Advertisement

Advertisement

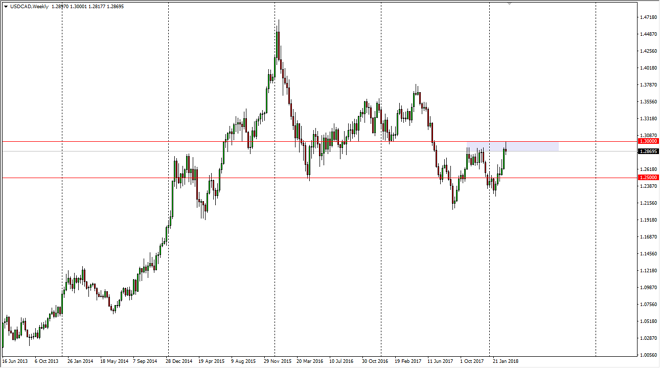

USD/CAD Price forecast for the week of March 12, 2018, Technical Analysis

Updated: Mar 10, 2018, 06:58 GMT+00:00

The US dollar rallied against the Canadian dollar initially during the week but ran into a lot of trouble at the 1.30 level above, an area that has been important more than once. By rolling back over, we ended up forming a shooting star which of course is a negative sign. That could have sellers jumping back into this market.

The US dollar initially tried to rally against the Canadian dollar but ran into a bit of trouble near the 1.30 level above, an area that of course is a psychologically significant number, and of course structurally important as well as it is a large, round number. I believe that the market rolling over and breaking down below the bottom of the weekly candle could send the US dollar back down towards the 1.25 level, an area that should attract a lot of attention. If we break down below the 1.24 level, that could roll everything right back over.

The alternate scenario of course is that we break above the 1.30 level, which would be a very bullish sign. I believe that the market will continue to find volatility in this range, as it is an area that has been choppy. Oil markets will have their influence as per usual, as the Canadian dollar is so highly leveraged to them. By being patient, you should be able to find a trade that is good for several handles. The market will continue to be noisy, but I do believe that this is an important enough level to pay attention to that we could be setting up for a huge move for those who are willing to let the market tell them which way it wants to go longer term.

USD/CAD Video 12.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement