Advertisement

Advertisement

Stocks, dollar slip as rate hike fears unsettle investors

By:

By Stella Qiu SYDNEY (Reuters) - Asian shares tracked Wall Street lower on Thursday, as a number of Federal Reserve speakers echoed Chair Jerome Powell in saying that interest rates are set to go higher, capping risk sentiment, while the dollar hovered near one-month highs.

By Herbert Lash and Huw Jones

NEW YORK/LONDON (Reuters) – The dollar slid and a global equity rally lost steam on Thursday as nagging concerns about the economy and the future pace of central bank interest rate hikes unsettled investors who earlier pushed European stocks to almost one-year peaks in Europe.

An afternoon rise in Treasury yields, especially for the two-year note that is key to a respected harbinger for a looming recession, took the edge off market optimism, as did further remarks by Federal Reserve officials about the pace of slowing inflation.

“Is inflation calming? That’s really the core question for this year,” said Richmond Fed President Thomas Barkin, adding that he felt the decline so far had been “distorted” by some falling goods prices.

Crude prices eased, with gold firmer as the dollar index fell 0.18%, while MSCI’s U.S.-centric index of stock performance in 47 countries shed 0.44%.

The market is confused as it thought it understood, despite the Fed’s rhetoric, that the U.S. central bank was very close to ending its rate-hiking cycle, said Quincy Krosby, chief global strategist at LPL Financial in Charlotte, North Carolina.

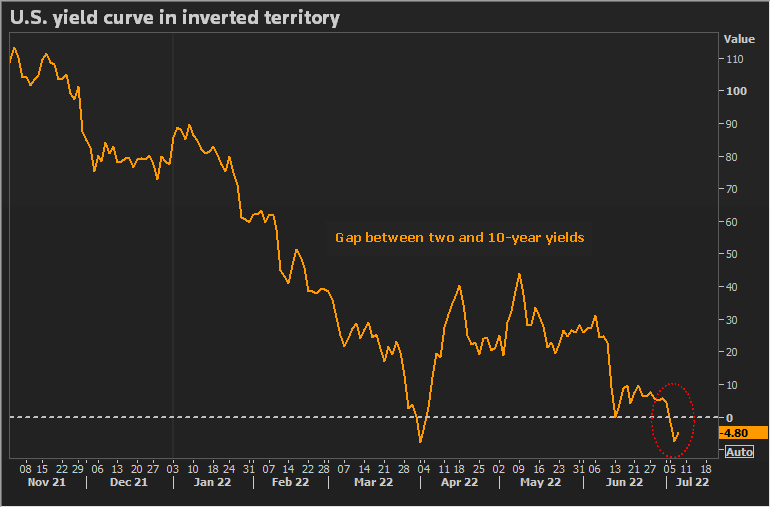

In addition, the closely watched inversion of the yield difference between short- and longer-dated Treasuries, which occurs when the two-year’s yield is higher than that of the 10-year note, is a cause for concern, Krosby said.

“Look at the inverted yield curve, it’s steepened. We stare at it and we want to believe it’s different this time,” she said.

“All this together, underpinned by a yield curve that is shouting, shouting recession coming. The market has to respect that, it may not agree with it, but it has to respect it.”

The gap between two- and 10-year yields remained inverted at -82.3 bps, after steepening to -87.5 bps earlier in the session.

The two-year rose 3.4 basis points to 4.488% after hitting an almost 10-week high of 4.514%

Futures priced in the Fed’s target rate to peak at 5.15% in July, about 25 basis points higher than last week, and by December showed the key rate will have declined to just 4.86%, or some 40 bps more than a week ago when the market expected a rate cut.

“There’s this belief we can still have a strong economy, a strong labor market and that inflation will continue to decline,” said Ed Moya, senior market analyst at OANDA in New York.

However, getting inflation down to the Fed’s 2% target could easily take more than a year as energy prices may remain elevated, a fact making some in the market nervous, he said.

“There’s going to be a rude awakening at some point and that you’re going to need to see something break to get inflation all the way back down,” Moya said.

Data again showed a tight U.S. labor market even as the number of Americans filing new claims for unemployment benefits rose more than expected last week, news that helped set aside concerns that interest rates will stay higher for longer.

In the latest move by major central banks, Sweden’s Riksbank on Thursday raised its key interest rate by half a percentage point to 3%, and forecast further tightening in the spring.

On Wall Street, the Dow Jones Industrial Average fell 0.73%, the S&P 500 lost 0.88% and the Nasdaq Composite dropped 1.02%.

German consumer prices, harmonized to compare with other European Union countries, rose by a less-than-expected 9.2% on the year in January, helping reassure markets that prices have peaked.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.62%, rebounding from an earlier decline, while Japan’s Nikkei eased 0.08%.

China’s blue chips rose 1.3%, pulling away from a one-month trough, while Hong Kong’s Hang Seng Index gained 1.6%.

Barclays upgraded their forecast of China’s economic growth to 5.3% this year, from 4.8% previously, with Fitch also revising its forecast up to 5%. Both cited an accelerated recovery in consumer spending.

Crude prices eased as oil infrastructure appeared to have escaped serious damage from the earthquake that devastated parts of Turkey and Syria, while U.S. inventories swelled and investors worried about central bank rate hikes.

U.S. crude futures settled down 41 cents at $78.06 a barrel, and Brent fell 59 cents to settle at $84.50 a barrel.

Gold prices rose for a fourth straight session as the dollar faltered, even as Fed officials indicated more rate hikes are warranted to rein in inflation. Gold is sensitive to high rates, which increase the cost of holding zero-yield bullion.

U.S. gold futures settled down $12.20 at $1,878.50 an ounce.

(Reporting by Herbert Lash, additional reporting by Huw Jones, Stella Qiu; Editing by Bernadette Baum and Jonathan Oatis)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Latest news and analysis

Advertisement