Advertisement

Advertisement

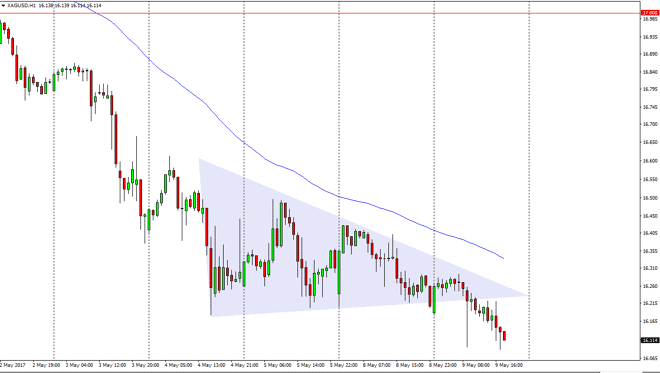

Silver Forecast May 10, 2017, Technical Analysis

Updated: May 10, 2017, 04:12 GMT+00:00

Silver markets fell again during the session on Tuesday, breaking down to fresh, new lows. The $16 level is just below, and that being an area where I

Silver markets fell again during the session on Tuesday, breaking down to fresh, new lows. The $16 level is just below, and that being an area where I would expect to see a certain amount of psychologically significant support. However, I believe that any rally from that area should offer a selling opportunity as the Silver markets are so obviously broken. I believe that the $16.20 level above is resistive, so any sign of and exhaustive candle should get sellers involved again. I believe that the Silver markets continue to fall overall, as the US dollar continues to show quite a bit of strength. Also, we have lost the “safety trade” for the time being, so I think that eventually the $16 level gets broken.

Much larger targets below.

I believe that the $15 level underneath should continue to be supportive, and I believe that the area will attract a lot of attention. Because of this, I think it’s only a matter of time before traders get involved and find a lot of value in that area. However, we have seen the 72-hour exponential moving average offer dynamic resistance, and it appears that the selling pressure remains firm. Because of this, I think that short-term rallies offering short-term selling opportunities will be the best way going forward in this market. With that being the case, I look for short-term trades and trying to go for a large trade at the moment is probably rather difficult. I believe that the market would have to break above the $16.50 level for it to offer enough value and strength for traders to feel comfortable being long in this market for any real length of time. Ultimately, the volatility should continue but I think eventually the buyers will get involved. Until that time, selling is the only option.

SILVER Video 10.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement