Advertisement

Advertisement

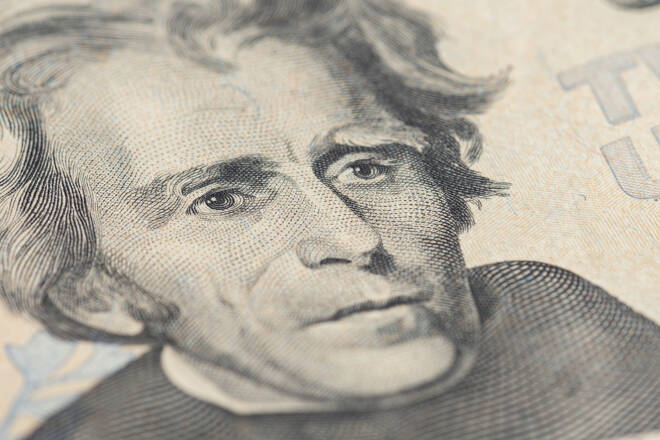

USD/JPY Forecast – US Dollar Dips Slightly on Tuesday

Published: Feb 14, 2023, 14:08 GMT+00:00

The US dollar has dipped a bit during the Tuesday trading session, only to turn around and show signs of life again.

USD/JPY Forecast Video for 15.02.23

US Dollar vs Japanese Yen Technical Analysis

The US dollar has pulled back just a bit during the trading session on Tuesday, but then turned around to show signs of life again. It still looks as if the US dollar is trying to break higher against the Japanese yen, but it’s also worth noting that the 50-Day EMA is sitting just above, and currently offers a little bit of resistance. If we can break above there, then I think the market will more likely than not go looking to reach the 200-Day EMA above. That is sitting just above the ¥133.50 level, so it all ties together quite neatly. Anything above there then becomes very bullish. On that bullish move, the ¥136 level, and then the ¥137.50 level both offer nice targets.

The alternate scenario of course is that we break down, but I think that the ¥130 level is going to be a massive support level, and therefore I’m not overly concerned. Ultimately, this is a situation where even if we do dip from here, I think there will be plenty of buyers willing to pick up the greenback against the yen. Remember, the Bank of Japan continues to fight interest rates, therefore a lot of people will be looking at this through the prism of whether or not the 50 basis point ceiling is being threatened.

At this juncture, certainly it looks as if we have plenty of people willing to threaten that, so therefore the Japanese yen will continue to be on its back foot. However, if interest rates around the world start to drop again, that helps the Bank of Japan do its job, therefore we could see this market fall again.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement