Advertisement

Advertisement

The U.S. Yield Curve Is Flattening And What You Need To Know About It

By:

Intro

The yield curve is one of the most talked about market indicators there is but what is it, and what is it doing now.

What Is The Yield Curve And Why Does It Matter

The yield curve is a much-talked-about phenomenon, especially in today’s market environment. With central banks around the world shifting policy stance, trade relations impeding economic activity, and global GDP slowing the yield curve is going to be in focus for some time.

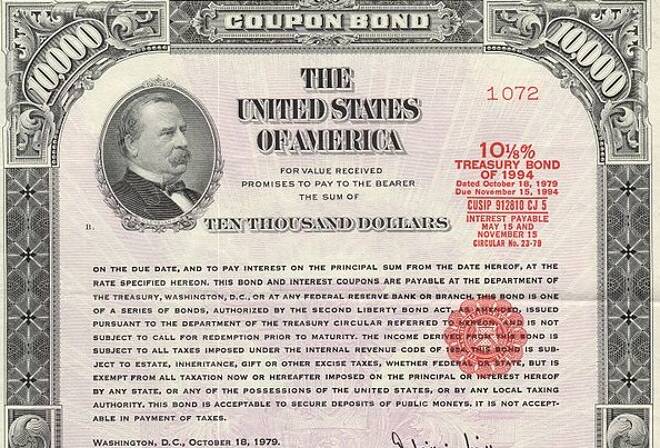

A yield curve is a plot showing the relationship between interest rates for similar securities across different maturities. The securities in question are fixed-income securities such as bonds. The most commonly tracked yields are for bonds issued by the U.S. Treasury but they are not the only ones. Bonds issued by any government could be tracked in this manner to glean information about the market.

The U.S Treasury issues bonds in durations of 3 months, 2 years, 5 years, 10 years and 30 years. The curve is most often used in two ways. In the first, the rates are used as a comparative benchmark when looking at other forms of investment. These include but are not limited to mortgages and bank lending rates.

The second way the curve is used is to determine changes in the economy. A normal yield curve is one in which longer-termed maturities have higher interest rates. This creates a rounded or humped curve. A flattened or inverted curve shows longer-maturity bonds have an equal or lower interest rate than the shorter end of the curve.

A normal yield curve is viewed as a sign of economic expansion. That is because it shows buyers are more interested in shorter-duration securities. Flattened or inverted yield curves are often viewed as signs of impending recession because traders are rushing to lock in higher rates on longer-term “safer” securities. This is a sign of investors seeking shelter from the storm. When the curve is flattening, in either direction, it is a sign of economic change.

What Is The Yield Curve Doing Now?

The U.S. yield curve has flattened over the past year. The odd thing is that rates on the long end of the curve, rates for the 5, 10, and 30-year maturities, have remained relatively flat while those on the short end are rising. This shows investors are selling their short maturities but not yet begun buying up the long end. Economic change is afoot, the problem for investors is knowing what kind of change is coming.

Economic indicators show the U.S. and global economy slowed down in the fourth quarter of 2018. That slow down may linger into 2019, it may turn into a recession, but there is a question waiting to be answered before the market will commit to that view; trade.

The economic slowdown and the gloomy economic outlook is all tied to the trade war between the U.S. and China. If the two sides reach agreement and trade ties are renewed economic activity will pick up and the curve will return to normal. If the two sides are not able to reach consensus tariffs and non-tariff barriers, and escalation of tensions, will drag the global economy and the yield curve will invert.

The curve may continue to flatten or invert, with or without a trade deal. If it does the FOMC will be forced to ease monetary policy in order to support the U.S. economy. Easing policy, lowering interest rates and ending the balance sheet run-off, are the only tools the Fed has to support economic growth and the yield curve. If there is no trade deal the Fed may not have enough fiscal power to stop the curve inverting.

This Is The Outlook For The U.S. Yield Curve

The outlook for the U.S. yield curve is uncertain although there are some who say it will invert in 2019. The flattening we’ve seen over the past year suggest a change in the economy is at hand, the fact that change is induced by trade relations leaves the outcome uncertain. For now, investors should view the flattened curve as a sign of caution; the market is ready for a recession but equally hopeful an economic downturn won’t happen. If the data remains weak, if the trade talks fall apart, we may see an inversion.

About the Author

Thomas Hughesauthor

Thomas has been a professional options trader and investor since October 2005. At that time, Thomas was introduced to financial markets, technical analysis, and financial market analysis. He tracks economic data from the worlds leading economies, corporate earnings, equities, currency, commodities, and cryptocurrencies.

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement