Using the Wisdom of the Crowd by Copy Trading with eToro

Copy trading’ is trading financial instruments by mirroring, or copying, the trading position of other traders linked through a social platform like that of eToro. Let’s look at how it works.Copy trading is a style of trading that has seen massive growth over the past five years. Inspired by the rise of social networks a few years earlier, financial markets trading platforms decided to try to merge the dynamism of financial markets trading, with the social and peer-to-peer information and knowledge sharing character of a social media platform.

It worked and copy trading has been the fastest growing part of the retail-facing CFDs and forex trading market since. But for those who haven’t yet become acquainted with this social, dynamic and educational trading format, we’ll explain everything you need to know here.

Hold tight and get ready to discover:

- What Exactly Is ‘Copy Trading’?

- Who Is Copy Trading Suitable For And Should I Try It?

- Can Copy Trading Be Profitable?

- A Step-by-Step Guide To Starting Copy Trading With eToro

What Exactly Is ‘Copy Trading’?

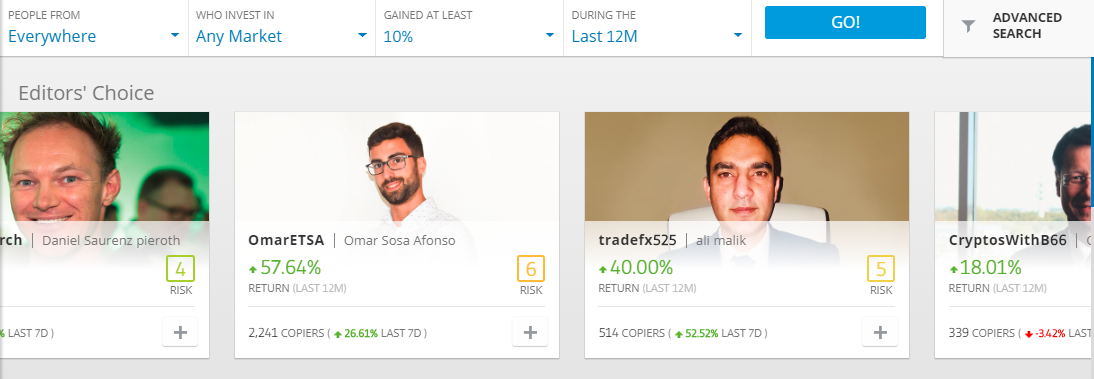

As the name suggests, the core of ‘copy trading’ is trading financial instruments such as forex pairs, cryptocurrencies, commodities, stocks and indices by mirroring, or copying, the trading position of other traders linked through a social platform. Copy traders can browse the historical record of traders they are considering copying and they are ordered in a leaderboard based on success rate.

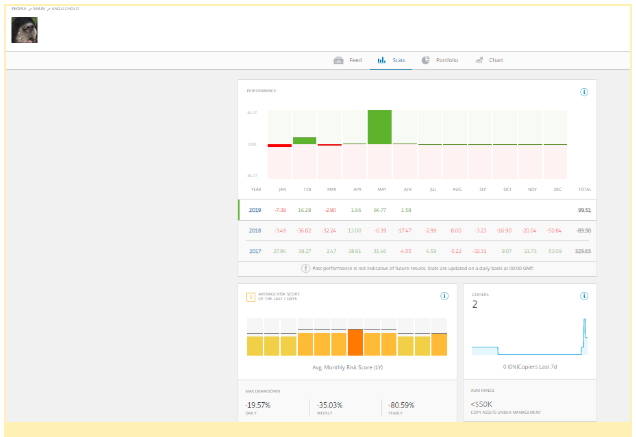

Copy traders can further burrow down into individual traders and look at their record for trades on particular instruments. For example, a trader might be successful overall but further inspection shows they have a particularly strong record trading forex pairs or just certain forex pairs such as EUR/USD or USD/JPY. They might also trade commodities like gold and oil, stocks like Facebook and Apple and indices like the S&P 500. But their record may not be quite as strong across these other asset classes.

So the copy trader may wisely decide to only copy trades placed on the instruments the trader being mirrored has the best record on. They’ll choose other traders to mirror when placing trades involving other instruments based on where they are strongest.

Traders can set alerts based on their own preferences that tell them when one of the traders they are following has set up a position. They can then decide on a trade-by-trade basis if they’d like to copy those trades.

Copy trading also involves plenty of flexibility. It’s not a case of selecting a trader to ‘copy’ and then the platform automatically mirroring their every trade exactly. It can be but only if the copy trader chooses to do so. But different traders have different account values. So a trader starting off with an account balance of $200, $500 or $1000 wouldn’t be practically able to exactly copy the trades of another trader with an account balance of $10,000.

Or at least all of them and it probably wouldn’t be wise. It is recommended that the investment exposure on individual trades doesn’t exceed a few percent of overall capital. Trading is not about every trade finishing in the money. Even the best traders take plenty of positions that finish out of the money. The secret is in getting enough right. So spreading risk is important. You don’t want to blow half your account balance on one trade that doesn’t work out.

With that in mind, traders can copy a trade exactly as a percentage of overall account balance rather than value. Or choose another value based on their own strategy if they wish. The ‘copy’ trade will use the copy traders selected value with the ‘copy’ restricted to when the position is opened and closed based on the actions of the trader being copied.

Copy trading also leaves room for flexibility. The trader can, should they wish, decide mid-trade to go their own direction and no longer copy the trader they chose to by closing a position early or leaving it open.

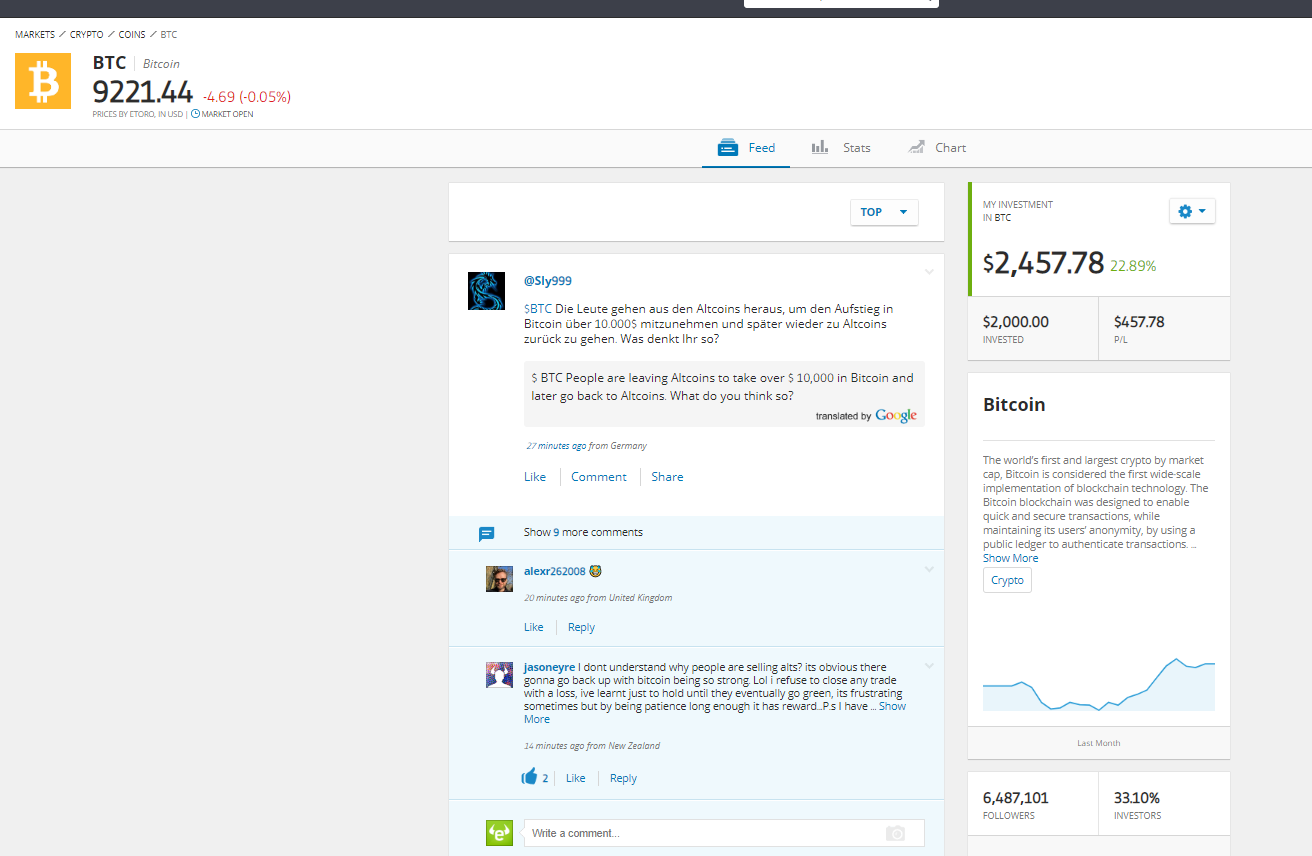

There’s also a lot of social interaction on Etoro’s copy trading platform with traders openly discussing potential trades, their reasoning and strategies. Used smartly this can be a great resource for new, less experienced and even more experienced traders to learn by sharing each other’s knowledge, opinions and research techniques.

For the CFDs or forex broker hosting a copy trading platform the advantage is encouraging more people to trade, for longer and more successfully. Brokers make their money by taking a small cut of every trading position. This is called the ‘spread’ – the difference between an instrument’s buy and sell price.

New traders often make a lot of mistakes while they are learning the ropes and can quickly burn through their initial deposit. Many never trade again after that. Offering copy trading and the ability to mirror the trades of more experienced and successful traders gives new traders a great opportunity to learn on the job and trade successfully by copying others before striking out on their own. They then trade more and for longer so the broker makes more money from them. Successful traders are incentivised to lend their experience and expertise to those copying their trading positions by being given a cut of the broker’s spread. It’s a win-win-win.

Why should people try social trading?

Basically any trader can learn something from seeing how other traders go about their business. When do they open a position and why, when do they get out and how much capital have they exposed to a trade? There’s no ‘right’ way to trade and markets are also constantly evolving so there’s always something to learn.

For Some, it might be less about copying particular traders or trades and more about interacting with other traders and exchanging views and approaches. For experienced traders with a solid track record of success, trading on a copy trading platform is further incentivised by the potential to build up a following of ‘copiers’. If their record shows they are worth copying and they succeed in attracting a strong following their share of the spread could be a great source of additional income on top of their own trading.

Can Copy Trading Be Profitable?

While there’s no guarantee that copying a previously successful trader will be profitable, because they might suddenly stop being successful, copy trading certainly can be. For some there is probably a better chance of being profitable by copying a trader with a strong track record than there is by going it completely alone and taking decisions based on still limited knowledge and experience.

Even for more experienced traders, learning things from others should help them become a more rounded, experienced and ultimately profitable trader.

However, traders should be aware that there are never any guarantees in trading and choose the traders they copy and how they copy them carefully. Copy trading is a very useful trading tool but shouldn’t be mistaken for a silver bullet to amassing riches quickly. Successful traders carefully and methodically build up their trading balance over time by spreading their risk and playing the odds, not by putting everything on a few positions and waiting for them to finish in the money before retiring in luxury!

A Step-by-Step Guide To Starting Copy Trading With eToro

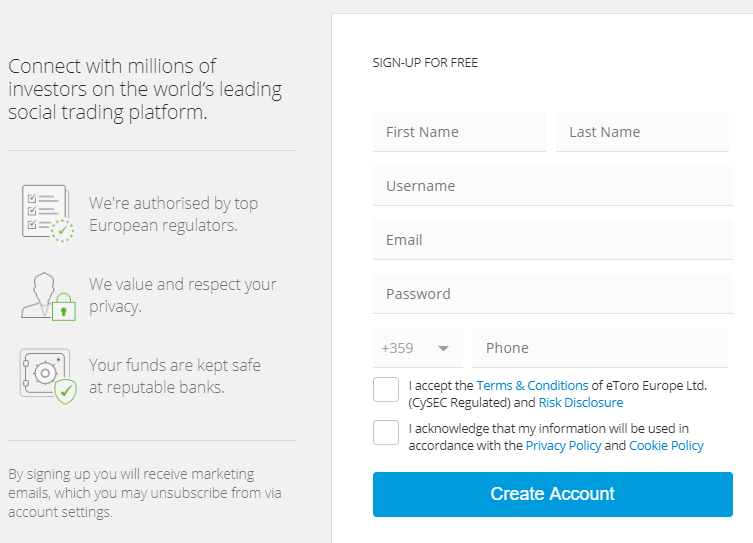

Starting to copy trade on the eToro platform couldn’t be simpler. Registering an account takes a matter of minutes. The only thing to really be aware of is that you will need your personal identification number, or NI number in the UK, at the ready. Before you put actual cash on your balance you may have to have to provide a scanned copy of your national identity document or passport.

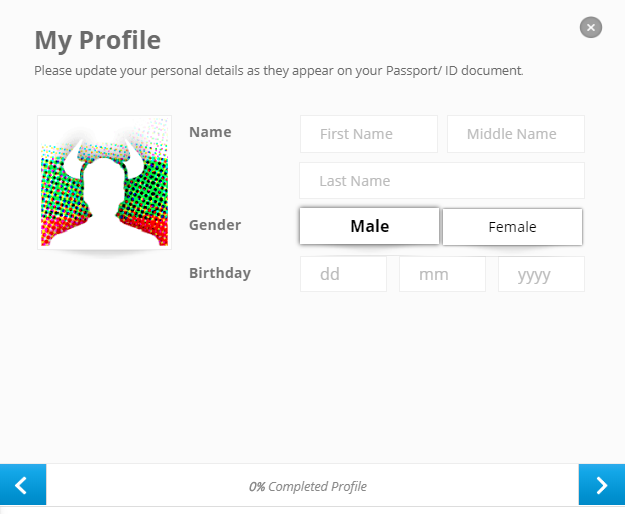

Once you’ve done that you’ll have an account. The next step is to fill in your public profile. That’s what will be seen by other traders and has to be completed before you can interact with them though you have some flexibility on how much information you provide.

Once you’ve done that, which literally takes 10-15 minutes from beginning to end, if not less, your all set to copy trade!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.