Advertisement

Advertisement

Marketmind: BOJ’s moment of truth

By:

By Jamie McGeever (Reuters) - A look at the day ahead in Asian markets from Jamie McGeever.

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever.

The waiting is almost over.

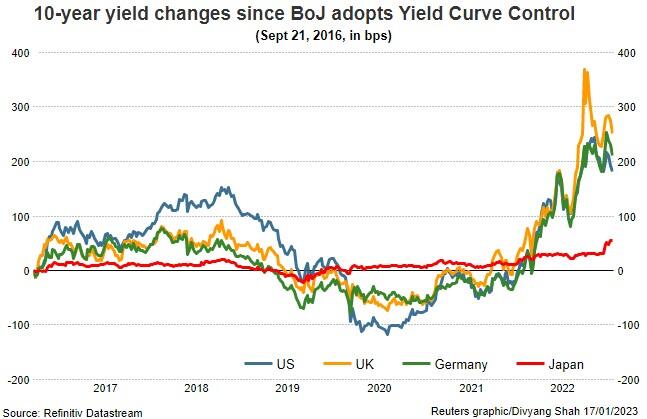

The Bank of Japan (BOJ) on Wednesday delivers one of its most eagerly anticipated policy decisions in years, if not decades, after it stunned markets last month by unexpectedly tweaking its ‘yield curve control’ (YCC) cap on government bond yields.

Speculation is rife that the BOJ will make further changes to its YCC, perhaps raising the cap and effectively tightening policy by allowing the 10-year bond yield to shoot higher.

This is what investors are positioned for: the yen is hovering around an eight-month high against the dollar – up nearly 20% since October – and the 10-year yield traded above the 0.50% de facto cap for a third straight day.

Analysts at Citi are among the few who think the BOJ will abolish its YCC policy. If it does, expect dollar/yen to fall as much as 5%, domestic yields to rise and Japanese life insurers and funds to repatriate trillions of yen of capital, they say.

Others caution the market may be setting itself up for a fall, setting a high bar for BOJ Governor Haruhiko Kuroda and colleagues to show they are moving away from the ultra-loose policy of recent years. Could disappointment push dollar/yen back up 5% through 130.00?

Either way, the era of Japanese capital flowing into higher-yielding foreign bonds seem to be over, for now. Japanese investors were net sellers last year, and repatriation pressures and rising hedging costs suggest they won’t be buyers this year.

World markets were in wait-and-see mode on Tuesday and held to pretty narrow ranges, despite the torrent of news flow and data.

China’s fourth quarter GDP and December snapshot of retail sales, investment and industrial output were universally weak, but they were all significantly stronger than economists had expected. Encouraging signs for the brave new world after zero-COVID?

A key index of U.S. manufacturing on Tuesday showed activity crashed this month, and Goldman Sachs reported a huge Q4 earnings miss. But a strong rise in Tesla shares, thanks to surging sales in China, kept the Nasdaq above water.

All eyes now on Tokyo.

Three key developments that could provide more direction to markets on Wednesday:

– Bank of Japan policy meeting

– World Economic Forum in Davos

– U.S. retail sales (December)

(Reporting by Jamie McGeever in Orlando, Fla.; Editing by Josie Kao)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement