Advertisement

Advertisement

If You Want to Know if The Fed Will Raise Rates, Just Watch Gold and T-Notes

By:

We’re in the last quarter of the year, or the homestretch, if you will, in a year in which the financial markets have started to take on the appearance of

We’re in the last quarter of the year, or the homestretch, if you will, in a year in which the financial markets have started to take on the appearance of a “barbell” formation on the charts of the major assets classes. This year saw increased volatility the first six months of the year, culminating with the Brexit vote, then a 3-month long sideways pattern, and now what appears to be the return of volatility.

In this article, we’re going to look at the two major asset classes the Nearby 10-Year U.S. Treasury Notes and Nearby Comex Gold, and dry to draw a conclusion about the chances of a Fed rate hike by the end of the year.

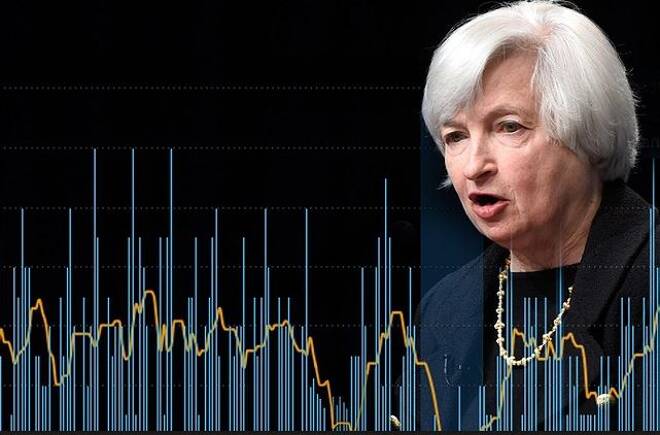

The most interesting chart to look at is the combination of the Nearby 10-year U.S. Treasury Note and the Nearby Comex Gold futures contract. As you can see, this chart shows that the two assets moved lock step with each other in 2016.

In order to understand how to read the chart, you have to remember that the T-Note futures contract moves inverse to interest rates. So when the T-Note market is going down, short-sellers are increasing bets that interest rates will go up.

This chart shows that on December 31, 2015, T-Notes closed at 124’15.5 and gold futures closed at $1072.30.

Throughout the early half of the year, the markets trended together closely as investors started to reduce the chances of a Fed rate hike. Remember at that time that the Fed was reducing the number of rate hikes it had hinted at late last year.

T-Notes topped for the year at 133’08.5 and Nearby Gold topped for the year at $1385.00 on July 6.

After drifting sideways to lower throughout July, August and September, T-Notes and Gold plunged the week-ending October 7. To look at it another way, gold plunged as interest rates soared during the week-ending October 7.

Another key area to look at is their respective 50% levels. The 50% level for the year for the Nearby T-Note contract is 128’27.5. The 50% level for the year for the Nearby Comex Gold futures contract is $1228.65.

The conclusion I have to draw while comparing the Nearby T-Notes futures contract and the Nearby Comex Gold contract is that early in the year, investors bet against a rate hike, but since July 6, investors have been preparing for a rate hike. However, since the two markets are trading slight above their 50% levels for the year, there is a little less than a 50/50 chance that the Fed will raise interest rates this year.

Between now and the end of the year, the key levels to watch are 128’27.5 for the Nearby T-Note contract and $1228.65 for the Nearby Comex Gold contract. If T-Notes and Gold cross to the weak side of their respective 50% levels then we are likely to see a rate hike. If these two markets stay above their 50% levels then the Fed will not raise rates in December.

You can see that we came close this week, but Friday’s jobs report was not enough to convince gold and T-Note traders that the labor market is strong enough to start preparing for a Fed rate hike.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement