Advertisement

Advertisement

Marketmind: To the inflation stations

By:

By Jamie McGeever (Reuters) - A look at the day ahead in Asian markets from Jamie McGeever.

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever.

U.S. inflation will set off the global market fireworks on Thursday and beyond, but there are a couple of other potential rockets that could spark Asian markets into life before that – Chinese and Indian inflation data.

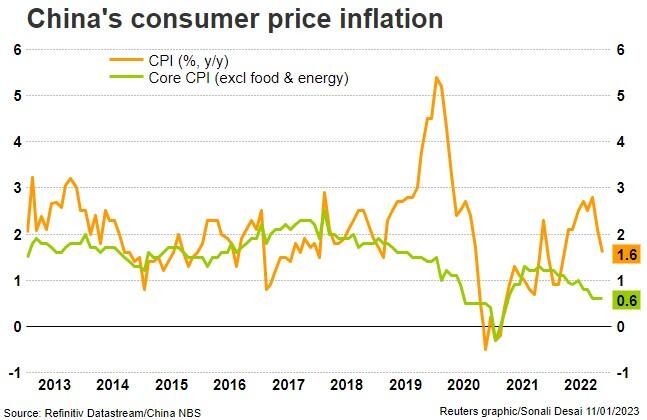

China, the world’s second largest economy, is expected to register a second consecutive month of month-on-month consumer price declines in December, something not recorded since the first half of 2021.

Economists are forecasting a drop of 0.1% following a 0.2% fall in November, while the annual rate of inflation is expected to tick up to 1.8% from an eight-month low of 1.6%.

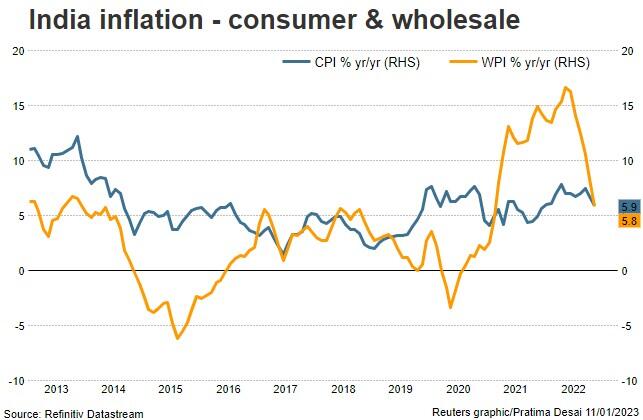

Indian CPI, meanwhile, has slowed steadily and fairly substantially in recent months. But with an economy growing much faster than China’s – India’s GDP is expected to expand this year by around 7% – inflation remains at a higher level.

Economists expect annual inflation of 5.9% in December, almost identical to November’s 5.88%, which was the lowest since January and almost two percentage points down from the April peak.

Needless to say, the two central banks are at different stages of the cycle. India’s has raised interest rates by 225 basis points since May to a three-year high of 6.25%, and another modest hike is expected soon. Almost alone among the world’s large economies, China’s eased policy last year.

But the main event of the day is the U.S. inflation report for December that lands at 8:30 a.m. Eastern (1330 GMT).

The consensus view is for the annual rate to fall to 6.5% from 7.1% in November, which would be the slowest since October 2021 and significantly down from the peak of 9.1% last June. The monthly rate of inflation is expected to be 0%.

Investors are in hopeful mood – Treasury bond yields fell on Wednesday, Wall Street and world stocks surged (again), and U.S. credit spreads are their narrowest since April.

Three key developments that could provide more direction to markets on Thursday:

– U.S., Chinese, Indian inflation (December)

– Japan current account (November)

– Fed’s Barker, Harkin and Bullard speak

(Reporting by Jamie McGeever in Orlando, Fla.; Editing by Josie Kao)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement