Advertisement

Advertisement

Euro zone bond yields plunge as SVB collapse scares investors

By:

By Stefano Rebaudo (Reuters) - Government bond yields on both sides of the Atlantic fell on Monday as investors rushed into safe-haven assets while assessing the possible fallout from Silicon Valley Bank's (SVB) collapse amid bets on less aggressive tightening from the U.S. Federal Reserve.

By Stefano Rebaudo and Harry Robertson

(Reuters) – Euro zone government bond yields tumbled on Monday as the collapse of Silicon Valley Bank (SVB) sent investors rushing into safe-haven assets and caused traders to bet on a smaller rate hike from the European Central Bank (ECB) on Thursday.

U.S. authorities launched emergency measures on Sunday to shore up confidence in the banking system after the failure of SVB threatened to trigger a broader financial crisis.

Regulators said the failed bank’s customers will have access to all their deposits starting Monday and set up a new facility to give banks access to emergency funds.

SVB’s collapse sparked a massive rally in European and global bond markets on Monday.

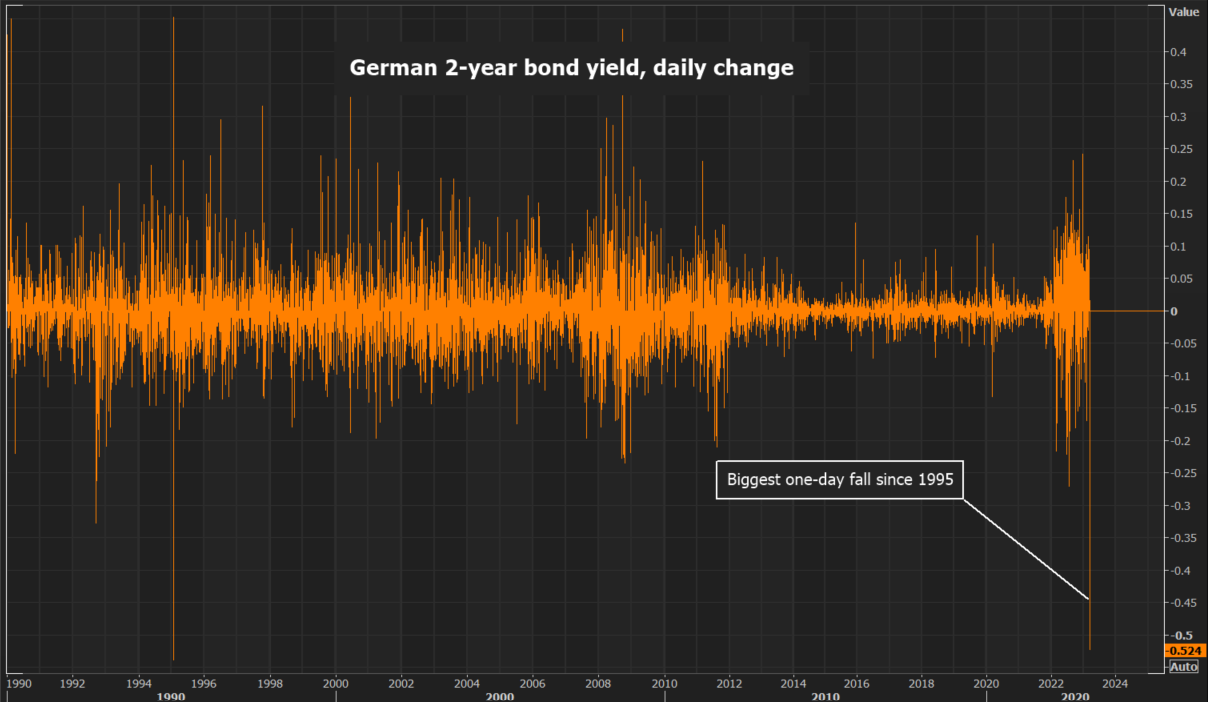

The German 2-year bond yield was last down 34 basis points (bps) at 2.746%, on track for its biggest one-day drop since 1995. Yields move inversely to prices.

The 2-year yield, which is highly sensitive to ECB interest rate expectations, stood above 3.3% last week.

Expectations for the ECB’s next decision, due on Thursday, also shifted dramatically on Monday. Market pricing showed traders thought a 25 bp hike is now the more likely outcome, despite 50 bps appearing almost certain last week.

In U.S. markets, the 2-year Treasury yield was down 36 basis points (bps) at 4.232%, its biggest daily fall since 2008.

“(Investors) are out there looking for what the next fragility might be… and looking to reduce risk as quickly as possible,” said Giles Gale, head of European rates strategy at NatWest Markets.

“I think there’s an element of, where is the safest place to put money? I think low-duration, high-quality bonds especially is an obvious choice.”

He added: “But an enormous part of this (is that) markets are taking the view that the rate hikes that haven’t taken place yet are much less likely to take place.”

Goldman Sachs analysts on Sunday said they no longer expect the Federal Reserve to deliver a rate hike at its March 22 meeting and saw considerable uncertainty about the path beyond March in light of SVB’s failure.

Pricing in money markets on Monday showed traders think there’s a roughly 20% chance that the Fed could leave rates on hold, and a 80% chance of a 25 bp hike.

Just last week, pricing suggested a 50 bp increase was the most likely outcome.

The rush into safe-haven assets included long-dated bonds, with Germany’s 10-year yield down 23 bps at 2.228%, after earlier falling to its lowest since Feb. 3 at 2.168%.

Italy’s 10-year yield fell 16 bps to 4.156%.

European shares fell sharply, although U.S. stocks rose. Europe’s bank index slumped 5%, having shed 3.8% on Friday. Meanwhile, a variety of indicators of market stress began to flash.

The European Central Bank is not planning an emergency meeting of its banking supervisory board on Monday after the collapse of SVB, a senior source told Reuters.

Some analysts said they still believe interest rates will rise.

“We don’t think that the developments will derail the Fed from hiking 50 bp next week, as also the labour market remains tight even with a slightly higher unemployment rate and a tad slower wage growth,” said Rainer Guntermann, rates strategist at Commerzbank.

Antoine Bouvet, head of rates strategy at ING, said: “We think euro rates are headed higher, with at least one more spike before the end of this cycle.” He added: “This could put the 10-year Bund at 3%.”

(Reporting by Stefano Rebaudo and Harry Robertson, editing by Sharon Singleton, Kirsten Donovan)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement