Advertisement

Advertisement

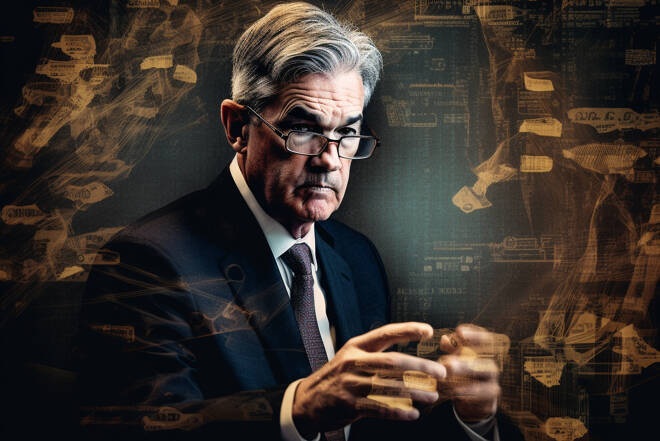

Powell’s Jackson Hole Speech Takes Center Stage as Markets Brace for Impact

By:

Key Points:

- Annual symposium focuses on reassessing monetary policy effectiveness

- Powell's speech eagerly anticipated for clues on future rate decisions

- Market reactions hinge on tone and hints about policy direction

Teton Talks: Where Economic Titans Converge

The annual Jackson Hole Economic Symposium, hosted by the Kansas City Federal Reserve in Wyoming’s Grand Teton National Park, will attract global attention as central bankers, economists, and policymakers gather to discuss critical economic issues. The event, running from Thursday to Saturday, will focus on “reassessing the effectiveness and transmission of monetary policy.”

Powell’s Podium: The Main Event

The highlight of the symposium will be Federal Reserve Chair Jerome Powell’s speech on Friday morning at 14:00 GMT. Investors and analysts eagerly await insights into the Fed’s next moves, particularly regarding potential interest rate cuts. While Powell is expected to acknowledge progress in cooling inflation, he’s likely to maintain a data-dependent stance, avoiding firm commitments to future policy actions.

Rate Cut Roulette: Will Powell Place His Bets?

Market participants will look for clues on whether inflation has eased enough to justify a rate cut in September. However, Powell may avoid pre-committing to a specific path, given upcoming economic data releases before the next Fed meeting on September 17-18. The focus will be on balancing inflation control with concerns about rising unemployment, though a significant rate reduction seems unlikely at this stage.

Market Tremors: When Words Move Mountains

The symposium’s impact on financial markets can be substantial, though not always predictable. Past experience shows that Powell’s speeches have sometimes triggered significant market movements. In 2022, his warnings about potential economic pain led to a 3.4% drop in the S&P 500 index. Conversely, past speeches by former Fed chairs have occasionally sparked rallies, as seen with Ben Bernanke’s remarks in 2009 and 2010.

Dollar Dilemma: Powell’s Balancing Act

This year, market reactions will largely depend on Powell’s tone and any hints about future policy direction. If Powell suggests a more dovish stance or signals openness to rate cuts, it could potentially boost stock markets and weaken the dollar. However, if he emphasizes the need for continued vigilance against inflation or expresses concerns about economic overheating, it might lead to market volatility or downturns.

Beyond the Spotlight: Whispers in the Wilderness

Beyond Powell’s speech, the symposium will feature discussions on various economic papers and informal interactions among attendees. These conversations often provide valuable insights into global economic trends and policy perspectives.

The Pivotal Step: Powell’s Grand Finale

As the Fed approaches what Powell has called a “consequential” first step in policy easing, his Jackson Hole address may focus less on shaping near-term expectations and more on assessing the current economic situation. He might reflect on the progress made in taming inflation over the past two years while acknowledging the challenges ahead.

Overall, while major policy changes are unlikely to be announced, Powell’s remarks will be closely examined for subtle indications that could influence market expectations and economic outlooks in the coming months.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement