Advertisement

Advertisement

Analysis-China’s rapid reopening brings joy and woe for world markets

By:

By Yoruk Bahceli (Reuters) - The rapid reopening of China's economy from COVID lockdowns is brightening the outlook for global investors keen to leave behind one of their worst years on record, but may also fuel the inflationary pressures policymakers hope are abating.

By Yoruk Bahceli

(Reuters) – The rapid reopening of China’s economy from COVID lockdowns is brightening the outlook for global investors keen to leave behind one of their worst years on record, but may also fuel the inflationary pressures policymakers hope are abating.

The impact of the reopening of the world’s second largest economy on financial markets, hit by double-digit losses last year as inflation and interest rates jumped, is critical.

Being touted among the top buying bets on recovery hopes are emerging markets, commodity currencies, oil, travel and European luxury companies.

No doubt, it will be a bumpy ride. COVID cases, deaths, and the economic hit to China from rampant infections are yet to play out and commodity prices are already rising, adding to inflation risks.

For now investors are focused on the positives, anticipating more stimulus measures by Beijing and that the health crisis and economic hit to China will peak in the first quarter.

“The reopening story is looking quite good and … there is a lot of credit and fiscal stimulus that China is putting into the system,” said Edward Al Hussainy, senior interest rate and currency analyst at Columbia Threadneedle, which manages $546 billion of assets.

“That stimulus is finding its way into global asset prices.”

China’s reopening also takes the sting out of recession risks. Goldman Sachs expects the euro zone economy to grow by 0.6% this year, versus a contraction forecast previously.

Chinese demand “will offset that story in the West…” that consumer demand and business spending have been slowing down as interest rates have gone up, said Chris Iggo, chief investment officer for core investments at AXA Investment Managers.

Winners

Emerging markets, seen benefiting from tourism and trade links to China, were at the top of the buy list.

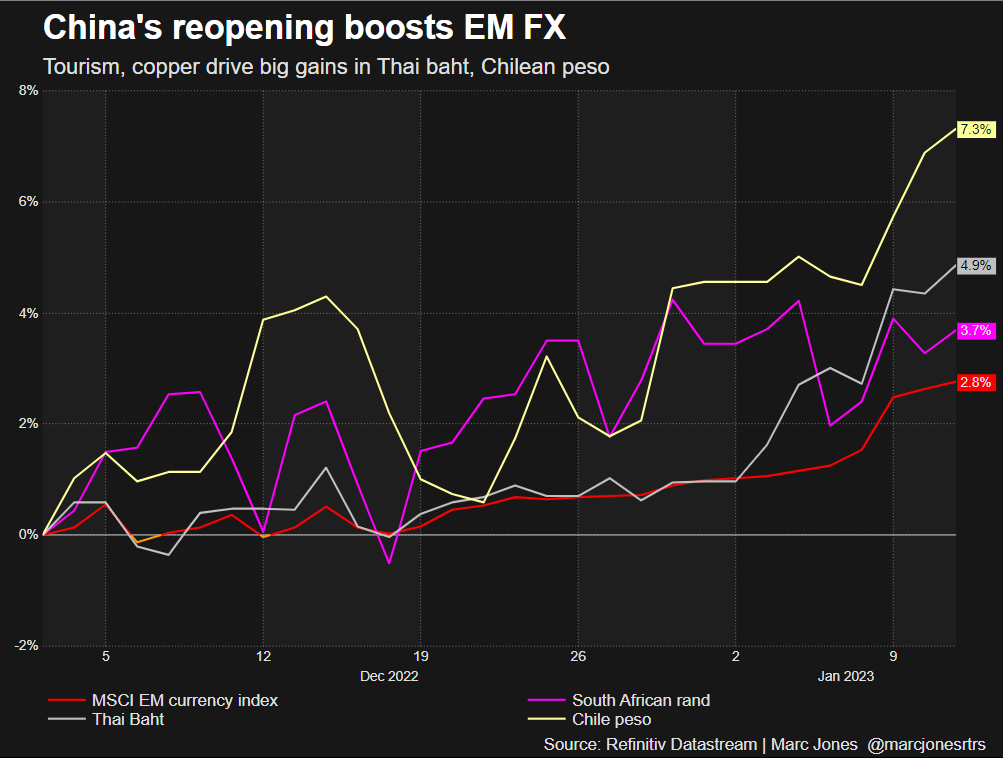

A favourite for Hussainy and other investors was the Thai baht. It has rallied to its highest since March and is up some 5% since the start of December..

Chinese tourists are critical to the Thai economy, accounting for a quarter of annual visitors to Thailand pre-pandemic.

Amundi, Europe’s leading investor, said the reopening may herald a “turning point” for emerging market equities, a trade also favoured by the investment institute at BlackRock, the world’s largest asset manager.

Company earnings in Malaysia, Singapore and Thailand should get a boost, Goldman Sachs said.

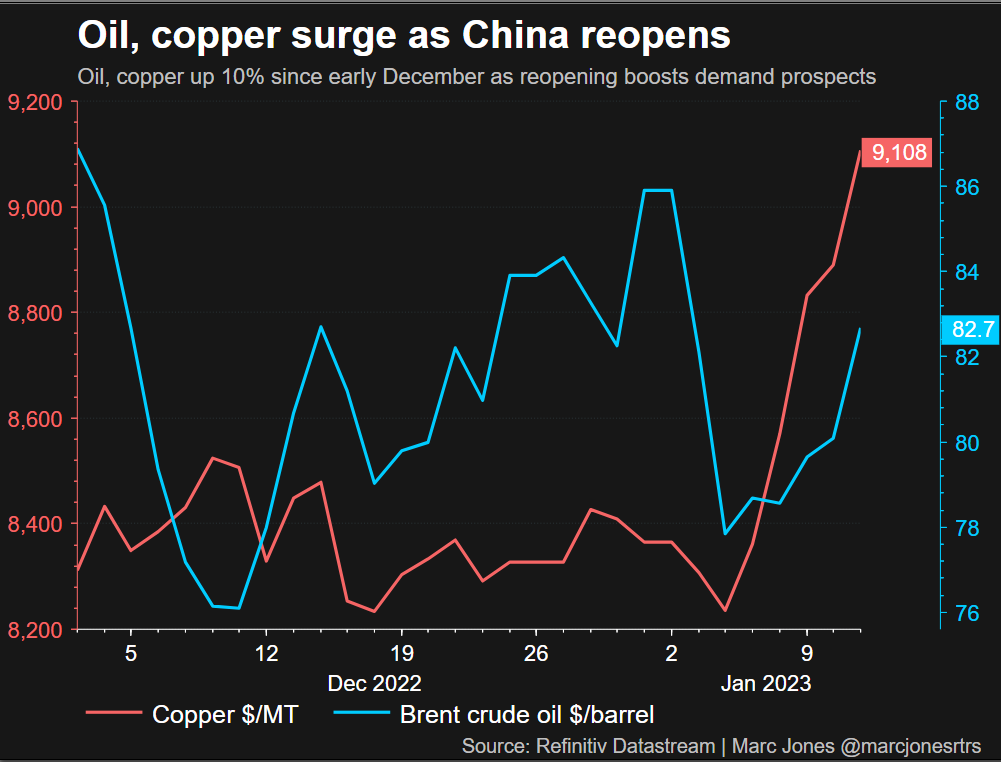

Another investor favourite is leading copper producer Chile. Its peso is up 7% since early December as copper prices have jumped to hit $9,000 this week for the first time since June.

The commodity-driven Australian dollar, could also rise further, said BlueBay Asset Management fund manager Zhenbo Hou.

Holiday?

Tourism and leisure stocks were expected to benefit. China was the world’s largest outbound tourism market before the pandemic.

Chinese consumers “will run to Beijing International Capital airport and go out of the country as fast as they can because they want to travel,” said Alison Shimada, head of total emerging markets at Allspring Global Investments.

Travel could also benefit European luxury stocks, where Chinese consumption has dwindled since the start of the pandemic, UBS noted, accounting for around 17% of sector sales versus 33% in 2019. That should boost valuations.

Luxury brand LVMH shares this week hit a record high.

The boost to world growth from China’s reopening was expected to hurt the safe-haven dollar but benefit the euro. China is the European Union’s leading trading partner at about 16% of all goods trade.

Barclays analysts reckon China’s slowdown was responsible for more than half the euro’s drop against the dollar last year.

The reopening supports the outperformance of European stocks and challenges the consensus underweight positioning, they said. UBS also favours European materials, industrials and consumer discretionary stocks.

Inflation caution

But a boost from China’s reopening raises some concerns about inflation.

China is the world’s leading importer of oil and many other commodities — oil prices have risen 10% since mid-December to almost $84.

“One thing that we need to be sensitive to is whether the recovery in China adds to global inflationary pressures,” AXA’s Iggo said. He added that the reopening could prompt the European Central Bank to raise rates for longer since euro area inflation is largely energy driven.

The hope is that economic slowdown outside China will offset its rising demand for commodities, dampening the inflationary impact.

Goldman Sachs estimates a return to normal travel and transportation behaviour in China could boost oil consumption by 1.5-2 million barrels per day, but slower growth globally means oil prices won’t touch 2022 highs near $140.

“The rise in rates is really starting to have the desired impact on inflation at this point in time, which I think should play through the course of the year, even with China reopening,” said Jason Pride, chief investment officer of private wealth at Glenmede.

(Reporting by Yoruk Bahceli; additional reporting by Davide Barbuscia, Samuel Indyk, Dhara Ranasinghe and Marc Jones; editing by Dhara Ranasinghe and Emelia Sithole-Matarise)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement