Advertisement

Advertisement

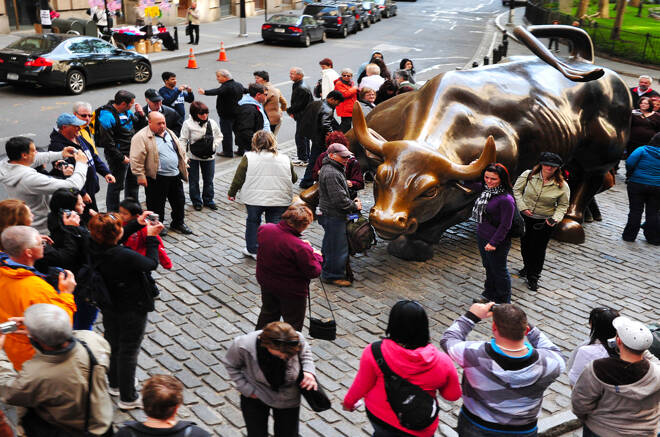

US Stock Market Overview – Stocks Rally Ahead of US Employment Report

By:

Jobless claims surge coming in higher than expected

US stocks moved higher on Thursday led by strong gains in the Nasdaq as technology shares continued to outperform. This came despite a worse than expected weekly jobless claims report that showed that another 3.2 million people applied for unemployment insurance. Most sectors in the S&P 500 index were higher, led by gains in financials and energy, consumer staples bucked the trend. Ahead of Friday’s employment report, the Nasdaq is up 4.3% for the week. Expectations that more than 21-million people will be counted as unemployed and the unemployment rate will surge to 16%. The reality is more than 33.5 million people of lost their jobs in the past 7-weeks, which should put the unemployment rate above 20%. Neiman Marcus filed for Chapter 11 on Thursday it was the first of the major retailers to file for Chapter 11. This comes filing bankruptcy protection earlier in the week by J. Crew.

Neiman Marcus files for Chapter 11

Neiman Marcus Group Inc. filed Thursday for chapter 11 bankruptcy protection in Texas, becoming the latest large retailer to seek a court restructuring during the pandemic that has closed much of the U.S. economy. J.Crew Group Inc. filed for bankruptcy earlier this week, and on Thursday Canadian shoe retailer ALDO Group Inc. also filed for court protection.

US Jobless Claims Continue to Tumble

US jobless claims came in at 3.17 million last week, bringing the total to 33.5 million over the past seven weeks, according to the Labor Department. The total was slightly higher than the 3.05 million expected and below the previous week’s 3.846 million, which was revised up by 7,000. Recent layoffs are expected to cause nonfarm payrolls to fall by 21.5 million and the unemployment rate to climb to 16% in the April jobs report.

Fintech is Alive and Well

On Wednesday after the bell, Paypal reported better than expected financial results. The company reported non-GAAP earnings of 66 cents per share in first-quarter 2020, which missed expectations by 12%. Increasing credit loss reserves owing to revised macroeconomic projections on account of coronavirus pandemic impacted the bottom line by $17 per share. Net revenues of $4.62 billion were in line with expectations. The figure improved 12% from the year-ago quarter on a reported basis and 13%.

About the Author

David Beckerauthor

David Becker focuses his attention on various consulting and portfolio management activities at Fortuity LLC, where he currently provides oversight for a multimillion-dollar portfolio consisting of commodities, debt, equities, real estate, and more.

Advertisement