Advertisement

Advertisement

Investors face unclear outcome in midterms, with questions over spending, regulation

By:

By Saqib Iqbal Ahmed NEW YORK (Reuters) - Investors are expecting Republican gains in U.S. midterm elections, a result that could ease worries about Democratic spending and regulation but set up a bruising fight over raising the U.S. debt ceiling next year.

By Lewis Krauskopf and Laura Matthews

NEW YORK (Reuters) – Investors on Wednesday were weighing a surprising outcome in the U.S. midterm elections, as a better-than-expected showing by Democrats muddies the outlook for issues such as fiscal spending and regulation.

Control of Congress, which is currently held by President Joe Biden’s Democratic party, remained up for grabs early on Wednesday with many of the most competitive races yet to be called.

Republicans were still expected to make gains and likely win control of the House of Representatives. But prospects of a “red wave,” which had picked up steam heading into Tuesday’s vote, had evaporated and the balance of power in the Senate remained unclear.

The S&P 500 fell 0.8% in morning trading, while the 10-year Treasury yield weakened and the dollar rose against a basket of currencies.

“It’s definitely different than what the expectation was heading into the night,” said Walter Todd, chief investment officer at Greenwood Capital.

“Largely the market and investors had coalesced around this idea of a pretty significant Republican wave. … That’s not happening, so I do think it is why the market is struggling a little bit.”

Investors pointed to a rise in clean energy shares, reflected in a 1.6% rally in shares of the Invesco Solar ETF as a potential ripple effect of the outperformance by Democrats, who are seen as friendlier to clean energy regulations.

Shares of prison operators Geo Group and CoreCivic slumped. The stocks had been seen as benefiting in a strong Republican victory.

While macroeconomic concerns and Federal Reserve monetary policy have been the dominant forces behind market moves this year, Capitol Hill politics could exert influence on asset prices.

If Republicans are able to take control of the House, it means split government with Democrat Joe Biden in the White House, an outcome that historically has been accompanied by positive long-term stock market performance.

A strong performance by Republicans had been seen as likely to allay investor concerns about higher fiscal spending exacerbating inflation and raise the chances of the party freezing spending via the debt ceiling, analysts at Morgan Stanley wrote this week. That could support a rally in 10-year Treasury bonds and help stocks extend their recent gains, they said.

Conversely, analysts have forecast that equities would react negatively if Democrats manage to maintain House and Senate majorities, with Goldman Sachs analysts saying there would be risk of additional corporate tax increases weighing on earnings and risk of higher interest rates to counter probable additional spending.

A gridlock situation would be more positive, analysts have said.

“It’s going to result in more gridlock in Congress probably than less,” said Peter Tuz, president of Chase Investment Counsel in Charlottesville, Virginia. “Markets generally can accept that pretty well.”

Still, a split government could lead to heightened tensions over raising the federal debt ceiling in 2023, setting up the kind of protracted battle that led Standard & Poor’s to downgrade the U.S. credit rating for the first time in 2011, sending financial markets reeling.

U.S. Treasury yields, which move opposite to bond prices, have soared this year, but government gridlock could help contain them – and the dollar – as it relieves concerns about heightened fiscal spending that could drive inflation.

Meanwhile, a gridlocked government could also cool a burgeoning dollar rally, which has battered corporate balance sheets and pressured many global currencies to multiyear lows, said Dan Wood, portfolio manager of William Blair’s Emerging Market Debt team.

“The outcome of the midterm elections has the potential to stall this rally, particularly as positioning is heavy and valuation of the dollar quite expensive,” he said.

Republican gains, meanwhile, could boost several areas of the stock market such as pharmaceutical and biotech shares, on diminished prospects for tougher prescription drug pricing rules. Big tech stocks could benefit from less likelihood of regulatory pressure and defense on expectations of more significant spending.

Cryptocurrency, meanwhile, spent millions on U.S. midterm races and may hope to influence laws as policymakers push forward digital asset legislation.

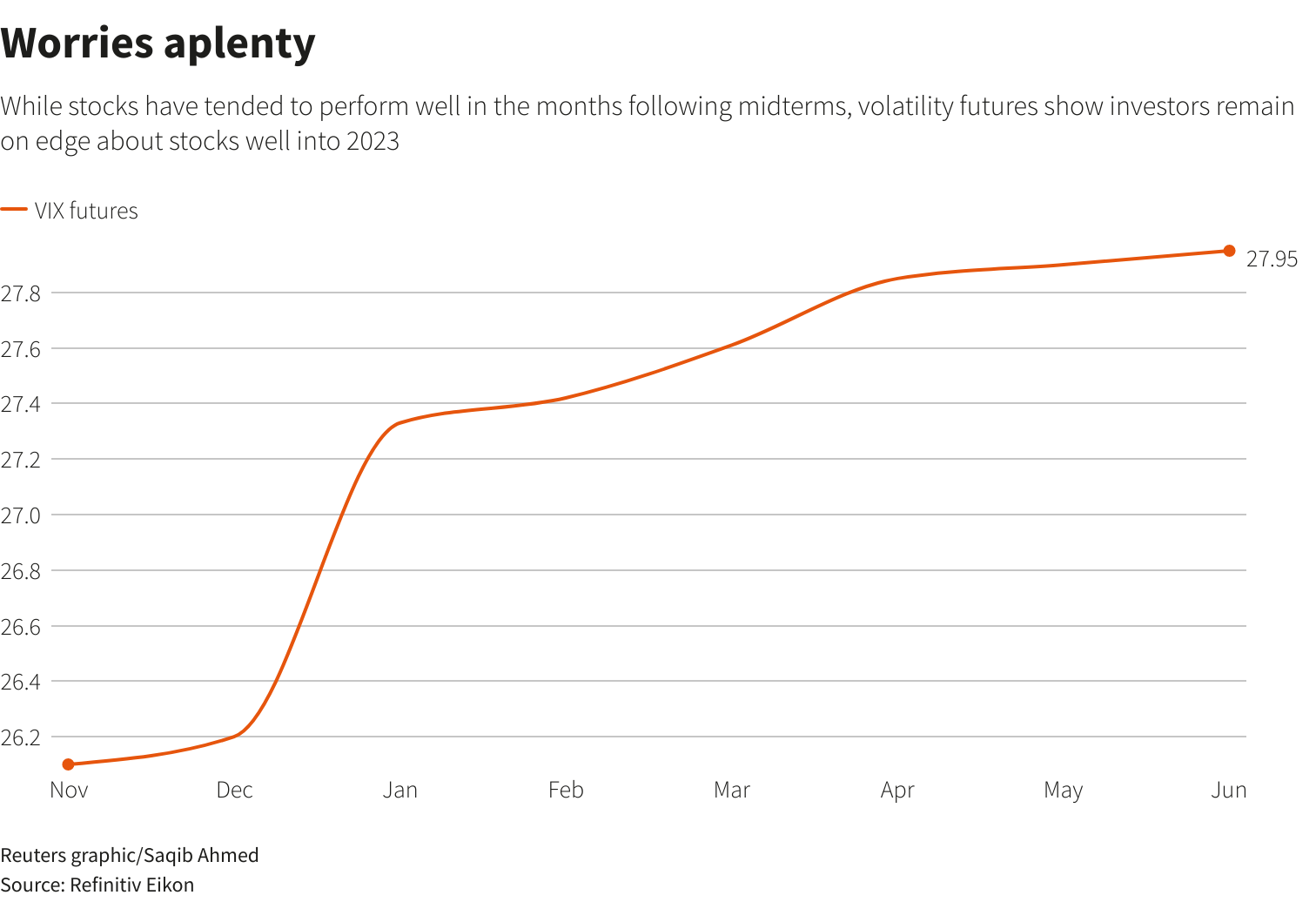

While many strategists are quick to cite the stock market’s perfect record of positive post-midterm performance, some investors cautioned against expecting a repeat this time, given uncertainty over how quickly the Fed will be able to tame inflation.

Indeed, while the election outcome could put some uncertainty to rest, investors remain on edge about the outlook for stocks, as shown by volatility futures tied to the Cboe Volatility Index trading at historically elevated levels well into next year.

Meanwhile, the outlook for inflation and the Fed’s monetary policy are likely to remain the most important factors in shaping investors’ views.

One potential catalyst for volatility comes Thursday with the U.S. consumer price report, a data point that has spurred sharp market moves throughout 2022.

“Next year’s earnings estimates are still too high, Fed policy is still tight and tightening, inflation is still too high,” said James Athey, investment director at Abrdn.

“This is all bad news for equities.”

(Reporting by Bansari Mayur Kamdar, Saqib Iqbal Ahmed, Carolina Mandl, Laura Matthews and Lewis Krauskopf; Editing by Ira Iosebashvili, Megan Davies, Jonathan Oatis, Claudia Parsons and Chizu Nomiyama)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Latest news and analysis

Advertisement