

S&P 500 Video 19.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement