Advertisement

Advertisement

Marketmind: BOK steady

By:

By Jamie McGeever (Reuters) - A look at the day ahead in Asian markets from Jamie McGeever.

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever.

An interest rate decision from South Korea takes center stage in Asia on Thursday, in the midst of a widespread selloff in risk assets on growing fears that the Fed will keep U.S. interest rates higher for longer to quell inflation.

Asian stocks are on course for their fourth down week in a row, the MSCI World index and the S&P 500 are eyeing their biggest weekly fall this year, and U.S. breakeven inflation rates are sailing up to 2.50% and beyond.

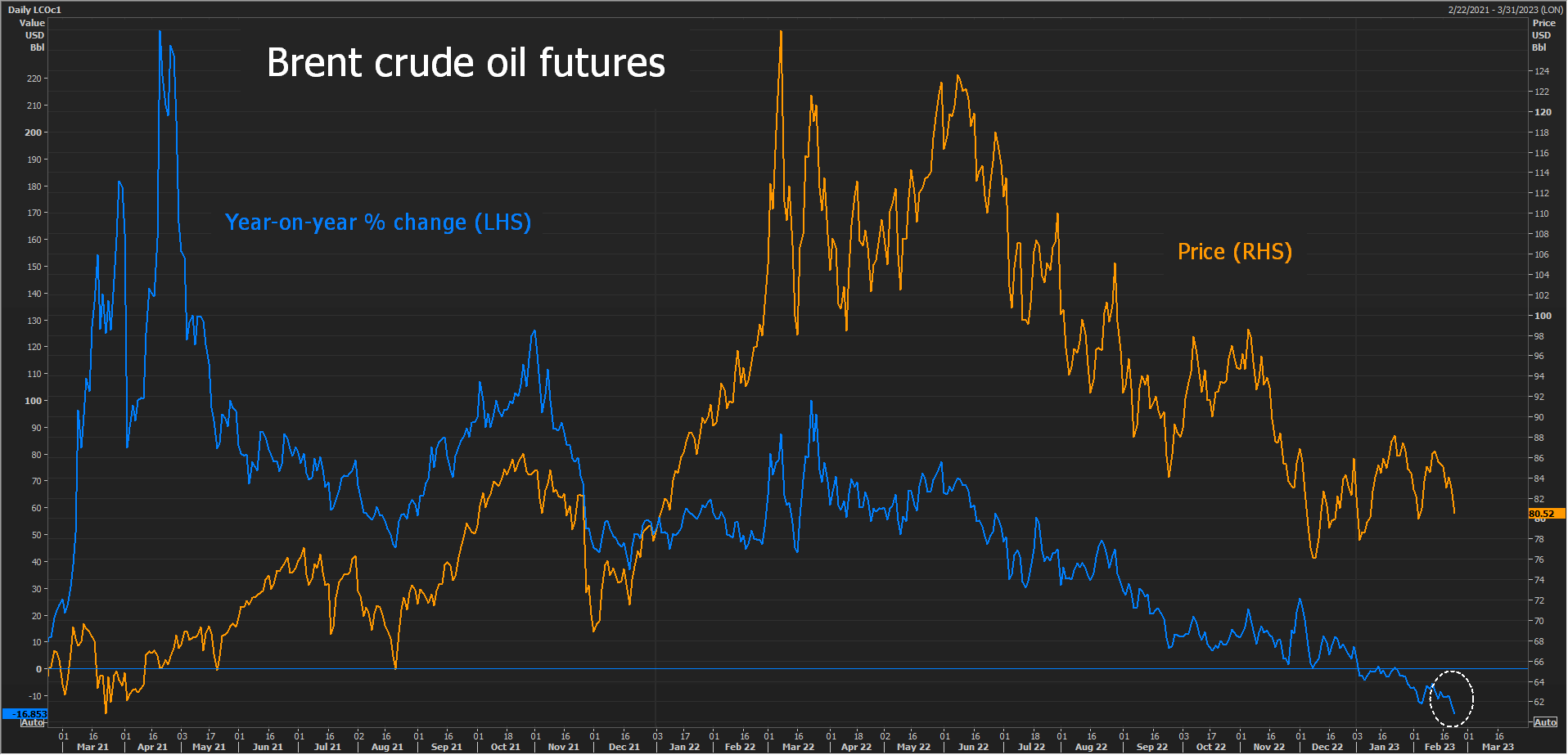

One quirk of rising global inflation fears, however, was a 3% slide in oil on Wednesday, as traders bet that high consumer prices will sap growth and demand. A lower oil price, of course, is disinflationary, and base effects right now also mean that Brent crude is 17% cheaper today than it was a year ago.

Light at the end of the inflation tunnel?

Minutes from the Fed’s Jan. 31 to Feb. 1 policy meeting showed that most rate-setters voted to slow the pace of tightening. But in an interview with CNBC on Wednesday, St. Louis Fed chief James Bullard reiterated his view that rates must be raised to 5.25% to 5.50% to get inflation down this year.

Central banks in Asia and elsewhere are getting caught in the Fed’s – and the dollar’s – slipstream.

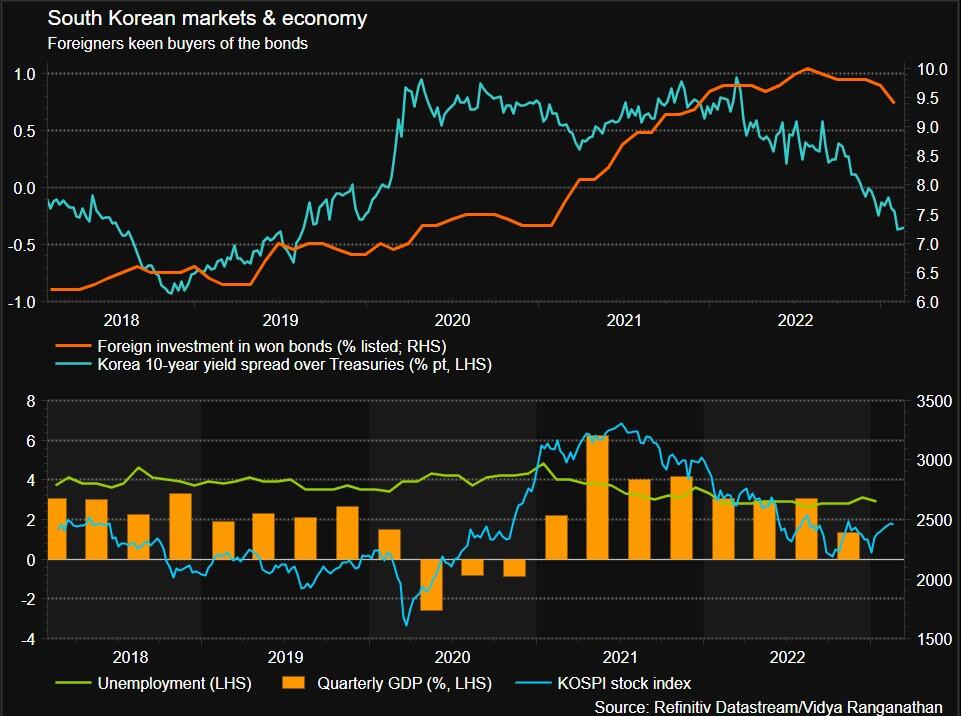

The Bank of Korea is expected to leave interest rates on hold at 3.50% on Thursday, and leave it there for the rest of the year, according to a Reuters poll. Economists surveyed reckon the BOK’s longest tightening cycle on record is over despite still high inflation.

However, Korean policymakers may be forced to talk tough and say they stand ready to raise rates again.

Anything other than that could lead the won to slip further from its two-month low against the dollar, which would only intensify domestic inflationary pressures and perhaps force the central bank to act again later in the year.

Consumer price inflation in January was 5.20%, well over double the central bank’s 2.00% target and unlikely to return there for at least another year, economists reckon.

Meanwhile, inflation figures from Hong Kong and Singapore will also be released on Thursday, as well as Thai trade and Taiwanese industrial production data.

Here are three key developments that could provide more direction to markets on Thursday:

– South Korea interest rate decision

– Fed’s Bostic and Daly speak

– U.S. Q4 GDP (second estimate)

(By Jamie McGeever; Editing by Josie Kao)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Latest news and analysis

Advertisement