Advertisement

Advertisement

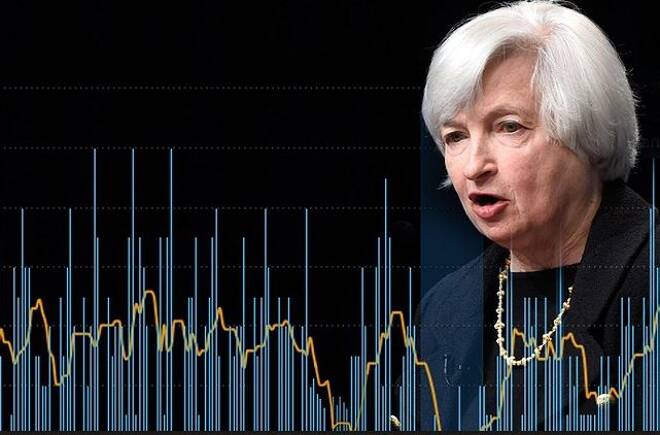

Frequency of Rate Hikes Could Change Investor Sentiment Towards Stocks

By:

The Federal Open Market Committee meets next Tuesday and Wednesday, and is widely expected to raise rates for the third time in close to ten years. With

The Federal Open Market Committee meets next Tuesday and Wednesday, and is widely expected to raise rates for the third time in close to ten years. With the chances of a Fed rate hike sitting at about 91 percent on the eve of the February Non-Farm Payrolls report, traders are now focused on whether the Fed will signal a faster pace of tightening.

It’s going to be hard for Friday’s jobs report to be negative in terms of rate hikes. The consensus forecast estimates a rise of 200,000 nonfarm payrolls in February, down from 227,000 in January. The unemployment rate is expected to decline slightly from 4.8 percent to 4.7 percent, while average hourly earnings are forecast to increase 0.3 percent from the prior month.

I believe that regardless of what Friday’s jobs report shows, there is nothing that can stop the Federal Reserve from raising rates at its March 14 – 15 meeting. This is because the threshold for the Fed when it comes to job creation is very low.

During her testimony last month Fed Chair Janet Yellen noted that net new monthly jobs are well above the longer-run trend in labor force growth between 75,000 and 125,000. As a result, Yellen said, the labor market is in the range of the Fed’s employment goal and policymakers consider “it appropriate to move toward a neutral policy stance.”

Expectations for a solid, if not strong, headline number are high for Friday’s report. The bar was raised on Wednesday when ADP reported private payrolls well above expectations at 298,000. Because of this, the consensus has jumped from 184,000 jobs at the start of the week to as high as 225,000 as of late Thursday.

With the March hike a given, investors are starting to look ahead at the timing of future rate hikes and this is very important because this will set the tone for the yearlong trend in U.S. Treasury yields, the U.S. Dollar, gold and equities. These are the major asset classes.

The importance of two, three or even four rate hikes in 2017 can’t be emphasized more because the number of rate hikes will force investors to think about reallocating assets from one asset class to the other. This is most significant for those investors who like to keep the appropriate risk/reward ratios in their stock and bond portfolios.

So while stock investors will tell us that they are long the market because they are betting big on President Trump’s economic policies, one has to realize that they are speculative notions at this time, while the Fed is closer to reality.

The consensus may be thinking two rate hikes this year, but a big jump in the jobs report to well over 200,000 jobs could lead analysts to bump up the number to three, or perhaps four rate hikes. If this occurs, then expect a serious shift in investor sentiment. This will likely lead to investors shedding risky assets like stocks for the guaranteed returns offered by government debt.

So going into Friday’s report, don’t be too concerned over the short-term movement in stocks, bonds, gold and the dollar, but watch the numbers for what they mean for longer-term asset allocation plays. It’s going to take a lot of time to start pulling money out of stocks and redeploying them into Treasurys, for example, and this process may begin with Friday’s report.

Am I saying that stocks have reached their high for the year? I won’t say until I see if the next rally fails to take out the March 1 high. But if it does fail to make a new high and continue the rally between now and the Fed’s meeting in June then I think I can safely say we’ve seen the high for the year.

Once the Fed hikes rates in back to back to back quarters, I think it will be difficult to maintain the current buying spree in the stock market.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement