Opinions

- FX Empire Editorial Board

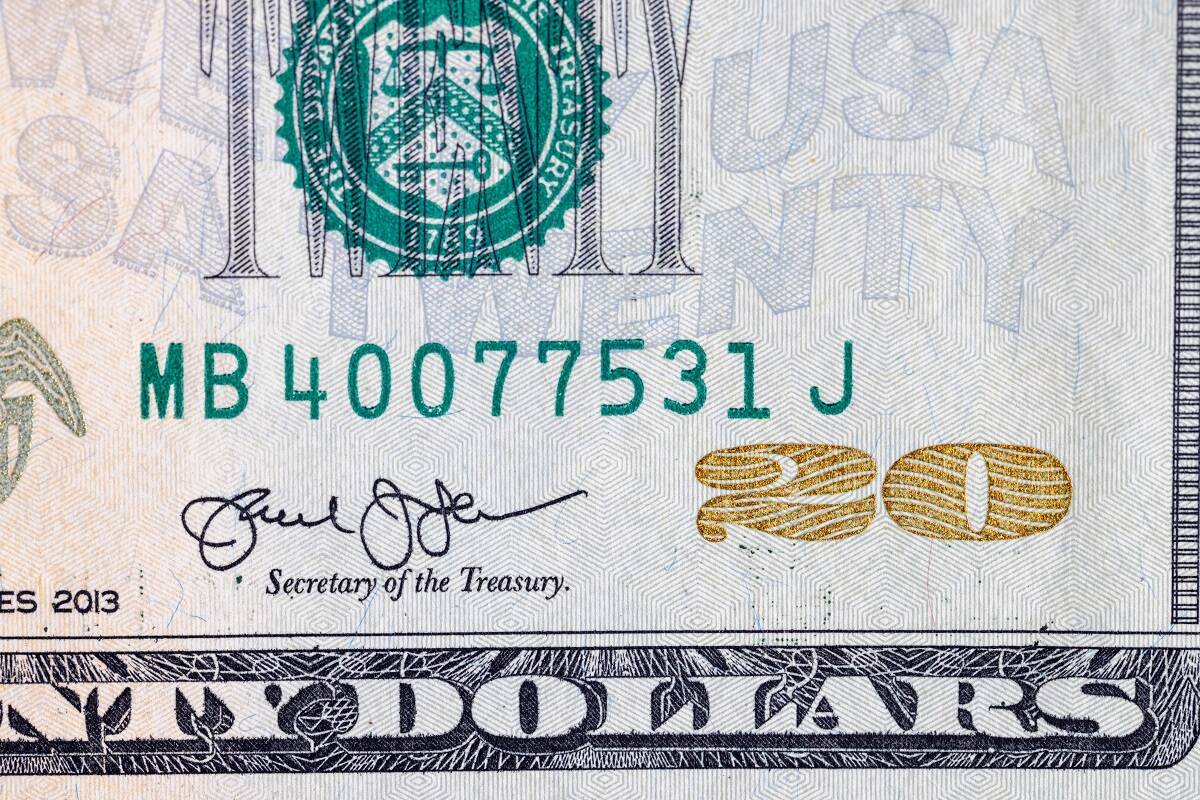

While the Federal Reserve has cut back on its money printing program, the fact of the matter is that the “official” U.S. national debt is closing in on $18.0 trillion. The unofficial national debt (when obligations like Social Security, Medicare, Medicaid, welfare, and now Obamacare are taken into consideration) is

- FX Empire Editorial Board

When you walk into a Cracker Barrel restaurant, you pretty much know what you’re going to get. (And you know what kind of candy will tempt you on the way out.) And when it comes to its action in the investing world, the situation isn’t all that different. Cracker Barrel

- FX Empire Editorial Board

Charles Oliver, lead portfolio manager with the Sprott Gold and Precious Minerals Fund, believes the only thing between investors and bigger investment returns on precious metals equities and bullion, especially silver, is time. In this interview with The Gold Report, Oliver discusses silver and gold demand drivers, as well as portfolio

- FX Empire Editorial Board

The retail sector is clearly undergoing some duress early on in 2014 as there is a worrisome feeling that the country’s economic growth may be stalling. The first quarter’s gross domestic product (GDP) growth was muted. Retail sales were also soft in April. The core reading showed spending contracted by

- FX Empire Editorial Board

is facing some growth issues, but so are the majority of the countries in the Western Hemisphere. The country’s new government leader, President Xi Jinping, came on board in March 2013 and is planning to change the landscape of China vis-a-vis a new focus on domestic consumption and a reduction

- FX Empire Editorial Board

There still is no real trend in the equity market. One day, stocks sell off big-time; the next, the S&P 500 and Dow Jones Industrial Average hit new record-highs. This is a very tough market to figure; anything can happen when monetary policy is highly accommodative. A lagging NASDAQ Composite

- FX Empire Editorial Board

If you want to see what happens when irrationality over a stock comes to an end, check out this chart of Amazon.com, Inc. (NASDAQ/AMZN). Chart courtesy of www.StockCharts.com In 2013, Amazon.com stock went up 63%. So far this year, the stock has collapsed 25% as investors realize converting

With more than 2,000 junior mining companies currently trading, it’s often difficult to sort out the promising gold equities. That’s why The Gold Report talked with Beacon Securities Managing Director and Analyst Michael Curran about some of his favorite ideas to unearth equities that add value and gold exposure to your portfolio.

- FX Empire Editorial Board

The Chinese economy had been growing at about 10% a year, like clockwork, for years. Now, China is in the midst of an economic slowdown, with growth expected to come in this year at 30%–50% below China’s five-year average growth rate. Why is China’s economy growing so slowly, and why

- FX Empire Editorial Board

In my mind, portfolio safety and consistency of equity market returns are paramount. This is a basic portfolio management principle, and I like to see consistent earners as core positions in any equity market portfolio. This doesn’t mean there isn’t room for more speculative stocks, but investing is different than

- FX Empire Editorial Board

As the country moves forward in providing medical coverage for all Americans, the healthcare sector will be one of the top growth areas for investment opportunity going forward. As I recently discussed in these pages, there are ways investors can benefit from Obamacare, whether you believe in the new healthcare

- FX Empire Editorial Board

A lot of stocks are rolling over, breaking their 50- and 200-day simple moving averages (MAs). This is a tired market that could very well consolidate or correct right into the fourth quarter. And the economic data has been softer, as well. Throw in geopolitical tensions with Russia and we

- FX Empire Editorial Board

Adrian Day has spent years making money for clients by steering them into and out of positions in precious metals equities. While higher commodity prices are always welcome, the founder of Adrian Day Asset Management says in this interview withThe Gold Report that he maneuvers toward more telltale fundamentals like strong

- FX Empire Editorial Board

Is silver presenting an even greater investment opportunity than gold bullion? It’s been well documented in these pages that demand for gold bullion is increasing and supply is declining due to lower prices. The silver market is going through the exact same thing. Last year, the Indian government decided to

- FX Empire Editorial Board

The housing market continues to hold. But there are some warning signs. Famed investor Warren Buffett suggested the housing market was overvalued and due for an adjustment. Now, while there are some indications of an overhyped housing market, I’m not convinced it’s bubble-like quite yet. But be warned: mortgage rates

The future will be decided in a race between global advances in demand for resources, complex technology and biotech innovation, and growing sovereign debt. In this interview with The Gold Report, Thoughts from the Frontline author John Mauldin points to the sectors that could benefit from the upside of improving world demand and

- FX Empire Editorial Board

Mother’s Day is on Sunday, and it’s not too late to begin thinking about how to celebrate and reward good old mom for all those years of managing the household. Of course, what always comes to mind are flowers, a special dinner, or perhaps a show or gift to display

- FX Empire Editorial Board

Finding really good businesses that grow their operations (and share prices) consistently over time is actually very difficult. Whether it’s the current state of the business cycle, interest rates, capital spending, or the weather, a business that can consistently grow through all the risks is golden. One such company that

- FX Empire Editorial Board

To assess an economy’s health and its direction, you have to look at how the general public is doing. You must ask if their standard of living is improving. Are they optimistic about their future prospects? As it stands, the average American Joe is suffering, and he’s making a solid

- FX Empire Editorial Board

In 2013, the U.S. budget deficit came down to $680 billion. Finally, after four consecutive years of annual budget deficits of more than $1.0 trillion, the government got its annual “hole” under the trillion-dollar level, and it seemed as though we were headed in the right direction. But stop. The