Advertisement

Advertisement

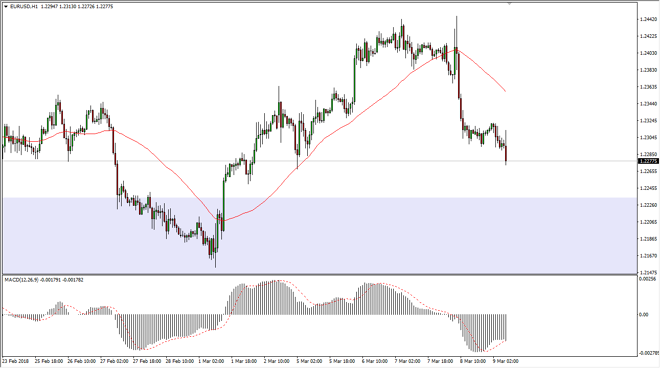

EUR/USD Price Forecast March 12, 2018, Technical Analysis

Updated: Mar 10, 2018, 06:49 GMT+00:00

The EUR/USD pair went sideways during most of the trading session on Friday, but eventually started to rally a bit. This is an interesting pair, because we have a strong jobs number coming out of America during the day on Friday, against the backdrop of the ECB not necessarily looking to raise rates right away.

The EUR/USD pair has rallied slightly during the day on Friday, after a significant amount of turbulence in the wake of the Non-Farm Payroll announcement in the United States. The US added 313,000 jobs for the month of February, better than anticipated. This generally will put a “risk on” feel back into the market, and I believe at this point that the pair is probably going to continue to grind towards the 1.24 level above, an area that has been important more than once.

Longer-term, the 1.25 level is massive in its importance, as the 1.25 level is the top of the overall consolidation. The 1.21 level underneath offers support, and I think that the market should continue to be very noisy in general. This is a pair that tends to rise when things are good and fall when they’re bad. With the jobs number coming out a strong as it did, I do think that we eventually go towards the 1.24 level above. Breaking above there then sends this market to the 1.25 level. If we can break above there, then we can continue the longer-term uptrend, perhaps reaching towards the 1.32 level as it was the measured move from the brake of a major bull flag on the weekly chart. If we were to turn around a breakdown below the 1.21 handle, that would be very negative, but at this point it seems to be unlikely.

EUR/USD Video 12.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement