Advertisement

Advertisement

ECB Stimulus: Fool Me Once, Shame on You, Fool Me Twice, Shame on Me

By:

The futures and Forex markets are set up for volatile reactions to the widely expected monetary easing announcement by the European Central Bank. Traders

The futures and Forex markets are set up for volatile reactions to the widely expected monetary easing announcement by the European Central Bank. Traders should expect expanded ranges and volatility. Several markets are set up for breakouts that could lead to major moves. These include the EUR/USD, Gold and the March E-mini NASDAQ-100.

The ECB is expected to takes interest rates deeper into negative territory and announce more asset purchases in a bid to stimulate the economy. The recent sell-off by the Euro suggest that traders have already priced in dovish action by the central bank. However, investors are also expressing caution ahead of the stimulus announcement after being burned in December when the ECB eased policy less than expected.

This time around, investors are betting the ECB will lower the deposit rate by 10 basis points to -0.40 percent, extend asset purchases and possibly introduce tiered interest rates. The latter isn’t a novel idea since the Bank of Japan did this in January.

There are some forecasts calling for a 20 basis point reduction in the deposit rate, however, if the ECB comes in with this figure, the EUR/USD is still expected to break sharply. The risk is to the upside if the central bank once again disappoints with a new easing policy that comes in less than expected.

The following are the expected moves if the ECB comes out with a blockbuster stimulus plan. Generally speaking, more stimulus is bad for the Euro, good for the U.S. Dollar and stocks. That’s the theory, of course, we don’t know how much has been built into the prices so we still have to watch the order flow and price action at certain key levels.

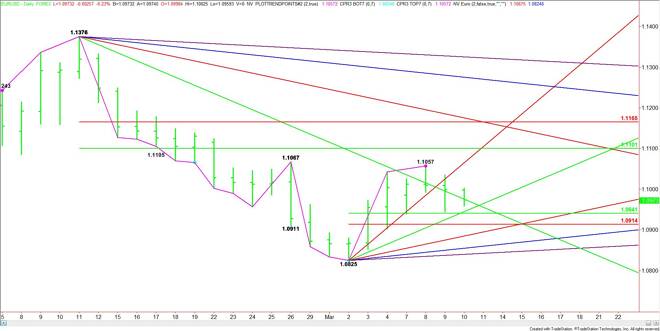

EUR/USD

The EUR/USD is currently trading at 1.0982. This means that the direction of the market today will be determined by trader reaction to the downtrending angle at 1.0976.

A sustained move under 1.0976 will signal the presence of sellers. Any break could be labored because of a number of potential support levels, the first being a price cluster at 1.0945 to 1.0941.

Taking out 1.0941 will indicate the selling is getting stronger with potential targets a Fib level at 1.0914, followed by a series of uptrending Gann angles at 1.0885, 1.0855 and 1.0840. The latter is the last potential support before the 1.0825 main bottom.

APRIL COMEX GOLD

If the ECB comes out with a strong stimulus plan then look for the Euro to break and the U.S. Dollar to rally. A strong move by the U.S. Dollar should pressure April Gold futures. The first downside target is a pair of uptrending angles at $1223.30 and $1220.50. There could be a technical bounce on the first test of this area, but it is also a trigger point for an acceleration to the downside.

The short-term range is $1108.50 to $1280.70. If $1220.50 is taken out with conviction then we could see a break into its retracement zone at $1194.60 to $1174.30. Since the main trend is up, value buyers may be waiting in side this zone.

MARCH E-MINI NASDAQ-100 INDEX

Based on yesterday’s close at 4294.50 and the earlier price action, the direction of the market is likely to be determined by trader reaction to the long-term downtrending angle at 4305.75 and the main 50% level at 4280.00.

A sustained move over 4305.75 will signal the presence of buyers. This could trigger an acceleration to the upside with the first target a main top at 4357.75. This is followed by the main Fib level at 4378.75.

The Fib level at 4378.75 is also a trigger point for an acceleration to the upside with the next target up at 4501.75.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement