Advertisement

Advertisement

Marketmind: Jay walks the walk, markets get Powell-slammed

By:

By Jamie McGeever (Reuters) - A look at the day ahead in Asian markets from Jamie McGeever.

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever.

To slightly mangle Bruce Springsteen’s “Born To Run”: the market’s jammed with broken heroes on a last chance Powell drive; everybody’s out on the run tonight, and there’s no place left to hide.

There certainly appears to be no place left to hide from higher U.S. interest rates, bond yields and a stronger dollar following Fed Chair Jerome Powell’s testimony to the Senate Banking Committee on Tuesday.

Investors had generally expected Powell to strike a hawkish tone, so the scale of price adjustment across financial markets after he opened the door to higher and possibly faster rate increases was even more staggering.

Asian markets will feel the aftershocks when they open on Wednesday, with Japanese current account data the only major economic data point on the calendar that could potentially influence the yen.

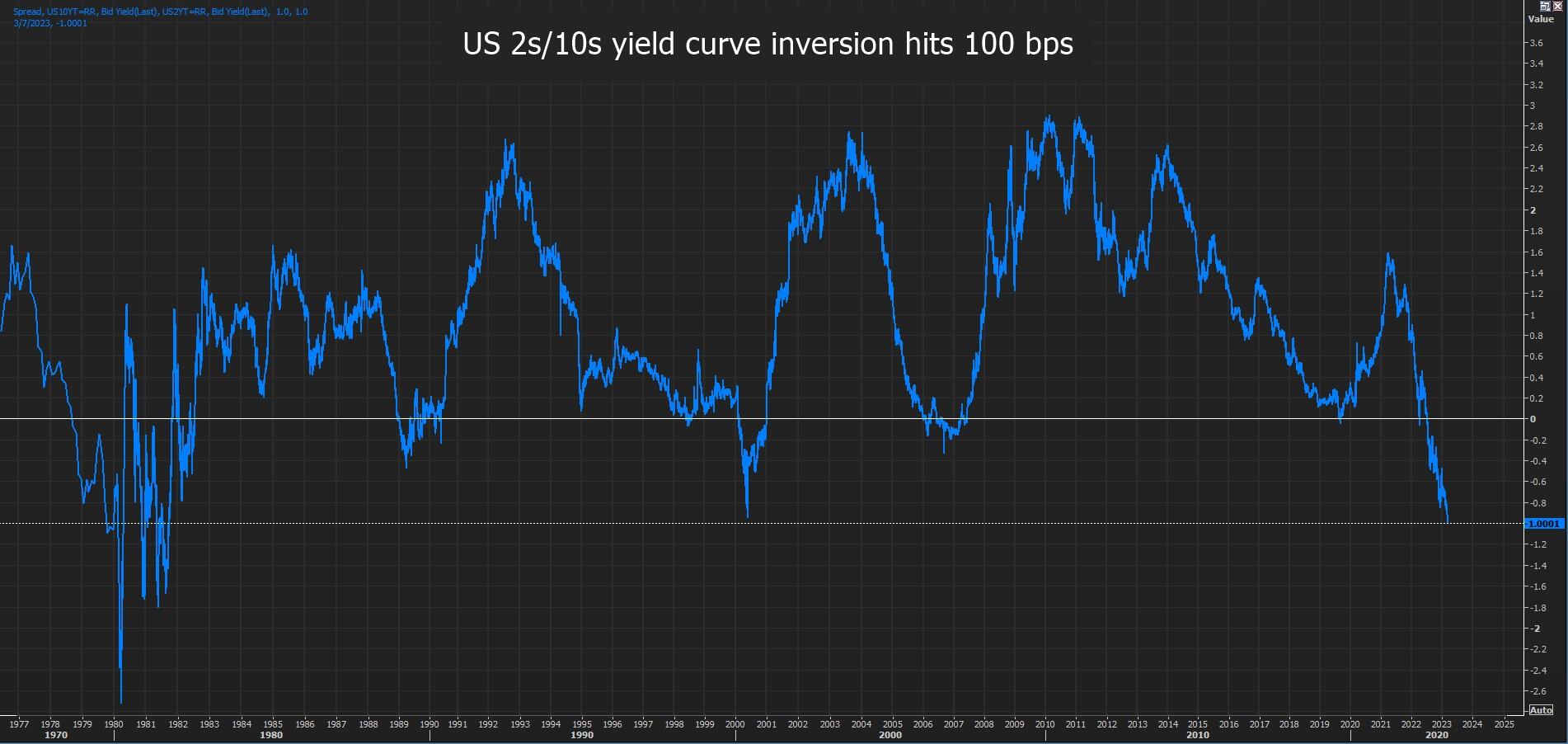

The tone, however, will be set by Tuesday’s seismic market moves, some of which bear repeating: the dollar jumped 1.2%, its best day since November; the two-year Treasury yield hit 5% for the first time since 2007; the 2s/10s yield curve inversion reached 100 basis points for the first time since 1981.

The implied peak Fed rate is now 5.65%, traders now reckon a 50 bps rate hike from the Fed later this month is twice as likely as a quarter-point increase.

Given all that, it is maybe surprising that Wall Street’s three main indexes ‘only’ fell between 1% and 1.5%.

Powell’s hawkishness contrasted with Bank of England policymaker Catherine Mann, who said sterling could be vulnerable to more aggressive policy moves from other central banks, especially the Reserve Bank of Australia (RBA).

The RBA raised rates by 25 bps as expected on Tuesday to 3.60%, the highest in more than a decade. But its dovish outlook caught markets flat-footed, and the Australian dollar plunged 2%.

Unsurprisingly, sterling and the Aussie dollar were easily the worst-performing major currencies on the day, but the greenback is sure to flex its muscles against Asian currencies on Wednesday.

As all-consuming as Powell’s remarks were, investors in Asia will also be keeping a close eye on news from China and signs that relations with the U.S. are deteriorating further.

Trade activity fell in February, reflecting weak global and domestic demand, but trade with Russia boomed. Asked if China and Russia would abandon the U.S. dollar and euro for bilateral trade, Foreign Minister Qin Gang said countries should use whatever currency was efficient, safe and credible.

Qin said currencies should not be the “trump card” for unilateral sanctions, or disguise for “bullying or coercion,” and warned Washington to stop suppression or risk ‘conflict’.

Here are three key developments that could provide more direction to markets on Wednesday:

– Fed Chair Jerome Powell testimony to House Financial Services Committee

– Fed’s Barkin speaks

– Japan current account (January)

(By Jamie McGeever; Editing by Josie Kao)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement