Advertisement

Advertisement

How Global Debt of More Than $100 Trillion Is Threatening Your Portfolio

Updated: Aug 23, 2015, 11:00 GMT+00:00

There is a recent statistic that is quite shocking: the total amount of debt globally is now over $100 trillion, a jump of 40% over the last six years.

There is a recent statistic that is quite shocking: the total amount of debt globally is now over $100 trillion, a jump of 40% over the last six years.

According to the Bank for International Settlements, which is run by 60 central banks, since the financial crisis, the majority of the $100 trillion in debt has been issued by governments and nonfinancial corporations. (Source: “March 2014 quarterly review,” Bank for International Settlements web site, March 9, 2014.)

You would think that with such a huge amount being issued, it would drive interest rates higher amid a debt crisis. But as we all know, the exact opposite has occurred with interest rates still near historic lows.

What’s really shocking is that governments and corporations have borrowed and pumped out a massive amount of money, yet the global economy is barely moving. We know why corporations have issued the debt; with interest rates low, it does make sense to take advantage of the environment, borrow money, and fund share buybacks and dividends.

Of course, it makes one ask the question—if high levels of debt fueled the previous debt crisis, can we fundamentally solve this problem with even more debt? Not likely.

The real question for investors who are allocating capital to these markets is: are they suitable for long-term investors, or should we consider if a debt crisis is possible?

With the situation in Ukraine deteriorating along with other parts of the world, such as Venezuela, this is creating a flight to the perceived quality of the bond market in the developed world. However, long-term, I’m not so sure.

With the U.S. official debt now well over $17.0 trillion, $100 trillion is a massive amount of money. As we all know, the unfunded liabilities for America are much higher.

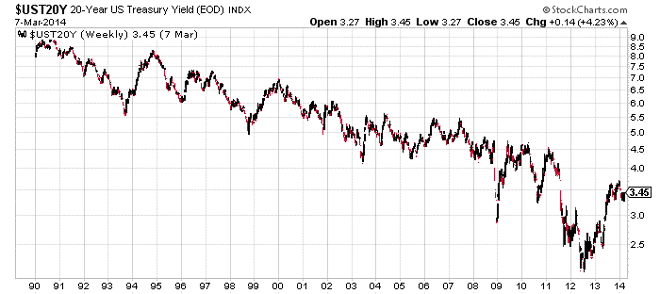

Chart courtesy of www.StockCharts.com

We’ve already seen long-term interest rates begin creeping higher, as investors are beginning to anticipate that higher interest rates will eventually be coming. The real question is: how will investors react? This is always a question to consider if we are talking about a potential debt crisis.

Let’s be honest: for the most part, countries are not running budget surpluses, which means that it’s impossible for them to pay back all the money borrowed. I think that most governments would be quite happy to see inflation begin rising enough to inflate away this overhang before a full debt crisis explodes.

I don’t believe U.S. interest rates will surge anytime soon, because of the lack of available investments for institutions elsewhere. I do think interest rates will continue rising at a steady rate, which means I would avoid long-term fixed-income products.

I also think we are close to an inflection point when it comes to the velocity of money. Trillions of dollars have been printed, yet inflation remains relatively low. This is because the velocity of money has hit all-time lows.

In my opinion, we are coming to a point where inflation is about to begin to increase here in America. However, it’s a fine line between somewhat manageable inflation and an outright debt crisis. If things get out of hand and long-term interest rates begin rising, this will severely affect the economy.

Of course, none of this will happen tomorrow, as it takes time for these events to occur. As long as interest rates remain low, the rise in the stock market will continue. But I would begin taking precautions by adding some gold bullion to a well-diversified portfolio.

About the Author

FX Empire editorial team consists of professional analysts with a combined experience of over 45 years in the financial markets, spanning various fields including the equity, forex, commodities, futures and cryptocurrencies markets.

Advertisement