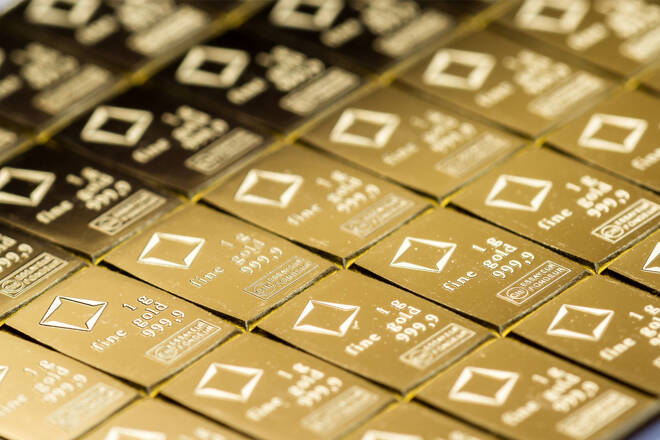

Gold prices surged to an all-time high of $3,230 during the Asian session on Monday, supported by a confluence of macroeconomic drivers. Chief among them: growing market expectations of U.S. Federal Reserve rate cuts, renewed trade tensions between Washington and Beijing, and a softening U.S. Dollar, which has slipped to levels not seen since April 2022.

“Investors are navigating a complex environment of slowing inflation and geopolitical uncertainty,” said a senior strategist at Standard Chartered. “In that context, gold is behaving exactly as it should—as a store of value.”

The Bureau of Labor Statistics reported that headline CPI declined 0.1% in March, while core inflation eased to 2.8% year-over-year—its lowest reading since mid-2021.

Traders are now pricing in at least three Fed rate cuts in 2025, amounting to 90 basis points of easing. With real yields sliding, gold’s appeal as a non-interest-bearing asset has strengthened.

Silver Eases After Rally but Sentiment Remains Firm

Silver (XAG/USD) eased 1.2% to $31.92 after hitting an intraday high of $32.35, as some investors booked profits. Still, silver remains up more than 17% month-to-date, buoyed by its dual role as a precious and industrial metal, particularly as Chinese stimulus measures begin to take hold.

While the pullback may reflect temporary profit-taking, analysts note that the broader bullish backdrop remains intact. “Silver is riding the same macro tailwinds as gold, and the technical setup supports further upside,” said an analyst at UBS.

Investors Look to FOMC and Retail Data for Direction

Attention now turns to the upcoming U.S. retail sales data and comments from Fed Chair Jerome Powell on Wednesday, both of which are expected to guide market expectations for interest rates. Any dovish signals could further weaken the dollar and sustain the current rally in precious metals.