Advertisement

Advertisement

Five trades from hedge funds to navigate US-China tensions

By:

By Nell Mackenzie, Carolina Mandl and Summer Zhen

By Nell Mackenzie, Carolina Mandl and Summer Zhen

LONDON (Reuters) – Hedge funds are watching growing U.S.-Chinese geopolitical tensions and have spotted ways to trade them.

U.S. authorities on Thursday told TikTok’s Chinese owners to divest their stakes in the popular video app or face a possible U.S. ban, Reuters reported. Britain, this week, described China as an “epoch-defining challenge” to the world.

A year after Russia’s invasion of Ukraine roiled markets, trading geopolitical risk is on investors’ radar.

Five prominent funds have shared five ideas using five different asset classes to try to profit from the increasing polarisation of the United States and China.

The ideas do not represent the trading positions of the firms, which cannot be revealed for regulatory reasons.

1/ GRAMERCY FUNDS MANAGEMENT

* Emerging markets fund chaired by Mohamed A. El-Erian

* Size: $5 billion

* Founded in 1998

* Key trade: Long Chinese distressed/short investment grade bonds

Philip Meier, head of emerging markets debt at Gramercy, suggests a two-sided value trade. Bond prices attached to Chinese property developers couldn’t get much cheaper, he says. A company’s bonds, when viewed as risky, trade at a discount. He would buy these.

“If tensions between China and the U.S. do not escalate, sanctions are not coming and both countries get along reasonably okay for the next couple of years, then we believe that the Chinese property leg of the trade will make quite a bit of money on the long side,” said Meier.

Meier said bonds of Chinese property developers would likely see limited falls as they are already at distressed levels if tensions escalate, but investment grade bonds in sanctioned-sensitive sectors would fall sharply.

Taking a short position on investment grade bonds would make up for losses on long positions elsewhere, he said.

2/ NWI MANAGEMENT LP

* macro hedge fund with emphasis on emerging markets

* Size: $2.1 billion

* Founded in 1999

* Key trade: long non-Chinese AI companies

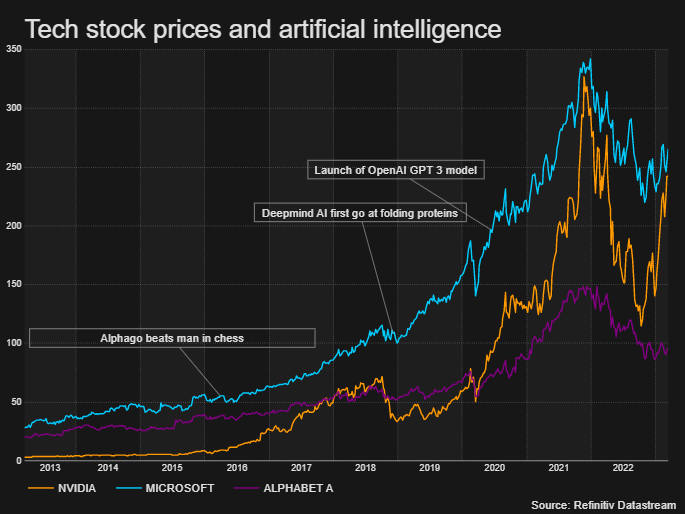

Buying shares of U.S. firms that develop artificial intelligence (AI) such as Alphabet, Nvidia and Microsoft, is another option, said NWI Management’s managing director of global macro research Tara Hariharan.

“U.S. investment in advanced technology through the Chips Act and Inflation Reduction Act will give U.S. tech companies a significant edge over Chinese counterparts,” said Hariharan, referring to recent legislation.

Hariharan added that NWI Management viewed AI as the “next frontier” in tech, noting that the most promising initiatives so far had come from U.S. firms.

If tensions were resolved, being caught with a negative view on Chinese stocks would not be beneficial, and therefore she would not short Chinese AI firms but invest in U.S. ones instead.

3/ PERENNIAL VALUE MANAGEMENT

* Global asset manager, with energy and renewable funds

* Size: $4 billion

* Founded in 2000

* Key trade: Commodities, buy shares of graphite companies or of those taking physical graphite shipments

Lithium-ion batteries power most technology from electric vehicles to wireless headphones, with graphite a key battery ingredient.

While graphite mines exist outside of China, essentially all of the processing to make the graphite needed for batteries occurs in China, said Sam Berridge, who manages the Strategic Natural Resources Fund at Perennial Value Management.

Supply disruption would devastate battery production globally until alternative manufacturing centres were established, Berridge said, adding buying shares of graphite firms or those firms involved in graphite shipment could be one way to trade geopolitical tensions.

“The most sensitive commodity to a break down in trade between China and Russia and the West is graphite,” he added.

4/ MKP Capital

* Trading on macro economic factors

* Size: $3 billion

* Founded in 1995

* Key trade: Short Hong Kong’s Hang Seng index

Michael Hume, head of strategy and research at MKP Capital, suggests taking a bet against Hong Kong stocks.

“You would need to get the timing right. Because at the moment, markets are still living off of the reopening in China,” Hume said.

Once this is priced in, stock prices could fall in sympathy with the exchange rates.

“The catalyst for the trade could be a renewal of concerns over China lending support to Russia in its war against Ukraine or any new potential worries over the situation in Taiwan,” said Hume.

While “risk flare ups” could serve for short term trades, he believes there is a broader trend.

5/MODULAR ASSET MANAGEMENT

*Actively managed pan-Asia macroeconomic fund

*Size: $1 billion

*Founded in 2020

*Key trade: long Singapore dollar versus short Chinese yuan

Jimmy Lim, chief investment officer of Modular Asset Management, said higher U.S-China tensions would likely lead to a weaker Chinese currency and the easiest way to trade this would be to take a short position, essentially a bet on price weakness, against China’s yuan.

To add to that, Lim would buy a South Asian currency, such as the Singapore dollar, which could benefit from U.S./Chinese decoupling.

To hedge political risks, Lim said the fund could use derivatives including options or swaps.

For long-term opportunities, Lim pointed to Southeast Asia.

“Supply chains are already shifting to Penang, and they are receiving investment from both China and the U.S. This is very positive for Malaysia’s current account going forward,” he said.

(Reporting by Nell Mackenzie, Carolina Mandl and Summer Zhen Additional reporting by Elizabeth Piper; Edited by Dhara Ranasinghe and Mark Potter)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement