Advertisement

Advertisement

Trend Following Strategies In Today’s Markets

Updated: Mar 5, 2019, 16:14 GMT+00:00

Intro

Trend following strategies have been under the limelight for its dismal performance in recent years. Whenever we think of trend following, we think about

Trend following strategies have been under the limelight for its dismal performance in recent years. Whenever we think of trend following, we think about Commodity Trading Advisors (CTA) and as a result, CTA funds’ performance has been closely scrutinized as well. Media has also been quick to jump onto the story proclaiming the “death” of trend following and CTA funds.

In this article we will take a quick look at how CTA funds have performed compared to traditional broad asset classes including Global Equities, Global Bonds and Broad Commodities. We explore using 3 different indices as a proxy for trend following strategies as well as CTA funds’ performance. They are namely

n Barclay US Managed Futures Industry BTOP 50

- The BTop 50 Index seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. The BTop 50 employs a top-down approach in selecting its constituents. The largest investable trading advisor programs, as measured by assets under management, are selected for inclusion in the BTop 50. In each calendar year the selected trading advisor programs represent, in aggregate, no less than 50% of the investable assets of the Barclay CTA Universe. The Index begins in January 1990 with a starting value of 1000.

n Barclay Trader Indexes CTA

- The Barclay CTA Index provides a benchmark of representative performance of commodity trading advisors (CTAs). In order to qualify for inclusion in the Index, a CTA must have four years of prior performance history. When a CTA already in the Index introduces an additional program, this additional program is added to the Index after its second year. In order to limit potential upward bias, only CTAs with at least four years of performance history are included in the Index and the performance history begins with year five, ignoring the first four years of performance. In 1999, 319 CTA programs were included in the calculation of the Barclay CTA Index. The index is unweighted and rebalanced at the beginning of each year.

n Newedge Trend Index

- The Newedge Trend Index, which is equal weighted, calculates the daily rate of return for a pool of trend following based CTAs. The index is rebalanced annually.

We are fully aware that CTA funds employ various strategies including arbitrage, counter-trend, fundamental, momentum, pattern recognition, seasonal, technical and trend following. Trend following strategies have historically been an important strategy among CTA funds and in this article we use CTA funds’ performance as a representation of trend following strategies’ performance.

The 10 Year monthly correlations between the 3 indices used as a proxy for CTA funds’ performance are listed in Table 1 below. Correlation is high over the past 10 years and thus we choose to use only 2 out of the 3 indices. For the rest of the article we will use the Barclays indices as a proxy as they date back further in time. As mentioned earlier we use the CTA funds’ performance as a representation of both CTA funds’ performance and trend following performance.

We compare the long term normalized returns of CTA funds with Global Equities, Global Bonds and Broad Commodities in Chart 1 below.

Chart 1: Comparison Of CTA Funds Performance With Traditional Asset Classes

Over the long term, we observed that CTA funds’ performance is less volatile compared to Global Equities and Broad Commodities while being comparable to Global Bonds. Global Bonds’ performance is represented by the Citigroup Broad Investment Grade Bond Index which comprises of Investment Grade Rates and Credit Bonds. The modified duration of the index is around 5 years with an average credit rating quality of “AA”. The Citigroup Broad Investment Grade Bond Index can be seen as a safe haven asset class. CTA funds’ performance characteristics seem to be closer to the characteristics of Citigroup BIG Bond Index than Global Equities or Broad Commodities.

The standard deviation of CTA funds’ monthly returns is 2.44% and 2.09% respectively for Barclay US Managed Futures Industry BTOP 50 and Barclay Trader Indexes CTA. The standard deviation is almost double for MSCI World Index at 4.40%. Not surprisingly, broad commodities tops at 6.15% while Global Bonds is least volatile at 1.08.

We also examine the rolling 3 years returns of the same asset classes as shown in Chart 2 below.

Chart 2: 3 Years Rolling Returns Of CTA Funds’ Performance And Traditional Asset Classes

CTA funds have been able to deliver positive 3 years rolling returns while Global Equities and Broad Commodities have been much more volatile. Global Equities in particular delivered 3 year returns of around negative 20% during 2003 and again during 2009.

One important characteristic of CTA funds is the diversification effects on a portfolio consisting of traditional asset classes. Table 2 shows the low correlation of CTA funds’ performance with traditional asset classes based on monthly returns over past 10 years. Even when we look at recent years i.e. 1 year or 3 year, the correlation is low between CTA funds’ performance and traditional asset classes’ performance.

Table 2: 10 Year Monthly Correlation Of CTA Funds And Traditional Asset Classes

Source: Bloomberg

( BARCBT = Barclay US Managed Futures Industry BTOP 50, BARCCT = Barclay Trader Indexes CTA, MXWO = MSCI World, SBBIG = Citigroup BIG Bond, SPGCCI = S&P GSCI Official Close Index)

Over the longer term, CTA funds and trend following strategies provides risk and return characteristics that differs from traditional asset classes especially Global Equities and Broad Commodities. They also further diversify a portfolio of traditional asset classes.

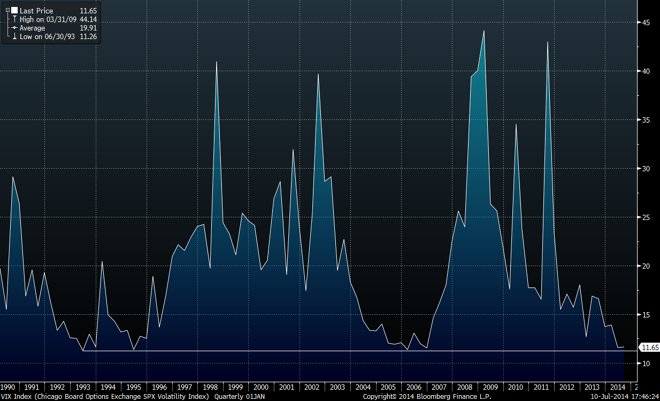

Trend following strategies are long volatility strategies in nature and they tend to perform well when volatility expands. On the other hand, they suffer when volatility is low with frequent small losses. Using VIX index as a proxy for broad market volatility, we observe from Chart 3 that volatility has been on a downtrend in recent years and reached very low levels in recent months. We have only seen the VIX Index at current levels a few times in history. (June 1993, June 1995, March 2006, December 2006)

Chart 3: CBOE SPX Volatility Index

Some Federal Reserve policy makers are now concerned that investors are growing too complacent about the economic outlook and risks. Historically a low VIX Index does give us an idea of how market is pricing risk.

When volatility picks up going forward, would we see better market regimes for trend following strategies?

Investors have been very impatient with their CTA allocations and many starts to believe CTA strategies are no longer profitable with various reasonings such as central bank policies, forced suppression of interest rates, structural changes in market place due to high frequency trading or increased usage of commodity and currency exchange traded funds. Positive diversification effects due to low correlations to traditional asset classes, continue to be important to many investors. A change in market regime may start to be favourable to trend following strategies.

Author:

Jay Ng, CMT

Co-Founder of Streetpips.com

Streetpips.com scans books and websites for trading strategy ideas. We then select those which are programmable, code them, and share these with our members.

About the Author

Advertisement