Advertisement

Advertisement

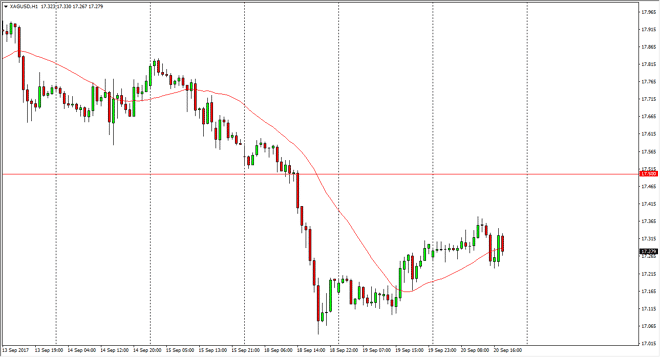

Silver Price Forecast September 21, 2017, Technical Analysis

Updated: Sep 21, 2017, 06:06 GMT+00:00

Silver markets went sideways initially during the session on Wednesday, as we continue to wait for the Federal Reserve’s next actions. Quite frankly, I

Silver markets went sideways initially during the session on Wednesday, as we continue to wait for the Federal Reserve’s next actions. Quite frankly, I believe that the $17.50 level above is going to be resistance. But if we can break above there, then the market should go towards the $18 level. I think that we will see a significant amount of support just below, especially near the $17 level. That is an area that should be supportive, based upon longer-term charts. That being said, unless the Federal Reserve raises interest rates, which is all but impossible at this point due to the hurricanes, it’s likely that we will continue to see a general uptrend over the next several sessions and silver. I think at this point though, we are essentially consolidating between the $17 level on the bottom and the $17.50 level on the top.

Longer-term buying opportunity?

One of the biggest problems with the Silver markets currently is that people are trying to gas with the Federal Reserve will do. If they do start tightening, that should work against the value of silver in theory. However, the tightening cycle won’t be like the ones in the past. Several Fed members have suggested that 2% is more of a normalization than the previous 5% was as far as interest rates are concerned. That is a completely different scenario than we are used to seeing, so I think it justifies higher precious metal prices over the longer term. That’s not to say that this is an easy trade today, but I think that ultimately Silver markets will go higher. I think that longer-term traders are going to be buying physical silver, stepping away from leverage if it is at all possible as it can mitigate some of the danger.

SILVER Video 21.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement