Advertisement

Advertisement

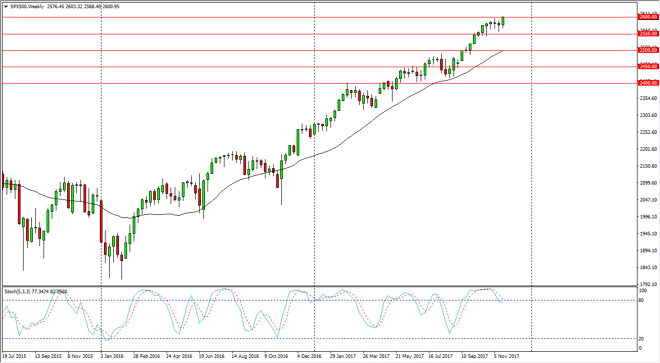

S&P 500 Index Price Forecast for the week of November 27, 2017, Technical Analysis

Updated: Nov 26, 2017, 08:52 GMT+00:00

The S&P 500 initially dipped during the week, but then turned around to show significant bullish pressure, reaching the 2600 level. By doing so, it

The S&P 500 initially dipped during the week, but then turned around to show significant bullish pressure, reaching the 2600 level. By doing so, it looks as if we are going to continue to go much higher, continuing the longer-term uptrend that we have seen for some time. The next target is 2625, and then eventually 2650. I believe the pullbacks continue to offer support at various levels, not to mention the 2550 level looking at a bit of a “floor” currently. If we were to break down below there, the market probably goes down to the 2600 level after that. Regardless, I have no interest in shorting this market, it is very strong, and the uptrend very well defined. Overall, the market should continue to find traders looking at the S&P 500 as a way to take advantage of the US dollar falling, and therefore think that the market is a “long only” market in the meantime.

S&P 500 Video 27.11.17

As we approach the holiday season, the markets are going to continue to be bullish, as the “Santa Claus rally” typically takes office time a year. Overall, as we approach Christmas there will be a lack of liquidity, but in the meantime a lot of hedge fund managers are out there trying to pad their portfolios, giving the customer something to look at. Longer-term, I anticipate that the S&P 500 will continue to attract the algorithmic traders that continue to jump into the market on signs of weakness. As far as selling is concerned, I don’t have an interest in doing so anytime soon, and I think we would have to break down below the 2400 level before that would be even a thought. I don’t see that happening anytime soon, so I continue to look for value.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement