Advertisement

Advertisement

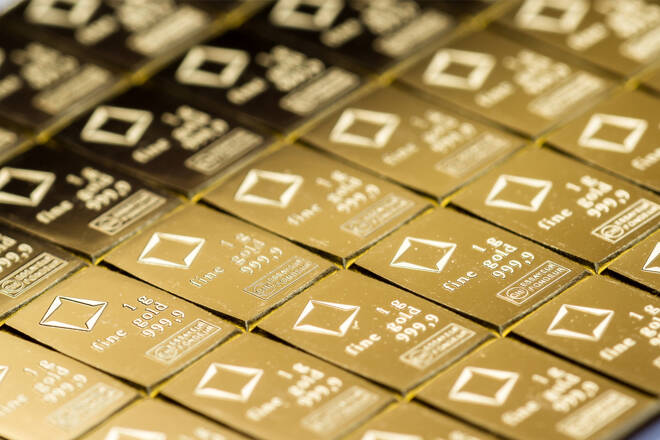

Gold Rebounds On Hopes China Will Relax Its Zero-COVID Policy

By:

Chinese officials have recently said that growth remained a priority.

Key Insights

- Gold and other precious metals rebound as traders hope that China will relax its strict anti-coronavirus policy.

- Rumors have circulated for several days, but there is no official confirmation of any policy changes.

- In the longer-term, Fed’s policy will remain the key catalyst for gold markets.

Traders Hope That China Will Drop Its Zero-COVID Policy To Boost Growth

Gold rebounded from yearly lows at $1615 and moved back above the resistance at $1640 as traders bet on the adjustment of the zero-COVID policy in China.

Officially, China sticks to its strict anti-coronavirus measures. However, markets have reacted to recent rumors that China was finally ready to adjust the policy which hurts its economic growth. Stocks in Hong Kong were up by more than 5% today, while Chinese yuan gained ground against the U.S. dollar.

The strong rebound in China provided significant support to commodity markets. Silver settled back above the resistance at $19.65. Platinum moved closer to the $950 level, while palladium settled back above the $1800 level.

It remains to be seen whether the current rebound will be sustainable if China does not officially announce that it will relax its strict anti-coronavirus policy. Chinese officials have recently highlighted the importance of economic growth, but markets will demand real moves for a sustainable rebound.

The Fed Will Remain The Key Catalyst For Gold

While China-related hopes pushed gold away from yearly lows, the pace of the Fed rate hikes will remain the key catalyst for gold prices in the upcoming months.

Higher interest rates are bearish for gold that pays no interest. Silver, platinum, and palladium are dependent on industrial demand, so they should be more sensitive to the potential economic rebound in China.

At the same time, gold will remain extremely sensitive to the dynamics of Treasury yields. Currently, the yield of 2-year Treasuries is trying to settle above the yearly highs at 4.75%, while the year of 10-year Treasuries has settled near the 4.15% level. Treasury yields have not been at current levels since 2007 – 2008, so it’s not surprising to see that gold has been under significant pressure in recent months.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Vladimir Zernovauthor

Vladimir is an independent trader, with over 18 years of experience in the financial markets. His expertise spans a wide range of instruments like stocks, futures, forex, indices, and commodities, forecasting both long-term and short-term market movements.

Advertisement