Advertisement

Advertisement

Bond euphoria grinds to a halt as inflation lingers

By:

By Naomi Rovnick and Yoruk Bahceli LONDON (Reuters) - Just like that, euphoria in the world's biggest bond markets has evaporated as signs that inflation is unlikely to ease as fast as hoped suggests major central banks will need to keep interest rates higher for longer.

By Naomi Rovnick and Yoruk Bahceli

LONDON (Reuters) – Just like that, euphoria in the world’s biggest bond markets has evaporated as signs that inflation is unlikely to ease as fast as hoped suggests major central banks will need to keep interest rates higher for longer.

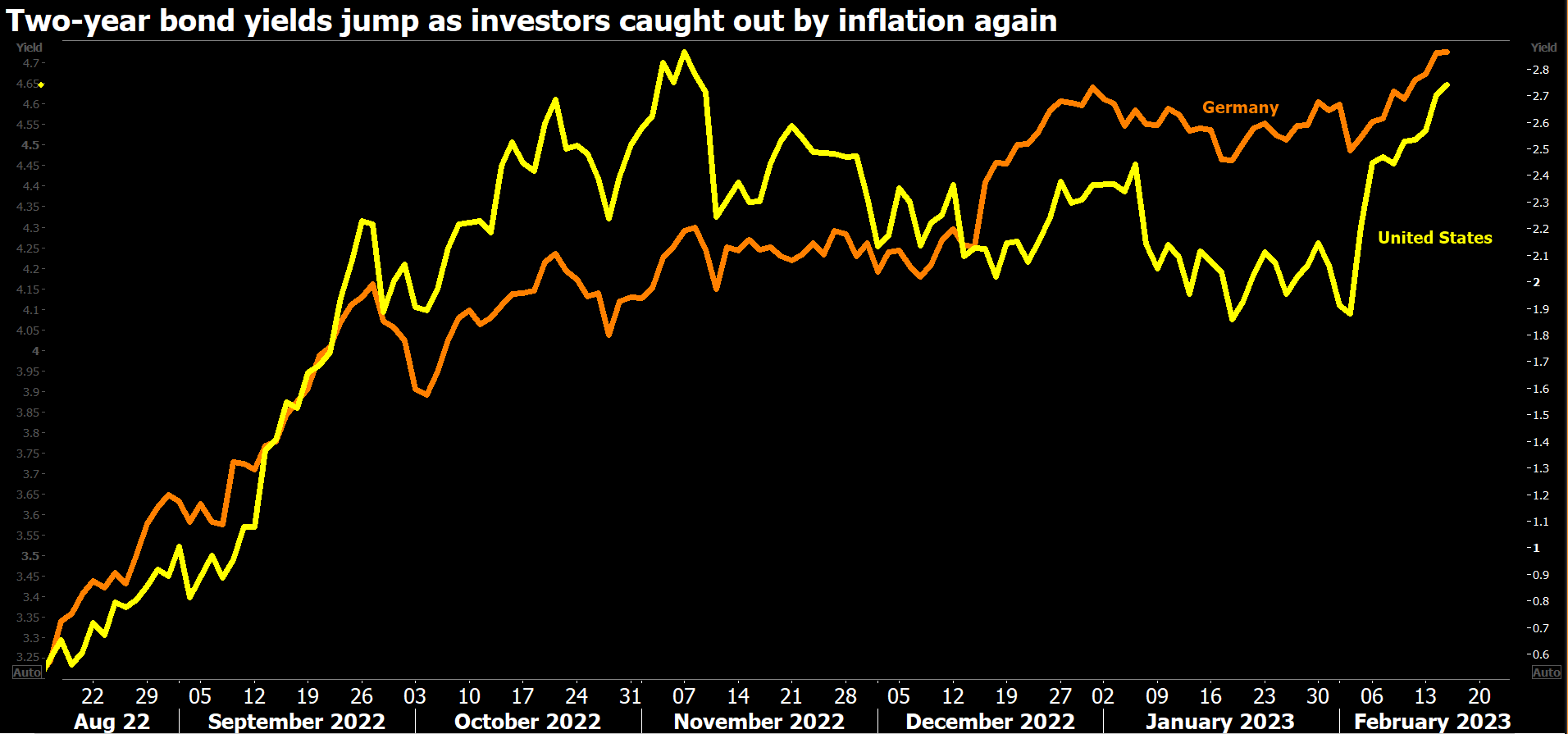

Two-year government borrowing costs, sensitive to changes in interest rates, are surging after having fallen sharply since October, with the market no longer betting that easing price pressures would soon pause the most aggressive round of global rate hikes in decades.

Bond yields move inversely to their prices.

At 4.6%, two-year U.S. Treasury yields are up 45 basis points this month, near their highest levels since November. German peers are close to their highest since 2008.

U.S. and European longer-dated borrowing costs have also risen sharply, practically reversing this year’s declines.

Data on Tuesday showing U.S. inflation slowed less than expected in January and a stunningly strong jobs report earlier this month have fuelled expectations that the Federal Reserve will need to raise rates further to contain inflation.

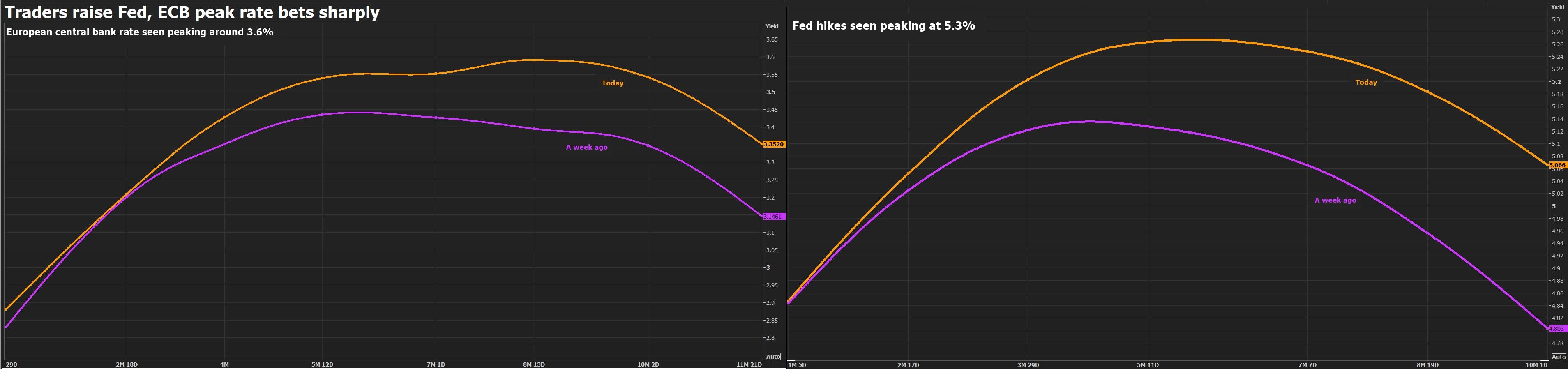

Deutsche Bank has increased its U.S. terminal rate forecast to 5.6% from 5.1%, while money market futures suggest U.S. Federal Reserve rates will now peak at around 5.3% compared with 4.8% in early February.

Bets on where euro zone rates will end up have soared to over 3.6%, higher than in December when the European Central Bank shook markets with its hawkish stance.

“The previous investment regime of central bankers riding in on their white horses and coming to the rescue might not happen because they may have their hands tied for longer than markets had expected,” said Georgina Taylor, head of multi-asset at UK fund manager Invesco, which manages $1.48 trillion in assets.

Taylor added that markets had believed the central banks would get inflation down quickly, but the latest data only highlights how challenging that will be, forcing a repricing of rates staying higher for longer.

In Britain the latest data showed inflation fell more than expected in January, easing pressure on the Bank of England, but it was still in double digits. Two-year gilt yields are near their highest since late October, when they surged following a budget crisis.

Reckoning

Some fund managers warned recent data suggested the reckoning for markets may be long-lasting.

Underpinning recent market euphoria has been bets that inflation will quickly fall below 3% over the next year, market-based inflation expectations show.

Idanna Appio, a portfolio manager at asset manager First Eagle, said she expected to see lower U.S. goods price inflation and higher services sector inflation continuing.

Appio, a former economist at the Federal Reserve Bank of New York, called that “exactly the wrong combination” for central bankers to tackle easily without engineering an unpalatable rise in unemployment that would cause cross-asset pain.

At risk is a strong cross-asset rally that began last October on bets that central rate rises so far would cool the global economy just enough to quell inflation, allowing policymakers to turn supportive towards markets again.

MSCI’s all-country stock index, which rose 7% in January alone, is up just 0.5% in February so far as the certainty backing what analysts called the “Goldilocks” trade has faded.

Saxo Bank’s head of equity strategy Peter Garnry said developed economies avoiding a recession, which now looks more likely, will keep inflation higher for longer. That will put “equity valuations under pressure from higher bond yields coupled with margin pressure,” he said.

The next battle ground may be a series of cuts that are priced in following peak rates. A reversal would push short-dated bond yields even higher, investors said.

“It is more a question of how long interest rates will stay at these kind of levels,” said Jonathan Day, fund manager at Newton Investment Management.

Markets priced two Fed rate cuts just a few weeks ago and now price roughly a 75% chance of a 25 basis-point cut by year-end. ECB rates are seen down at around 3.2% by June 2024.

“That doesn’t feel quite right,” Day said.

(Reporting by Naomi Rovnick and Yoruk Bahceli; Writing by Yoruk Bahceli; editing by Dhara Ranasinghe and Sharon Singleton)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Latest news and analysis

Advertisement