Advertisement

Advertisement

U.S. stocks end down slightly after early boost from Powell; oil falls

By:

By Sam Byford TOKYO (Reuters) - Asian stocks slipped in volatile trade on Wednesday, failing to extend Wall Street's rally as persistent worries about interest rates and inflation remained a key focus for investors, while the Japanese yen hit a fresh 24-year low against the dollar.

By Caroline Valetkevitch

NEW YORK (Reuters) – Major U.S. stock indexes ended down slightly Wednesday, losing early gains tied to remarks by Federal Reserve Chair Jerome Powell that the U.S. central bank is “strongly committed” to bringing down inflation, while sharply lower oil prices weighed on energy shares.

The S&P 500 energy sector was down 4.2%.

The dollar fell alongside U.S. Treasury yields on fears the U.S. economy could slip into recession after Powell, in testimony to the U.S. Senate Banking Committee, said higher rates are painful but are the means the U.S. central bank has to slow inflation.

“Like all Fed commentary, there are positives and negatives, but the overall message is the Fed is not backing away from rate hikes,” said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder in New York.

The Fed recently raised its benchmark overnight interest rate by three-quarters of a percentage point – its biggest hike since 1994.

The Dow Jones Industrial Average fell 47.12 points, or 0.15%, to 30,483.13, the S&P 500 lost 4.9 points, or 0.13%, to 3,759.89 and the Nasdaq Composite dropped 16.22 points, or 0.15%, to 11,053.08.

The pan-European STOXX 600 index lost 0.70% and MSCI’s gauge of stocks across the globe shed 0.49%.

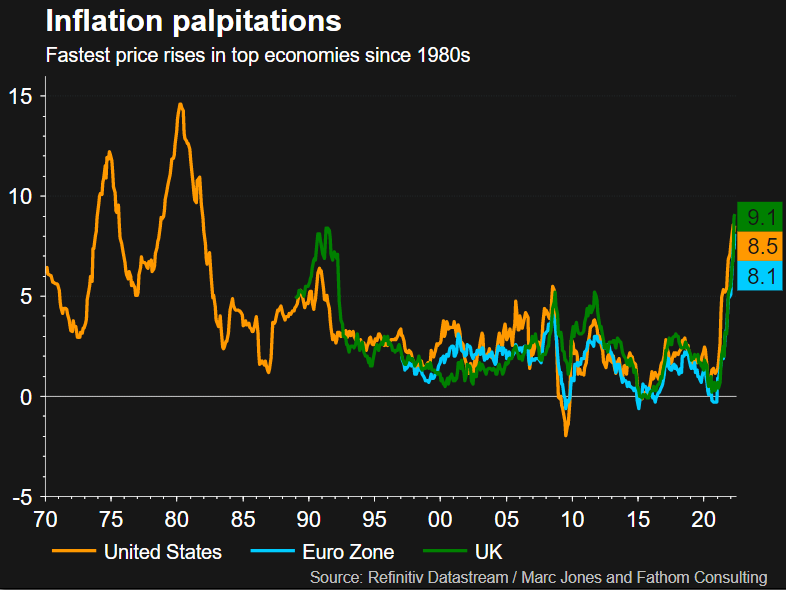

Investors are continuing to assess how worried they need to be about central banks potentially pushing the world economy into recession as they attempt to curb inflation with interest rate increases.

Minutes from the Bank of Japan’s April policy meeting released Wednesday showed the central bank’s concerns over the impact the plummeting currency could have on the country’s business environment.

The Japanese yen strengthened 0.27% versus the greenback at 136.24 per dollar.

In Treasuries, benchmark 10-year notes rose in price to yield 3.156%, from 3.305% late on Tuesday.

U.S. crude fell $3.33 to settle at $106.19 a barrel while Brent dropped $2.91 to settle at $111.74.

U.S. President Joe Biden called on Congress to pass a three-month suspension of the federal gasoline tax to help combat record pump prices.

Spot gold added 0.3% to $1,838.03 an ounce.

(Reporting by Caroline Valetkevitch; Additional reporting by Marc Jones in London, Sam Byford in Tokyo, Shadia Nasralla in Bengaluru and Stephen Culp in New York; Editing by William Maclean, Will Dunham and Deepa Babington)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement