Advertisement

Advertisement

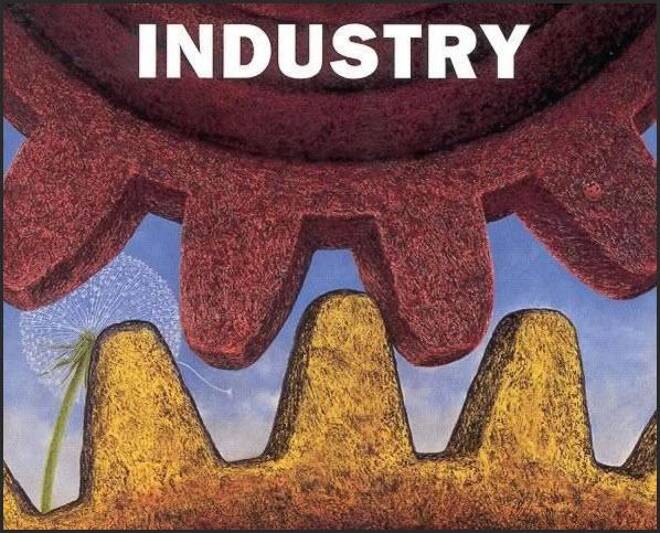

Managing Industry Risk

By:

Intro

Within the financial industries risk comes in many forms. When you are looking at industry risk analysis, you are determining the financial risk of

Within the financial industries risk comes in many forms. When you are looking at industry risk analysis, you are determining the financial risk of investing in an industry and how risk in one specific industry can potentially affect another industry due to spillover.

When performing industry risk one should analyze events that may erode a specific industry. There is a good deal of importance when establishing assets within a portfolio. An investor should look at and evaluate industry risk when creating their portfolio. A well diversified portfolio should assist in avoiding pit falls particularly when one industry collapses and creates poor returns for an investor.

Asset allocation is extremely important when reviewing strategies used to reduce industry risk. Asset allocation entails distributing capital to financial vehicles other than securities, typically avoids purchasing products which will have direct exposure to one specific industry. A perfect example of this is an investor who distributes capital to corporate bonds should not purchase bonds that may have exposure within the same industry.

A clear way that industry risk analysis can assist an investor is to show if the portfolio is to top heavy in one single industry. If the investor has a portfolio that is to top heavy in one industry that investor may face difficult times if events take place and generate downward prices for all stocks within that industry. A well diversified portfolio of securities from several industries with varying degrees of risk levels can assist in preventing a portfolio collapse if a negative price movement takes place.

When looking at specific investing styles and industry risk you can evaluate the best style which will help you in the long term. A bottom up approach to investing dissects an organization and will determine if that organization is undervalued based on its own doing. Typically, this investing style does not pay attention to industry risk or macro risk because the investment decision is strictly associated to the merit of the organization. A top down style of investing will incorporate macro factors along with industry issues to decipher if a security is valued correctly. Both a bottom up and top down investing style are subject to industry risk, however, it is more important for a bottom up investor to create a diversified portfolio given the lack of focus to industry rick when investing.

Usually, industry risk is associated to organizations that take place in a specific line of business. For example, the energy industry includes service oil and gas drilling organizations, downstream refiners, upstream producers, service oil and gas drilling organizations along with numerous other organizations that help in the petroleum process. These organizations have a direct risk factor to the energy industry. There are also a number of organizations that have an indirect risk to energy. An example of an organization that has indirect exposure to energy prices would be a transportation organization. This would be a perfect example of how an organization can be directly affected by indirect costs.

In closing, industry risk can potentially have a direct affect on the returns of an investor’s portfolio. When a sudden change within a sector takes place this can rapidly change the way an investor views an industry. Investors should be aware of the risks associated to an industry and diversity their portfolios accordingly.

About the Author

David Beckerauthor

David Becker focuses his attention on various consulting and portfolio management activities at Fortuity LLC, where he currently provides oversight for a multimillion-dollar portfolio consisting of commodities, debt, equities, real estate, and more.

Advertisement