Advertisement

Advertisement

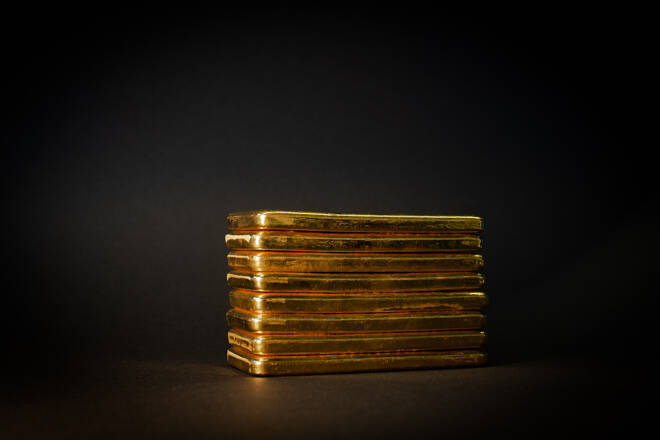

Strong US Housing Report and Restrictive Monetary Policy by Fed Pressure Gold Lower

By:

Chairman’s Powell upcoming testimony coupled with a report revealing strong economic growth has created continuous bearish market sentiment for gold.

Technical Analysis for Gold

The decline in gold futures today was so severe that the precious yellow metal gave up $23.50 with the most active August futures contract settling at $1947.70 by the close of trading in New York. On a technical basis, this created major chart damage as today’s close falls below the 100-day moving average. Market technicians use the 50, 100, and 200-day moving averages to gauge bullish or bearish market sentiment.

The last time gold closed under its 100-day moving average was approximately 8 months ago in November 2022. This occurred after a multi-month price correction which took gold from $2085 to a low of approximately $1620.

Hawkish Fed Policies and Strong Economic US Data Pressure Gold to Lower Prices

Today’s decline is partially due to the lingering bearish market sentiment created when the Federal Reserve revealed that it plans to enact more rate hikes this year at last week’s FOMC meeting. Now, market participants are focused on what Chairman Powell will say during his testimony to Congress tomorrow.

On Monday the National Association of Homebuilders (NAHB) reported that homebuilders have become optimistic about the housing market outlook. US single-family homebuilding surged in May to its highest level in more than a year. Last month construction on new homes in the United States was up 21.7%. The strong uptick in demand for new single-family homes is partially the result of high mortgage rates which are currently above 6%. This creates very little incentive for existing homeowners to sell as approximately 92% of pre-existing homeowners have mortgages at much lower rates.

The combination of a highly restrictive and hawkish monetary policy by the Federal Reserve and data revealing strong economic growth in the United States continue to pressure gold to lower prices. Today’s price decline did create technical chart damage as gold futures closed below its 100-day moving average a key indicator used by market technicians to gauge intermediate market sentiment.

For those who would like more information simply use this link.

Wishing you as always good trading,

Gary S. Wagner

About the Author

Gary S.Wagnercontributor

Gary S. Wagner has been a technical market analyst for 35 years. A frequent contributor to STOCKS & COMMODITIES Magazine, he has also written for Futures Magazine as well as Barron’s. He is the executive producer of "The Gold Forecast," a daily video newsletter. He writes a daily column “Hawaii 6.0” for Kitco News

Advertisement