Advertisement

Advertisement

With the U.S Markets Closed, Service PMIs Put the EUR in the Spotlight

By:

Service PMIs from the Eurozone will be in focus today. Away from the figures, expect the markets to continue to respond to the U.S NFP numbers.

Earlier in the Day:

It was a busier start to the day on the economic calendar on Friday. The Aussie Dollar and Japanese Yen were in action early in the day. There were also stats from China for the markets to consider.

Away from the morning stats, the markets responded to economic data from the U.S on Thursday and COVID-19 news.

Looking at the latest coronavirus numbers

On Thursday, the number of new coronavirus cases rose by 190,716 to 10,985,093. On Wednesday, the number of new cases had risen by 210,499. The daily increase was lower than Wednesday’s rise and down from 235,258 new cases from the previous Thursday.

Germany, Italy, and Spain reported 1,027 new cases on Thursday, which was down from 1,062 new cases on Wednesday. On the previous Thursday, 1,286 new cases had been reported.

From the U.S, the total number of cases rose by 48,853 to 2,828,313 on Thursday. On Wednesday, the total number of cases had risen by 51,607. On Thursday, 25th June, a total of 45,503 new cases had been reported.

For the Japanese Yen

The June Services PMI came in at 45.0 according to finalized figures, which was up from a prelim 42.3. In May, the PMI had stood at 26.5.

According to the finalized Survey,

- An end to the state of emergency delivered much-needed support as the PMI hit a 4-month high.

- Levels of activity and new orders saw a faster pace of decline, however, attributed to the impact of COVID-19 on the economy.

- Employment levels declined only marginally, with 88% of firms reporting no change to employment levels.

- Confidence improved to a 4-month high in spite of firms seeing challenges ahead.

The Japanese Yen moved from ¥107.472 to ¥107.541 upon release of the figures. At the time of writing, the Japanese Yen was down by 0.04% to ¥107.54 against the U.S Dollar

For the Aussie Dollar

May’s retail sales figures were in focus early on. According to the ABS, retail sales jumped by 16.9%, reversing most of a 17.7% slide from April. Economists had forecast a 16.3% rise.

- Clothing, footwear, and personal accessory retailing jumped by 129.2%.

- Cafes, restaurants, and takeaway food services reported a jump of 30.3%

- Food retailing increased by 7.2%, with household goods retailing up by 16.6%.

- Department store retailing rose by 44.4%.

The Aussie Dollar moved from $0.69262 to $0.69206 upon release of the figures. At the time of writing, the Aussie Dollar was up by 0.01% to $0.6925.

Out of China

China’s Caixin Services PMI rose from 55.0 to 58.4 in June. The composite increased from 53.4 to XX, supported by an uptick in activity across both manufacturing and services.

According to the June Services Survey,

- Business activity and new orders rose at a sharper pace in June, with the rate of expansion the quickest since 2010.

- New business also rose at the sharpest pace since 2010, while workforce numbers continued to decline.

- The modest decline in the workforce was attributed to voluntary leavers.

- Optimism across services sector firms hit a 3-year high, attributed to strong demand.

The Aussie Dollar moved from $0.69229 to $0.69237 upon release of the figures

Elsewhere

At the time of writing, the Kiwi Dollar was up by 0.09% at $0.6517.

The Day Ahead:

For the EUR

It’s a busy day ahead on the economic calendar. June Service PMI numbers are due out of Italy and Spain, with finalized PMIs due out of France, Germany, and the Eurozone.

Expect the Eurozone’s Services and Composite PMIs to have the greatest influence on the day.

With the U.S markets closed in recognition of Independence Day, expect volumes to be on the lighter side.

Any chatter on the EU’s Recovery Fund and Brexit will also be an influence on the day.

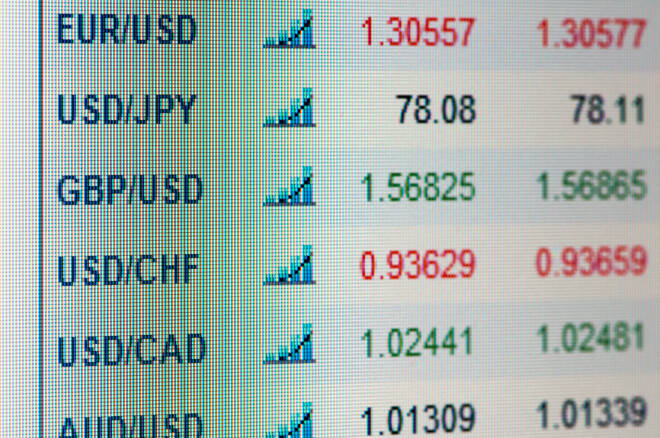

At the time of writing, the EUR was up by 0.05% to $1.1245.

For the Pound

It’s a quiet day ahead on the economic calendar. June’s finalized services and composite PMIs are due out later this morning.

Barring any deviation from prelims, the stats are unlikely to have a material impact on the Pound.

Brexit and COVID-19 will remain the key drivers on the day.

At the time of writing, the Pound was down by 0.01% to $1.2467.

Across the Pond

The U.S markets are closed in recognition of Independence Day. That leaves the Greenback in the hands of market risk appetite on the day.

At the time of writing, the Dollar Spot Index was down by 0.12% to 97.199.

For the Loonie

It’s a quiet day ahead on the calendar. There are no material stats due out of Canada to provide the Loonie with direction.

With the U.S markets closed, expect volumes to be on the lighter side. Market risk sentiment will influence on the day, however.

At the time of writing, the Loonie was flat at C$1.3564 against the U.S Dollar.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement