Advertisement

Advertisement

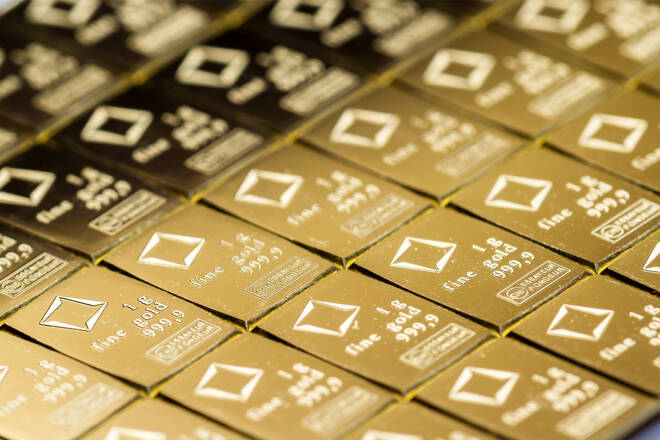

Gold Prices Forecast: Focus Shifting from Hawkish Fed to Banking Concerns

By:

The decline in U.S. Treasury yields and growing banking sector concerns are driving investors towards gold as a safe haven.

Key Points

- Hawkish Fed, strong dollar challenge gold market.

- Falling yields, safe-haven demand boost gold prices.

- Banking sector instability heightens gold’s appeal.

Hawkish Fed and Banking Sector Anxiety

Gold prices are manuevering through a particularly intricate market landscape. The Federal Reserve’s current hawkish stance, marked by its hesitation to implement rate cuts in the near term, is a critical factor influencing the market. This position typically results in a stronger U.S. Dollar, which historically has a bearish impact on gold prices. However, the present scenario is not straightforward, as traders are contending with multiple economic indicators that are influencing gold’s value in different ways.

At 08:55 GMT, XAU/USD is trading $2041.71, up $2.55 or +0.13%.

Dollar Strength and Gold’s Response

The strength of the U.S. Dollar, bolstered by the Fed’s position, usually signals a downturn for gold. However, gold is showing resilience in this environment, partially due to its status as a safe-haven asset. This resilience is particularly noteworthy given the backdrop of global economic uncertainties and the ongoing concerns in the banking sector.

Falling Yields and Safe-Haven Demand

The decline in U.S. Treasury yields is playing a significant role in the current market trends. As yields fall, gold becomes more attractive to investors seeking safe-haven assets. This trend is amplified by the growing apprehensions surrounding the health of the banking sector, highlighted by recent developments at regional banks such as New York Community Bancorp. These banking sector fears are driving a shift in investor sentiment, favoring assets like gold that are perceived as more secure during times of economic uncertainty.

Banking Sector Concerns

The banking sector is currently under scrutiny, with regional banks facing particular challenges. The surprise loss and dividend cut announced by New York Community Bancorp have heightened concerns about the sector’s stability. This situation has led to increased demand for safer investments, with U.S. Treasuries and gold being primary beneficiaries.

Market Outlook: A Cautious Bullishness for Gold

In light of these factors, the short-term outlook for gold is cautiously bullish. The combination of a hawkish Federal Reserve, a strong U.S. Dollar, falling Treasury yields, and banking sector anxieties creates a complex but potentially favorable environment for gold.

Traders should be prepared for volatility and closely monitor the Fed’s upcoming policy decisions and any further developments in the banking sector. These elements will be crucial in determining the direction of gold prices in the coming weeks, with a careful balance of these factors likely to support gold prices.

Technical Analysis

Gold (XAU/USD) are marginally higher on Thursday, but holding above the 50-day moving average, which is keeping the intermediate-term uptrend intact.

If this move continues to exert enough upside momentum then look for a drive into the pivot $2067.00 level. This is a potential trigger point for an acceleration into new all-time highs.

Conversely, a failure to hold the 50-day MA will be a sign of weakness and increasing selling pressure. This could lead to a quick test of support at $2009.00. Breaking this level with conviction could unleash a plunge into the 200-day moving average at $1964.95.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement