Advertisement

Advertisement

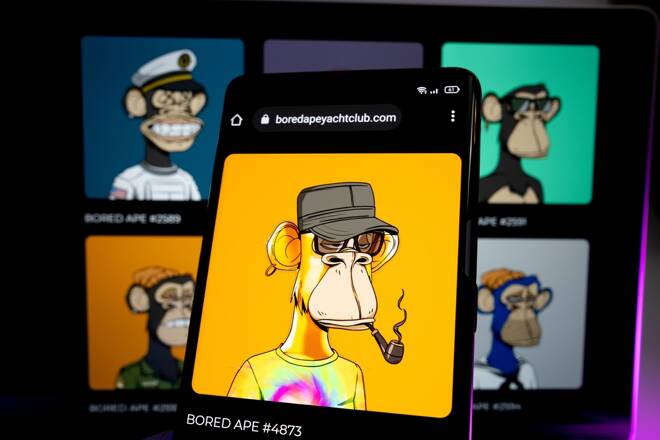

New Bored Ape NFTs and Animoca Brands Introduce KYC Registration

By:

Illicit activity and a marked increase in regulatory scrutiny sees BAYC and Animoca Brands include KYC registration for the next launch.

Key Insights:

- KYC registration is a new requirement for prospective new Bored Ape Yacht Club NFTs.

- Increased regulatory scrutiny and surge in illicit activity have forced a change.

- Investors will be looking for any impact on demand and price.

It’s been a stellar start to the year for NFT marketplaces. In January, OpenSea trading activity hit an all-time high before easing back.

The jump in trading volume also saw illicit activity across the NFT space surge through the early part of the year.

KYC Arrives at the Door of BAYC

Today, Bored Ape Yacht Club chatter heated the Twitter airwaves. News of the next BAYC launch requiring prospective buyers to complete a KYC registration drew condemnation.

Btw, it’s not this…https://t.co/twU7DQnRo8

— Bored Ape Yacht Club (@BoredApeYC) March 10, 2022

Based on media reports and responses to the Twitter announcement, information will include identity document details, name, date of birth, address, proof of address, email, and Ethereum (ETH) address.

Bored Ape Yacht Club is requesting detailed information. Users would need similar information to open a bank account or crypto account. Reaction to the KYC news has been less than favorable and brings into question the ethos of decentralization.

With heightened government scrutiny, however, the BAYC and Animoca Brands collaboration may have little choice but to go down the KYC route.

For NFT collectors, the days of anonymity could have passed. The crypto markets and exchanges had faced a similar fate back in 2018.

Illicit Activity Forces NFT Market into KYC Rollout

Several high-profile thefts, rug pulls, phishing attacks, together with talk of plagiarism, the illegal selling of NFTs, and wash trading, led to increased regulatory scrutiny.

Governments across major digital asset jurisdictions highlighted concerns over the lack of regulatory oversight. The UK, the US, China, and India have all called for increased NFT market oversight.

The concerns over a marked increase in cybercrime coincided with Russia’s invasion of Ukraine in February. Governments are eager to prevent Russia from circumventing imposed sanctions via digital assets.

It was, therefore, only a matter of time before some form of checks and balances hit the NFT marketplace.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement