Advertisement

Advertisement

U.S. dollar retreats, comes off 32-year high vs yen as inflation-fueled gains fade

By:

By Rae Wee SINGAPORE (Reuters) - The yen floundered near a fresh 24-year low on Thursday, while sterling held onto overnight gains as investors skittishly await an impending deadline for the end of the Bank of England's emergency bond-buying programme.

By Gertrude Chavez-Dreyfuss

NEW YORK (Reuters) – The dollar fell against most currencies in volatile trading on Thursday, after initially spiking following a hotter-than-expected U.S. inflation report, as some investors thought the market’s initial response to the data was excessive.

The greenback briefly hit a 32-year peak against the yen of 147.665 after the data, and was last up 0.1% at 147.09 yen.

The euro also fell against the dollar initially to a two-week low, then rebounded to trade up 0.8% on the day at $0.9773.

Europe’s single currency may have rallied from lows after a Reuters report, citing four sources, said European Central Bank staff see the need for fewer rate hikes than markets now estimate to tame inflation. That suggested that the situation in the euro zone may not be as dire as many thought.

“The initial response to the CPI was exaggerated: Aussie and New Zealand dollar earlier dropping 1.5%, Canadian dollar dropping 1.3%,” said Greg Anderson, global head of foreign exchange strategy at BMO Capital Markets in New York.

“These are signs of a distressed market, freaking out over a mild miss on a data point. A partial reversal shouldn’t be a surprise, but this is a full reversal and then some,” he added.

Data showed U.S consumer prices increased more than expected in September and underlying inflation pressures continued to escalate, cementing expectations that the Fed will deliver another 75-basis-point (bps) rate increase.

The consumer price index rose 0.4% last month after gaining 0.1% in August, the Labor Department said on Thursday. Economists polled by Reuters had forecast the CPI climbing 0.2%. In the 12 months through September, the CPI increased 8.2% after rising 8.3% in August.

Following the data, fed funds futures have priced in a 9.1% chance of a 100 basis-point rate hike, and a 90.9% probability of a 75 basis-point increase at next month’s Federal Reserve policy meeting.

“Anybody who says (Fed could) pivot is wishful thinking right now. The Fed has got to get a handle on inflation right now,” said Arthur Laffer, president of Laffer Tengler Investments in Nashville, Tennessee.

“Soft landing is also becoming wishful thinking the more they raise rates. We’re going to have a really soft, maybe even negative fourth quarter.”

Traders overall remained on the lookout for Japanese intervention to prop up a struggling yen. Officials have reiterated they stand ready to take appropriate steps to counter excessive currency moves, though whether they wish to defend particular levels remains unclear.

The greenback also initially soared against the Swiss franc, hitting its highest since May 2019. The buck was last up 0.2% at 0.9996 francs.

The Australian dollar briefly dropped to a 2-1/2-year low against the dollar at US$0.6170, before recovering to trade 0.3% higher at US$0.6294.

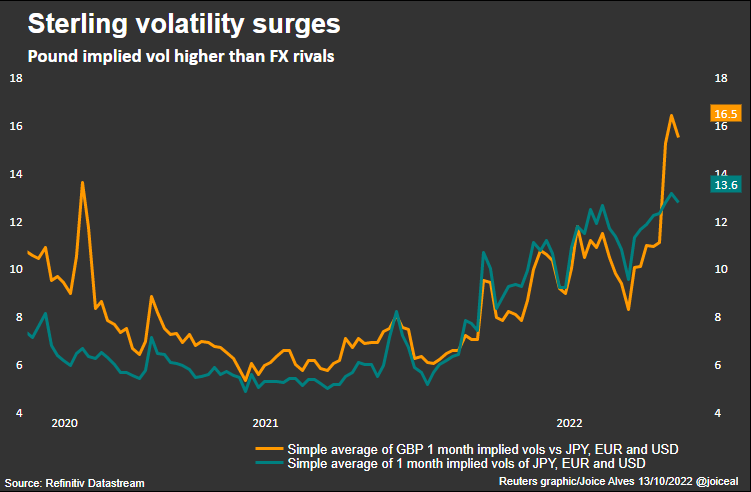

Sterling, meanwhile, posted steep gains against the dollar after reports of a possible U-turn by the UK government on its fiscal plans, before strong U.S. inflation data tempered some of those gains.

Sky News reported on Thursday that the British government is discussing making changes to the fiscal plan announced last month and looking at which parts of the tax-cutting package might be ditched in a further U-turn by Prime Minister Liz Truss.

British finance minister Kwasi Kwarteng said “let’s see”, when asked in an interview if financial markets had improved on Thursday because of expectations of a U-turn on his plans to scrap an increase in corporation tax, the Telegraph reported.

The pound last changed hands at $1.1325, up 2.1%. Against the euro, sterling rose to a five-week high. The euro last traded at 86.33 pence, down 1.2%.

========================================================

Currency bid prices at 1:14PM (1714 GMT)

Description RIC Last U.S. Close Pct Change YTD Pct High Bid Low Bid

Previous Change

Session

Dollar index 112.5300 113.2300 -0.60% 17.632% +113.9200 +112.1900

Euro/Dollar $0.9768 $0.9702 +0.69% -14.07% +$0.9800 +$0.9632

Dollar/Yen 147.2300 146.9200 +0.22% +27.91% +147.6550 +146.4550

Euro/Yen 143.82 142.54 +0.90% +10.36% +144.0300 +141.8200

Dollar/Swiss 1.0001 0.9976 +0.18% +9.55% +1.0073 +0.9961

Sterling/Dollar $1.1301 $1.1099 +1.83% -16.43% +$1.1379 +$1.1061

Dollar/Canadian 1.3762 1.3819 -0.44% +8.81% +1.3977 +1.3735

Aussie/Dollar $0.6283 $0.6278 +0.10% -13.55% +$0.6299 +$0.6170

Euro/Swiss 0.9769 0.9679 +0.93% -5.79% +0.9779 +0.9675

Euro/Sterling 0.8641 0.8740 -1.13% +2.82% +0.8767 +0.8610

NZ $0.5624 $0.5608 +0.37% -17.77% +$0.5639 +$0.5512

Dollar/Dollar

Dollar/Norway 10.5875 10.7595 -1.58% +20.21% +10.8580 +10.5805

Euro/Norway 10.3473 10.4364 -0.85% +3.34% +10.4786 +10.3370

Dollar/Sweden 11.2581 11.3353 -0.01% +24.82% +11.4777 +11.2178

Euro/Sweden 10.9968 10.9981 -0.01% +7.45% +11.0648 +10.9850

(Reporting by Gertrude Chavez-Dreyfuss in New York and Joice Alves in London; Additional reporting by Medha Singh in Bengalaru; Editing by Jonathan Oatis and David Gregorio)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Latest news and analysis

Advertisement